Native cryptocurrencies of smart contract-capable blockchains, of which Ethereum (ETH) is the largest, are suffering significant market losses, a process that has been going on for at least a year. This development raises some fundamental questions for the crypto industry. Do these coins’ key concepts and use cases grow irrelevant? Does the industry need so many smart chains? Are these cryptocurrencies too dependent on user activity on their chains, making them poor long-term investment choices? In this article, we are taking a closer look at this pivotal industry development.

Emergence of Smart Contract Chain Cryptocurrencies

When the Bitcoin (BTC) blockchain was launched in 2009, the BTC crypto was meant to act as merely a digital asset for value storage and transfers. It was only in 2015, with the arrival of Ethereum (ETH), that the concepts of smart contracts and decentralised apps (DApps) took off. ETH was the first notable crypto that was used not only for storage and transfers but also to power the functionality of blockchain-based DApps and provide connectivity between them.

Over the following few years, a plethora of smart contract-capable blockchains, some of them dubbed “Ethereum killers”, were launched. Their native cryptocurrencies were designed to emulate the utility role of ETH on the Ethereum blockchain. Among the galore of the smart contract chains, the largest ones that have survived and risen in the market cap rankings are BNB Chain (BNB), Cardano (ADA), and Solana (SOL). Their native cryptos, along with ETH, are now in the top 10 of all cryptocurrencies by market capitalisation.

This quartet in the top 10 – ETH, BNB, ADA, and SOL – forms a segment of their own. They are used in a utility function on their respective smart contract blockchains. In contrast, cryptos like BTC, XRP, and DOGE power the blockchains that have no direct smart contract functionality and are used mostly for fund transfers, value storage, and of course, since we mentioned Dogecoin, speculation.

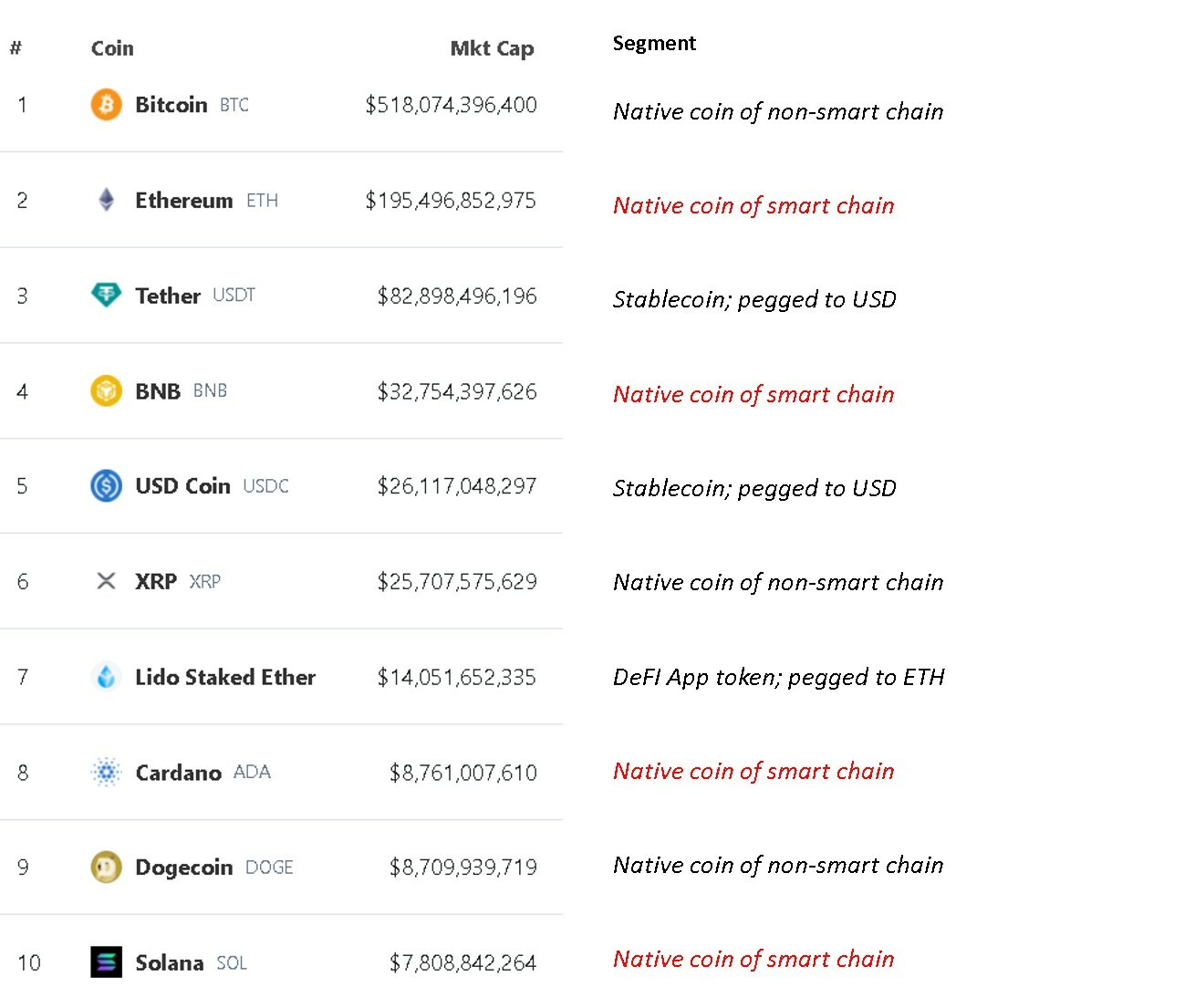

Below, we list the current (as of 14 September) top 10 cryptos by market cap, with an indication of their key segments.

Image source: adapted from Coingecko.com by adding segments

Disastrous Year for Smart Chain Cryptocurrencies

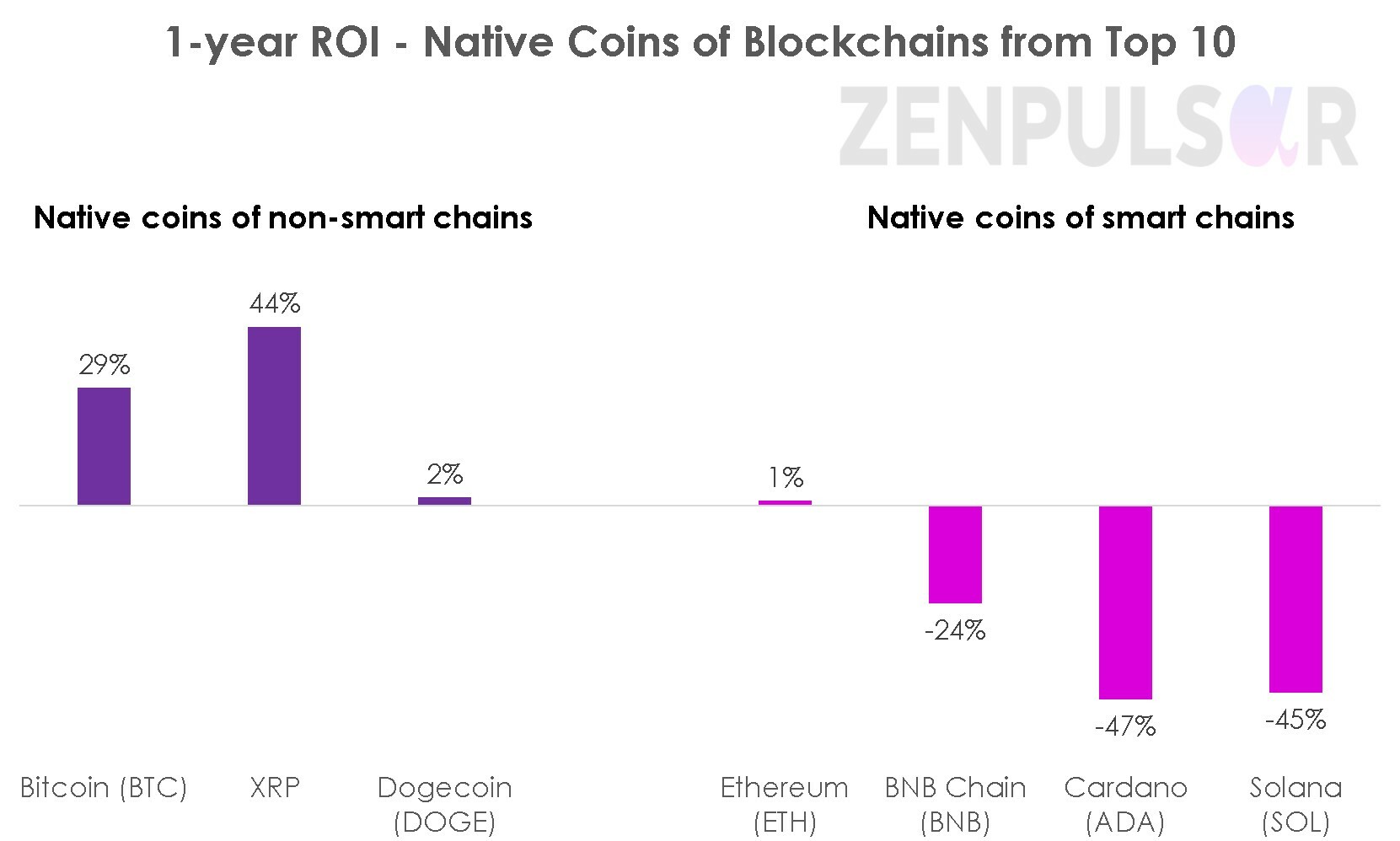

While the last few weeks have been underwhelming for Bitcoin, the world’s top cryptocurrency and the primary gauge of the overall crypto market has achieved a respectable yearly growth figure of 29% (as of 13 September). In contrast, the leading smart contract chain coin, ETH, has posted virtually no growth on a yearly basis (only 1.2%). The other three smart chain cryptos in the top 10 – BNB, ADA, and SOL – have suffered large, double-digit losses.

The chart below shows the 1-year growth rates for the native coins of all blockchains in the top 10 as of 13 September.

Leaving aside the highly speculative Dogecoin, whose rises and falls are typically driven by pure hype, the native coins of the top non-smart chains, Bitcoin and XRP, have done exceedingly well over the last year, with 29% and 44% growth rates, respectively.

BTC is the investor community’s preferred store of value in the crypto world. XRP is also actively used as a store of value, often by institutional investors. Both coins are also actively used for crypto transfers and payments. However, due to the non-smart nature of the Bitcoin and XRP Ledger blockchains, the use of these coins in the DeFi industry or other sectors enabled by DApps is minimal.

The chart above shows the dire situation for the top smart chain coins. Ethereum eked out a minimal growth rate of 1.2%, one of the worst results for the coin since the late 2021 crypto market crash. The other three smart chain coins – BNB, ADA, and SOL – have posted losses of 24%, 47%, and 45%, respectively. This is nothing short of a disastrous result for these coins. In the past, these coins largely followed Bitcoin’s moves, albeit with higher volatility levels than the latter. However, in the last year, this pattern has been broken. For these coins’ price trajectories, Bitcoin is no longer a safe guidance point.

Why Are Smart Chain Cryptocurrencies Nosediving?

Observing the chart in the previous section, one might notice the stark difference between BNB, ADA, and SOL in comparison with ETH. ETH has had a lackluster year with minimal growth but has vastly outperformed the other large smart chain cryptos. BNB, ADA, and SOL are taking a true hiding despite the overall crypto market doing reasonably well.

In our view, this is likely an early indication of one important development – a realisation in the market that the industry simply doesn’t need all this variety of smart chains. After the launch of Ethereum, many smart contract blockchains have been initiated. Nearly all of these attempted to rival Ethereum by offering a faster and cheaper blockchain environment.

Many have been successful in achieving these advantages over Ethereum but have still failed to attract enough DApps and user bases. To be fair to Ethereum, at least after the 2021 upgrade to the Proof of Stake transaction validation model, this blockchain has featured transaction confirmation times comparable to most of its rival smart chains.

The issue of high transaction costs on Ethereum remains, but at the same time, a plethora of Layer 2 protocols linked to the blockchain have also hit the market, driving the cost of transacting on it much lower.

All these factors have led to the other smart chains failing to come anywhere close to Ethereum in terms of the number of DApps, user counts, or total value locked (TVL). For instance, Ethereum alone currently holds 70% of the entire DeFi industry’s TVL.

BNB Chain, owned and supported by the resource-rich Binance Holdings, has managed to grow larger than Ethereum in terms of the number of DApps hosted. However, most of these DApps have low levels of activity. For instance, nine out of the ten largest DeFi protocols by TVL ply their trade mostly on Ethereum, and Ethereum’s TVL is still around 12 times that of BNB Chain’s.

Cardano and Solana have done even worse than BNB Chain. Solana, once promoted as the fastest blockchain around, experienced significant network outages on numerous occasions. It has failed to translate its widely promoted technical superiority into any meaningful advantage over Ethereum and is dwarfed by the latter on all the key measures – user base, number of DApps, TVL, and native coin’s market cap.

Cardano, dubbed the ultimate smart contract chain upon launch, has also failed to grow its DApp ecosystem to provide any meaningful competition to Ethereum.

It’s worth mentioning that right now, there IS a large smart contract chain and coin on the rise – Tron (TRX), a crypto positioned 11th in the market cap rankings. However, Tron’s rise has raised numerous suspicions of potential manipulation at play. Whether the allegations of fraud and manipulation at Tron are true or completely unfounded, one thing is certain – Tron is still vastly smaller than Ethereum and would require unrealistically rapid growth to come anywhere near it.

Ethereum’s continuing dominance in the smart contract domain sends a clear message – the industry, especially with its tamed growth rates at the moment, is unwilling to prop up a multitude of smart chains. Even Ethereum itself, judging by its largely flat price and TVL growth rates, is struggling.

Given how badly ETH has done over the last year compared to BTC, the market is clearly choosing the concept of cryptocurrency as primarily a store of value (BTC) rather than a utility to facilitate active trading and transacting (ETH).

Conclusion

The niche of smart chain native cryptocurrencies is being challenged, perhaps for the first time, to prove the need for the colourful variety of coins and platforms it currently features. It looks like many of the leading cryptos in the niche are struggling to prove their relevance, at least in the presence of Ethereum. Cryptocurrencies like BNB, ADA, SOL, and smaller native coins of smart chains might be currently undervalued, but they might also be at the early stage of further losses, struggling to prove their relevance to the industry, at least at the price levels and market caps they currently sport.

For Ethereum, this looks like a potential opportunity to benefit from the looming consolidation in the smart chain niche. However, the ETH crypto itself also has a challenge to meet: proving to the market that its key use case – facilitation of activity on the smart contract blockchain – is good enough for investors to choose the coin. The ETH price performance over the last year shows that the market isn’t fully convinced by this proposition.