Image source: DLNews.com

By early 2022, the three most controversial and audacious individuals in the crypto industry were probably Sam Bankman-Fried (FTX Exchange), Do Kwon (Terra Blockchain), and Justin Sun (Tron Blockchain). The first two are now behind bars - Bankman-Fried in the US and Do Kwon in Montenegro. Justin Sun, on the other hand, continues to steer the Tron (TRX) platform.

In the last few months, despite the overall sluggishness of the crypto market, TRX has been on a remarkable rise. Tron’s ascent has raised suspicions in some corners of the crypto community, not least due to Sun’s highly contentious image. In this article, we are looking at what is brewing up with this cryptocurrency.

TRX Rise in Sluggish Market

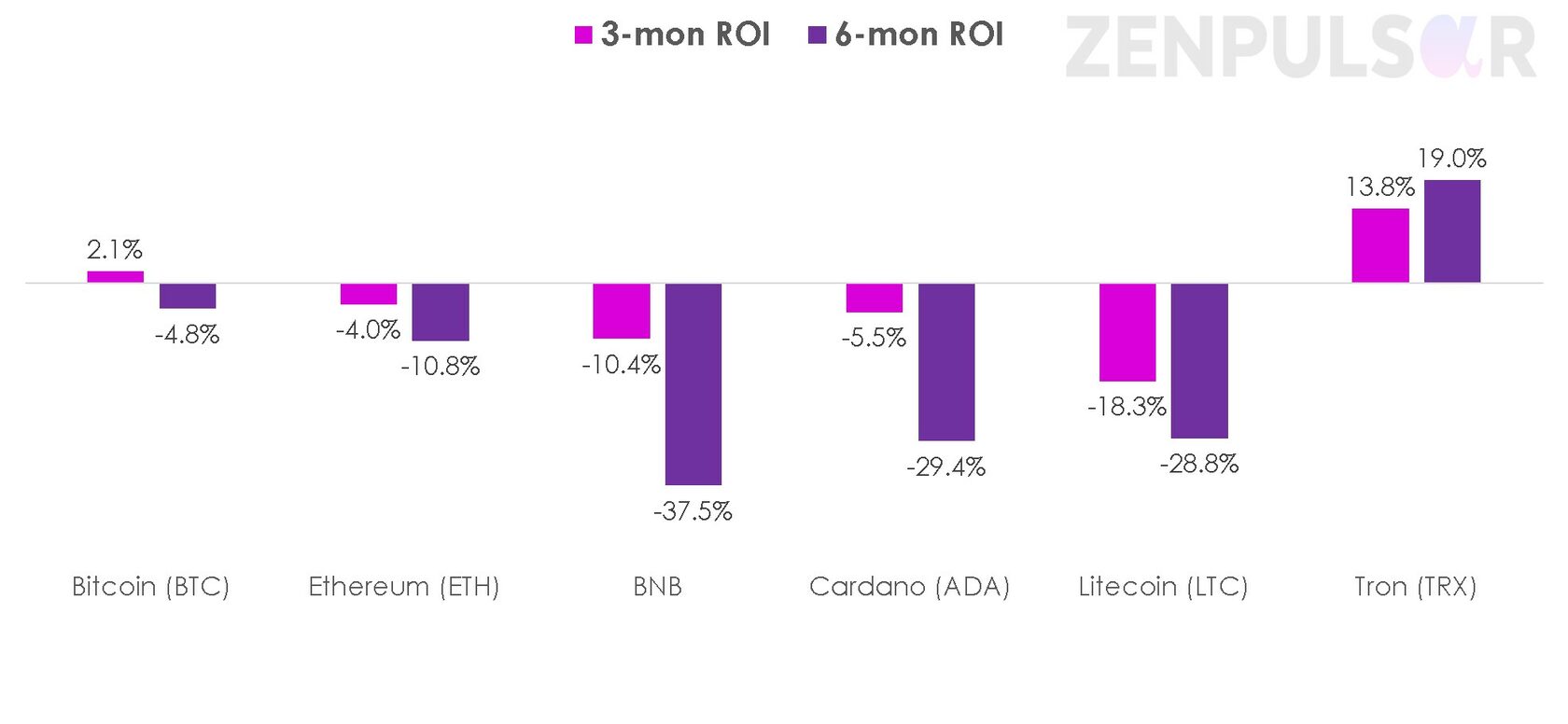

The last few months have been far from great for the majority of the big cryptocurrencies. As of 13 September, the market’s primary gauge, Bitcoin (BTC), is down 4.8% on a 6-month basis and is up by a meager 2% in the last 3 months. However, BTC has still been one of the better performing top coins. The six-month and three-month return figures for Ethereum (ETH) are both negative, at -10.8% and -4%, respectively. BNB, Cardano (ADA), and Litecoin (LTC) have all suffered even larger declines. Yet, Tron (TRX) is doing exceedingly well against the backdrop of all this misery. The chart below shows the six-month and three-month returns for a number of popular cryptos, including TRX and the market leaders, BTC and ETH.

TRX’s market-defying, great performance is evident from this chart. In fact, TRX has been on a confident growth pattern since late 2022.

Why Is TRX Rising?

TRX’s increases in late 2022 - early 2023 were not surprising. The Tron blockchain had long been regarded as undervalued, staying in the shadows of the likes of Ethereum, BNB Chain, Cardano, Solana, and Polkadot. Yet, the blockchain has great technical features – it is scalable, fast, and transaction fees are comparatively very low.

Partly due to the platform owner Justin Sun’s image as an outlandish and controversial person, some investors had stayed away from investing in TRX. However, as Tron kept attracting more decentralised app operators, many in the industry came to appreciate the platform’s great potential. In January, Tron overtook BNB Chain by total value locked (TVL) on the platform, taking the 2nd spot by this important measure, behind the DeFi industry’s long-time leader Ethereum.

This news put a rocket under the TRX coin, with more investors setting aside their suspicions and committing to the crypto.

However, TRX’s more recent impressive growth is less clear and has raised concerns among some industry observers. There are a couple of reasons why TRX’s more recent growth, specifically in the last 3 to 6 months, looks less transparent:

1. TRX had gained confidently in late 2022 – early 2023, largely due to being previously undervalued, but there has always been a limit on how much this coin might appreciate based on its undervalued status. By around May-June, the crypto’s continual rise looked less natural. As a blockchain, Tron had been underappreciated, but not to the extreme degree its unrelenting growth implies. In recent months, there has been nothing fundamental happening on the platform that might suggest further growth on top of the earlier gains.

2. In early July, Tron introduced a new crypto asset, stUSDT, that gives its holders the opportunity to invest in “real-world assets” like government and corporate bonds. stUSDT is called a Real World Asset (RWA) by Tron to highlight the opportunities this token provides for investing in financial products beyond the crypto ecosystem. stUSDT is pegged at a 1:1 rate to the USDT stablecoin. Using their stUSDT staked on Tron, holders can earn interest from the underlying real-world assets.

stUSDT is a unique concept in the DeFi industry, which creates potential for enthusiastic uptake of the token by investors. It is currently the fastest-growing DeFi asset within Tron. Undoubtedly, it is also a major, if not the major, contributor to TRX’s recent growth.

However, soon after stUSDT’s launch and aggressive marketing by Tron, some crypto sources (here and here) reported that nearly all of the stUSDT funds are owned and controlled either solely by Justin Sun or by him and Huobi (rebranded to HTX on 13 September), a crypto exchange known for its close affiliation with Sun. If these allegations are true, this is highly concerning.

Is TRX Good Investment?

Largely undervalued until late 2022, TRX looked like a great investment with significant upward potential earlier this year. The coin continues its impressive growth pattern.

However, the recent allegations concerning stUSDT create an uncertain future for the coin and the Tron platform. Justin Sun’s aggressive marketing approach and controversial profile aside, the allegations, if proven to be true, might result in a new major drama in the crypto world, just when the Sam Bankman-Fried and FTX saga has started to fade off.

Justin Sun has so far not addressed the stUSDT-linked accusations, and, in another piece of recent industry news, he was alleged to move “hundreds of millions of dollars” around amidst insolvency suspicions.

Given the nature of the developments, for now, TRX looks too hot to handle. The coin’s future aside, we might be in for some big news in the crypto world in the coming weeks and months. News that might have a bearing not only for TRX but also for many more cryptocurrencies, just like it happened during the FTX disaster.