Following the collapse of Silicon Valley Bank, Signature Bank, First Republic Bank, and Credit Suisse earlier this year, the banking industry is far from being a tranquil environment. Banks in the US and all over the world are worried, and the biggest worry they have right now on their minds is potential bank runs.

Bank Runs Before the Reign of Social Media

Modern fractional reserve banking has both been praised as a driver of the entire bank system and lamented as a fraud by self-serving bankers, depending on who you ask. At the core of the fractional reserve system is the requirement for banks to hold only a small fraction of their total liabilities to customers at any given time. No matter how flexible and meritorious this system is, it opens up any banking institution to the potential risk of bank runs.

More than two decades ago, bank runs typically took some time to develop as the phenomenon of social media that spreads and amplifies discussions was non-existent. TV, newspapers, and even the internet in its early days simply didn’t have the virality and speed factor of modern social media. This is now changing with the arrival of social media platforms used by the majority of the planet’s population. Twitter in particular has become a medium where even a single (possibly wrong or intentionally misleading) opinion can snowball into viral news content shared and discussed by many thousands or millions.

The Bank Panic of 1907 developed over the course of no less than six weeks. As recently as 2008, the largest banking failure in US history – the collapse of Washington Mutual – had its major phase, the actual bank run, play out over a period of 9 days. On 15 September 2008, Washington Mutual received a credit downgrade that acted as the starting point for the bank run. Nine days later, on 24 September, the behemoth of the US financial industry collapsed.

Bank Runs Have Now Become Fast and Furious

The March 2023 events, when Silicon Valley Bank (SIVB) collapsed largely as a result of a massive bank run, clearly show that in the age of social media, bank runs play out much faster. In fact, SIVB failed as a result of just a 2-day bank run that took place on the 8th and 9th of March. Technically speaking, it was only one day, 9 March, when a large-scale bank run occurred. A day earlier, on 8 March, rumours of liquidity problems at the bank started to actively circulate in the news and on social media.

The next US bank to collapse, Signature Bank (SBNY), also experienced at most a 2-day bank run event, on the 9th and 10th of March. As was the case with SIVB, the bank run was the major driver for the bank’s collapse.

How Banks Have Reacted to the Bank Runs

To say that the speed and intensity of the SBNY and SIVB bank runs have made many banking organisations worried would amount to an understatement of the (financial) year. Banks, both in the US and around the world, are now busy developing strategies to mitigate the risks of potential bank runs.

Of course, there are long-established good practice approaches to insulating a bank from a potential run, such as:

· Putting contingency plans in place

· Diversifying funding sources

· And of course, strengthening capital adequacy and liquidity levels

However, some banking institutions are going beyond the basics. One approach used is making long-term deposits attractive to customers via good fixed interest rates paid for deposits that cannot be withdrawn for a certain period of time.

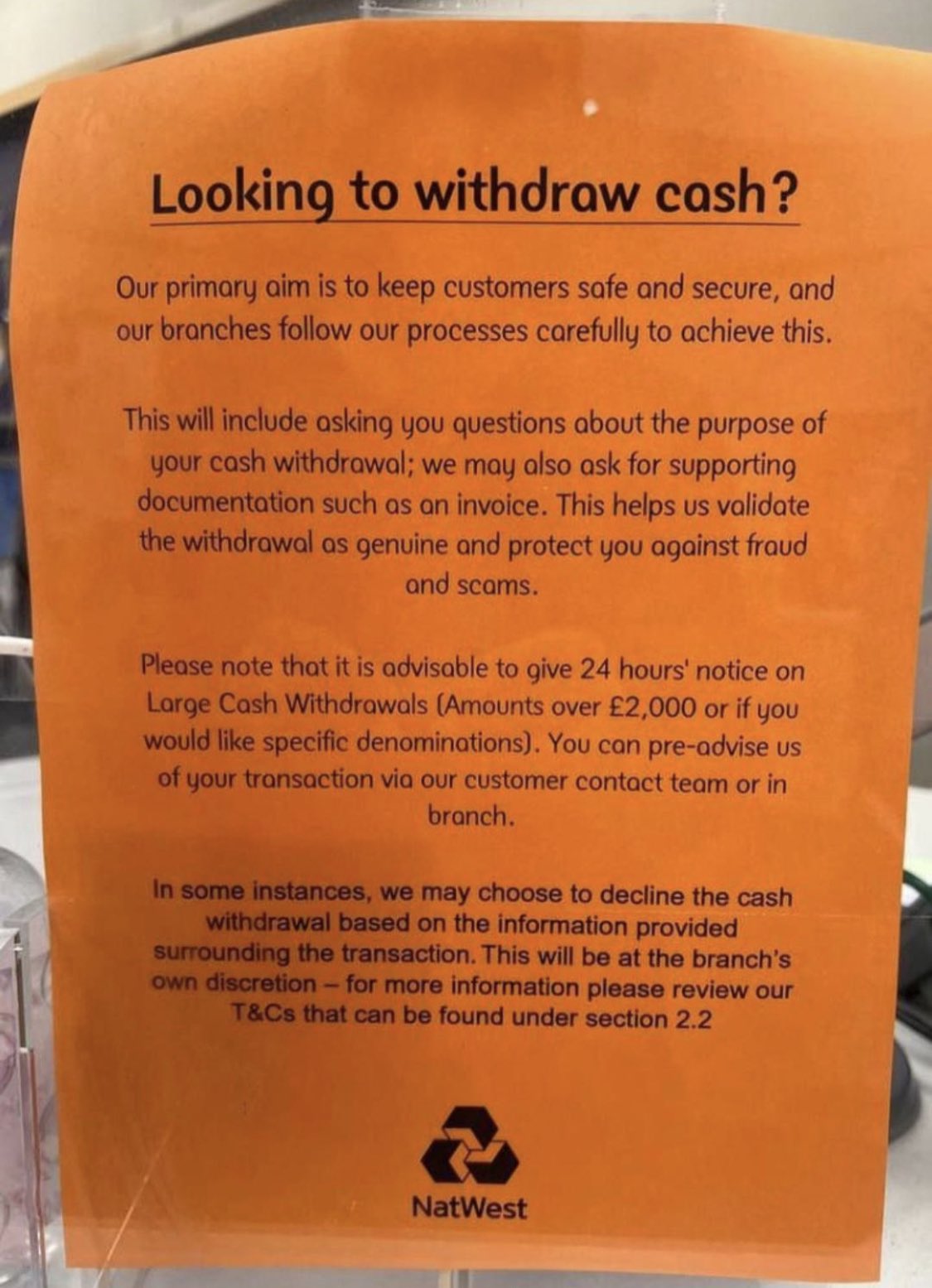

Unfortunately, there is another “novel” approach that is being adopted, at least by some banks – making fund withdrawals difficult by implementing cumbersome procedures for customer identification, withdrawal intent declaration, and more.

The image below has recently been posted by the Twitter account Wall Street Silver. It shows some “creative” ways how a UK-based bank decided to mitigate the risk of a bank run.

Our take – this might slow down an initial withdrawal tide to some degree, but it is much more likely to ignite distrust and worry about the bank’s position among its customer base. By implementing this kind of tough-love approach to clients, a bank would only fuel any discussions about its liquidity standing. Even if there are no liquidity problems at the bank, such withdrawal procedures (or rather obstacles) might easily create bank run potential out of thin air. Let’s remember that under the fractional reserve system, there is no bank, healthy or otherwise, that is completely immune from a run on it.

Reputation Monitoring & Management – A Better Approach for Bank Run Risk Mitigation

Rumours and panic that led to the bank runs earlier this year originated and grew massively on social media. Thus, it is imperative for any banking institution to monitor, manage, and respond to social sentiment proactively.

Reputation management and monitoring are among the major use cases for our social sentiment platform, PUMP. Using PUMP, any banking institution can monitor in real-time their company’s social sentiment. PUMP can be used to identify sudden spikes in negative/bearish sentiment for financial assets and companies. These spikes are often precursors to panic waves and bank runs.

Besides PUMP, ZENPULSAR offers two specialised API-based social sentiment datasets that are useful within the framework of a comprehensive reputation monitoring programme:

1. Bank-run is a social sentiment dataset designed specifically for financial assets. Besides the usual bullish/bearish sentiment measures, it provides indicators for panic waves – major catalysts for bank runs.

2. Oracle is a dataset that further calibrates social sentiment data by classifying social signals into three categories – fact, opinion, and prediction. When social media hysteria over a specific banking stock runs high, opinions and predictions often take centre stage, leaving facts in the shadow. This becomes a perfect breeding ground for panic that leads to bank runs. Oracle helps you spot the difference between facts, opinions, and predictions, further enhancing your reputation monitoring activities.

We recommend that banking organisations implement comprehensive social media reputation monitoring and management programmes based on social sentiment tools and datasets as above.

This is a far more preferred, healthy, and viable approach to mitigating the risks of a bank run than putting artificial withdrawal obstacles in place or hoping that adequate liquidity levels held at the bank will simply help avoid the run. Remember that under the fractional reserve system, no bank is immune from a run. Even the healthiest bank with ample liquidity might find itself a victim of a social media-driven run. By now, social media reputation management for a banking organisation has become as critical as maintaining good liquidity levels.