ZENPULSAR introduces a new product to measure and track social sentiment for banking stocks. The new API Dataset, called “Bank-run”, will help listed banking organisations, stock market investors, analysts, and news outlets closely monitor social media sentiment related to banks, including any potential panic waves - viral spikes in negative social signals.

The Bank-run Product Comes at a Time of Massive Events in the Banking World

In the last two months, we have witnessed the collapse of three US banks (Silicon Valley Bank, Signature Bank, and First Republic Bank) and one European banking giant (Credit Suisse). Events leading up to the collapses typically unfolded in the following stepwise fashion:

1. Initial reports of balance sheet vulnerabilities emerge

2. Social media discussions start spreading the news virally, magnifying their reach, and in some cases their severity

3. The social media driven panic causes a bank run by depositors along with a large-scale stock selloff

4. The bank collapses

Last month, the importance of social media in driving bank runs was further confirmed in a research paper by an international team of academics called “Social Media as a Bank Run Catalyst”. The researchers found that social media acts as a powerful catalyst of bank runs.

The crucial role of social media sentiment as a precursor to bank stock collapses and price crashes can no longer be ignored.

Details of the Bank-run Product

Bank-run is an API dataset (available in JSON and CSV formats) that measures and tracks social media sentiment for banking stocks from Twitter, Reddit, Telegram, Weibo, and SeekingAlpha.

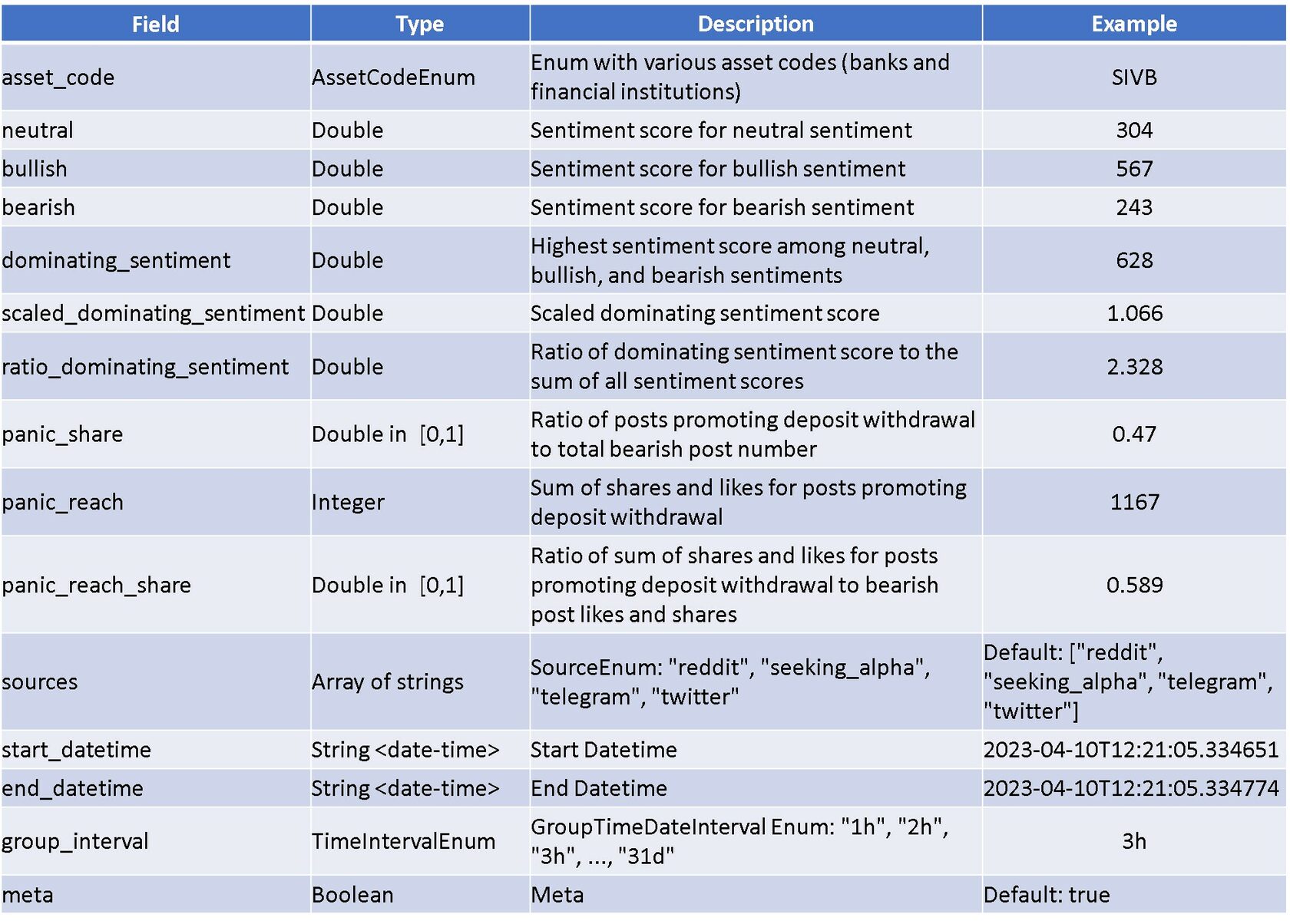

The dataset includes detailed time-series sentiment data and provides various metrics, such as panic share, panic reach, dominating sentiment, scaled dominating sentiment, and ratio dominating sentiment, calculated using specific formulas:

· Panic share: share of posts attributed to deposit withdrawal promoting posts divided by the number of bearish posts

· Panic reach: sum of likes and shares of deposit withdrawal promoting posts

· Panic reach share: panic reach divided by the total number of shares and likes for the asset

· Dominating sentiment: bullish - bearish + neutral posts

· Scaled dominating sentiment: (bullish - bearish) / neutral posts

· Ratio dominating sentiment: (-1 - bullish) / (-1 - bearish) posts

Assets Covered

A total of 316 banking and financial equities are included. Virtually all the leading US banking stocks, along with some top European and Hong Kong banks, are included. Contact us for a complete asset list.

Dataset Attributes

Use Cases

· Sentiment Analysis

· Hedge Funds

· Asset Management

· Trading Strategies

· Market Insights

· Quantitative Investing

· Alpha Generation

· Online Reputation Management

· Brand Image Management

To enquire about all the details of the product or to purchase it, please email us at [email protected] or use the contact form on our website.