Some of the key problems modern blockchain networks face are issues of cross-chain and cross-token compatibility. Despite their sophisticated functionality, blockchains are largely isolated entities with a limited ability to accommodate crypto tokens created on other chains. In some cases, there are also compatibility issues between tokens on the same blockchain.

Wrapped tokens have emerged as a convenient solution to address these problems.

What Are Wrapped Tokens?

Any crypto user who has ever tried to send their assets from one blockchain to another knows about the problem of cross-chain compatibility. Simply speaking, in most cases, you cannot transfer a crypto token from its native chain to another blockchain platform. This is because each blockchain has its own unique token standard.

Wrapped tokens are an eloquent solution to this issue. A wrapped token is an equivalent of another crypto token created to represent the latter on a different blockchain platform. In some cases, wrapped tokens are also used on the same blockchain as the original token to resolve token standard incompatibilities.

In most cases, wrapped tokens are used for cross-chain operations. For example, the Bitcoin cryptocurrency cannot be directly transferred to the Ethereum blockchain since it is based on the token standard of its native BTC network. When someone wants to send Bitcoin to Ethereum, the BTC funds are wrapped into a new token called Wrapped Bitcoin (WBTC). The WBTC funds may then be freely used on Ethereum. WBTC is a token that is based on Ethereum and complies with this blockchain’s token standards.

Wrapped tokens maintain a 1:1 peg to their original token, i.e., one WBTC may be swapped for one BTC and vice versa at any time.

In some cases, token wrapping is used for the purpose of enabling token operations and swaps on the same blockchain. For example, the WETH token is a wrapped representation of the Ether token created for use on the Ethereum blockchain.

Although Ethereum is Ether’s native chain, this cryptocurrency was created before the launch of the ERC-20 token standard, the main standard used by Ethereum tokens. As such, while most crypto tokens used by Ethereum decentralized apps (dApps) comply with the ERC-20 standard, Ether itself does not! In order to enable the use of Ether within those dApps, the token is wrapped in WETH.

Another popular wrapped token is Wrapped BNB (WBNB), which is used on the BNB chain. Similar to WETH, WBNB is typically used on its own native platform to support operations in the chain’s dApps.

How Does Wrapping Work?

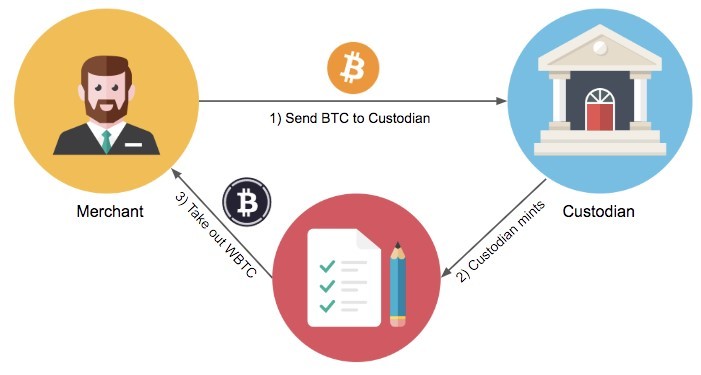

The process of wrapping a token is normally as follows:

1. A user sends the original cryptocurrency to the address of the wrapping service provider. These providers, called custodians, might be private companies, non-profit organisations, or decentralized entities, such as a DAO. In the case of WBTC, the custodian is a Californian technology company, BitGo. Let’s say a user sends 10 BTC to BitGo’s smart contract address.

2. The custodian retains the original funds and issues the equivalent amount of the wrapped token to the user. In this example, the user gets 10 WBTC on the Ethereum blockchain.

3. At any time the user decides to swap their WBTC back to BTC, they may do so via the custodian. When the user swaps the funds back, they receive their BTC funds on the BTC blockchain.

The process of wrapping BTC in WBTC

Wrapped tokens have emerged as a convenient solution to address these problems.

What Are Wrapped Tokens?

Any crypto user who has ever tried to send their assets from one blockchain to another knows about the problem of cross-chain compatibility. Simply speaking, in most cases, you cannot transfer a crypto token from its native chain to another blockchain platform. This is because each blockchain has its own unique token standard.

Wrapped tokens are an eloquent solution to this issue. A wrapped token is an equivalent of another crypto token created to represent the latter on a different blockchain platform. In some cases, wrapped tokens are also used on the same blockchain as the original token to resolve token standard incompatibilities.

In most cases, wrapped tokens are used for cross-chain operations. For example, the Bitcoin cryptocurrency cannot be directly transferred to the Ethereum blockchain since it is based on the token standard of its native BTC network. When someone wants to send Bitcoin to Ethereum, the BTC funds are wrapped into a new token called Wrapped Bitcoin (WBTC). The WBTC funds may then be freely used on Ethereum. WBTC is a token that is based on Ethereum and complies with this blockchain’s token standards.

Wrapped tokens maintain a 1:1 peg to their original token, i.e., one WBTC may be swapped for one BTC and vice versa at any time.

In some cases, token wrapping is used for the purpose of enabling token operations and swaps on the same blockchain. For example, the WETH token is a wrapped representation of the Ether token created for use on the Ethereum blockchain.

Although Ethereum is Ether’s native chain, this cryptocurrency was created before the launch of the ERC-20 token standard, the main standard used by Ethereum tokens. As such, while most crypto tokens used by Ethereum decentralized apps (dApps) comply with the ERC-20 standard, Ether itself does not! In order to enable the use of Ether within those dApps, the token is wrapped in WETH.

Another popular wrapped token is Wrapped BNB (WBNB), which is used on the BNB chain. Similar to WETH, WBNB is typically used on its own native platform to support operations in the chain’s dApps.

How Does Wrapping Work?

The process of wrapping a token is normally as follows:

1. A user sends the original cryptocurrency to the address of the wrapping service provider. These providers, called custodians, might be private companies, non-profit organisations, or decentralized entities, such as a DAO. In the case of WBTC, the custodian is a Californian technology company, BitGo. Let’s say a user sends 10 BTC to BitGo’s smart contract address.

2. The custodian retains the original funds and issues the equivalent amount of the wrapped token to the user. In this example, the user gets 10 WBTC on the Ethereum blockchain.

3. At any time the user decides to swap their WBTC back to BTC, they may do so via the custodian. When the user swaps the funds back, they receive their BTC funds on the BTC blockchain.

The process of wrapping BTC in WBTC

The role of the custodian is crucial in the entire wrapping process. Custodians are the guarantors of funds and the 1:1 peg.

Some people in the crypto community prefer to use wrapped tokens guaranteed by decentralized custodians rather than by private companies. These are typically “decentralization purists” who distrust most centralized entities. For these users, there is an option to use RenBTC, which is another Bitcoin wrapped token for the Ethereum platform. Unlike WBTC, RenBTC uses a decentralized custodian represented by a network of blockchain nodes.

Some people in the crypto community prefer to use wrapped tokens guaranteed by decentralized custodians rather than by private companies. These are typically “decentralization purists” who distrust most centralized entities. For these users, there is an option to use RenBTC, which is another Bitcoin wrapped token for the Ethereum platform. Unlike WBTC, RenBTC uses a decentralized custodian represented by a network of blockchain nodes.