With the stock market heating up, many investors are getting into the profit-taking mood, or at least start to consider selling their stocks if the time is judged to be right. In this article, we are looking at the best timing to sell your stocks.

Emotions driving the buy and sell decisions

When it comes to trading stocks, the winning formula seems to be pretty straightforward – buy low and sell high. However, the stock market is far from being so trivial. In the real world, two emotions – fear and greed – cause traders to make impulsive, less-than-optimal choices. Driven by greed, we might buy an overvalued stock out of fear of missing out (FOMO).

In turn, overcome by fear, we might sell an asset that has just experienced only a temporary correction.

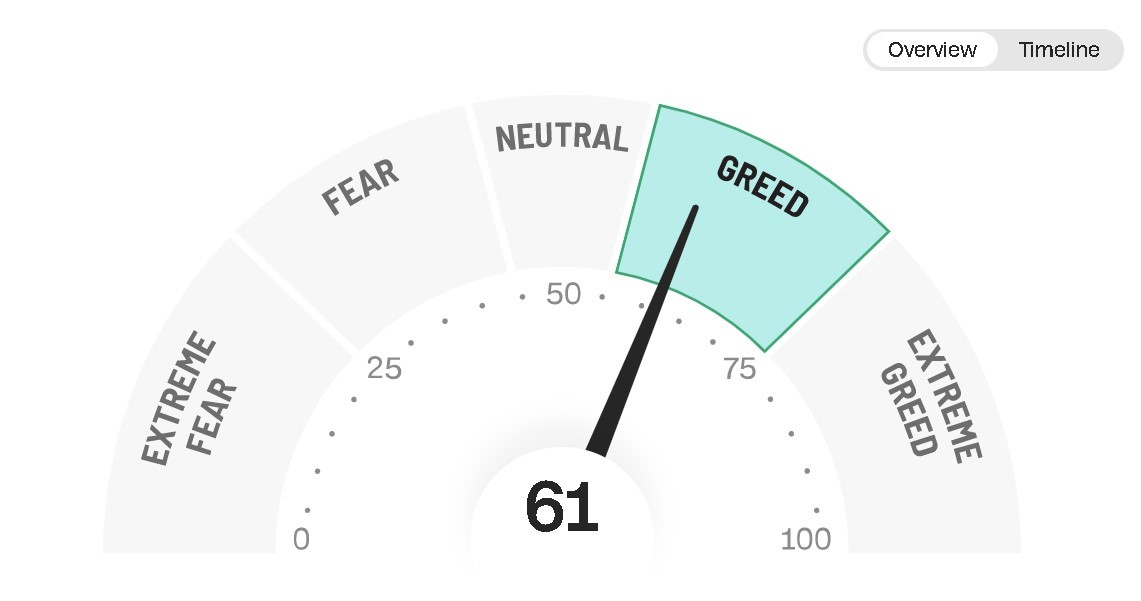

Right now, CNN’s famous greed-fear index is showing 61, meaning that the market is in the greed territory.

Emotions driving the buy and sell decisions

When it comes to trading stocks, the winning formula seems to be pretty straightforward – buy low and sell high. However, the stock market is far from being so trivial. In the real world, two emotions – fear and greed – cause traders to make impulsive, less-than-optimal choices. Driven by greed, we might buy an overvalued stock out of fear of missing out (FOMO).

In turn, overcome by fear, we might sell an asset that has just experienced only a temporary correction.

Right now, CNN’s famous greed-fear index is showing 61, meaning that the market is in the greed territory.

Investors are buying, encouraged by the rising market and the FOMO factor. Whether it is the right time for you to buy stocks is a matter of a different discussion. What we would like to explore today is the opposite proposition – should you sell stocks now, and in general, what market conditions are most suitable for selling?

When is the best time to sell stocks?

Condition 1 – When the market is greedy. Yes, greedy markets are a great time to sell some of your stocks. The greedy market we are in now might be an optimal time to act on that sell decision. Many investors are growing excited about the recent solid rallies for the stock market, Bitcoin, and the world’s premier precious metal, Gold.

During the build-up of the greed sentiment, a potential correction is slowly, or perhaps not so slowly, forming. Those who sell before the correction arrives derive the greatest benefit from the greedy market.

Condition 2 – Your stock has been on an extended uptrend (and you have made good profit out of it). Similar to a greedy market, prolonged uptrends for a stock are an ideal time to sell. Yes, you might make a bit more profit by risking it and holding onto the stock – at the end of the day, the uptrend might be going on for a while more! However, you are just as likely to see the uptrend break and the feared correction arrive. Sell now to avoid the guess game and scoop your profit up.

A note regarding this condition – selling on an extended uptrend is a good advice for short- and medium-term traders. These traders are more interested in actively profiting from asset price movements. Long-term investors might consider simply holding onto their stock regardless of temporary price trends.

Condition 3 – Marked deterioration in the stock’s fundamentals. Sometimes, negative fundamentals might be slow to have an effect on the stock’s price chart. This is particularly the case when greed rules supreme and lifts up the entire market. Along with stocks featuring solid fundamentals, those with a deteriorating situation might continue to rise.

Don’t be deluded by the overall market optimism. Pay close attention to your stock’s key financials, management changes, competitors’ moves, and other fundamental parameters. If you see negative signs emerging, act upon it and consider selling.

When should you not sell your stock?

Individual circumstances when you should probably avoid selling might vary but there is one situation when you should definitely avoid selling your stock – selling during a market panic. When fear rules over markets, many investors and traders get overcome with anxiety and sell in panic mode.

However, if your stock’s key fundamentals haven’t declined, you should probably avoid selling during a market panic. Panic-driven bear markets often rebound strongly. By selling in fear, you might get rid of a valuable asset when the rebound arrives.

When is the best time to sell stocks?

Condition 1 – When the market is greedy. Yes, greedy markets are a great time to sell some of your stocks. The greedy market we are in now might be an optimal time to act on that sell decision. Many investors are growing excited about the recent solid rallies for the stock market, Bitcoin, and the world’s premier precious metal, Gold.

During the build-up of the greed sentiment, a potential correction is slowly, or perhaps not so slowly, forming. Those who sell before the correction arrives derive the greatest benefit from the greedy market.

Condition 2 – Your stock has been on an extended uptrend (and you have made good profit out of it). Similar to a greedy market, prolonged uptrends for a stock are an ideal time to sell. Yes, you might make a bit more profit by risking it and holding onto the stock – at the end of the day, the uptrend might be going on for a while more! However, you are just as likely to see the uptrend break and the feared correction arrive. Sell now to avoid the guess game and scoop your profit up.

A note regarding this condition – selling on an extended uptrend is a good advice for short- and medium-term traders. These traders are more interested in actively profiting from asset price movements. Long-term investors might consider simply holding onto their stock regardless of temporary price trends.

Condition 3 – Marked deterioration in the stock’s fundamentals. Sometimes, negative fundamentals might be slow to have an effect on the stock’s price chart. This is particularly the case when greed rules supreme and lifts up the entire market. Along with stocks featuring solid fundamentals, those with a deteriorating situation might continue to rise.

Don’t be deluded by the overall market optimism. Pay close attention to your stock’s key financials, management changes, competitors’ moves, and other fundamental parameters. If you see negative signs emerging, act upon it and consider selling.

When should you not sell your stock?

Individual circumstances when you should probably avoid selling might vary but there is one situation when you should definitely avoid selling your stock – selling during a market panic. When fear rules over markets, many investors and traders get overcome with anxiety and sell in panic mode.

However, if your stock’s key fundamentals haven’t declined, you should probably avoid selling during a market panic. Panic-driven bear markets often rebound strongly. By selling in fear, you might get rid of a valuable asset when the rebound arrives.