Social Media (SM) has grown into a massive universe that has a clearly observable impact on major financial markets. High-profile cases where financial assets have been strongly affected by SM sentiment are well known in the crypto market - the stratospheric rise of Dogecoin and many other hyped-up cryptos - and the stock market - the classic case of GameStop (GME). While commodities are not as frequently in the news about SM hype, many commodity segments are affected by SM sentiment to a much greater degree than even the most experienced commodity traders might have assumed.

In this article, we cover seven reasons why SM sentiment data and its use in trading analytics are critical for commodity traders of all ilks.

Reason 1: Commodity trading is highly reliant on fundamental analysis. Many commodities are strongly affected by political and major economic events around the globe. This spells the particular importance of fundamental analysis for the commodities market. By 2023, carrying out quality fundamental analysis is no longer limited to official news, company announcements, and PR publications. SM has now become an important source of the fundamental analysis fact-finding process.

Reason 2: Some major commodities are strongly affected by emotions. Cryptocurrencies and popular high-tech stocks aren’t the only assets where emotion plays a crucial role. When it comes to the price of some major commodities, particularly precious metals and energy, there are significant emotional forces at play. Commodities like gold, oil, or gasoline are often affected by public sentiment, and SM is the place where this sentiment is most evident.

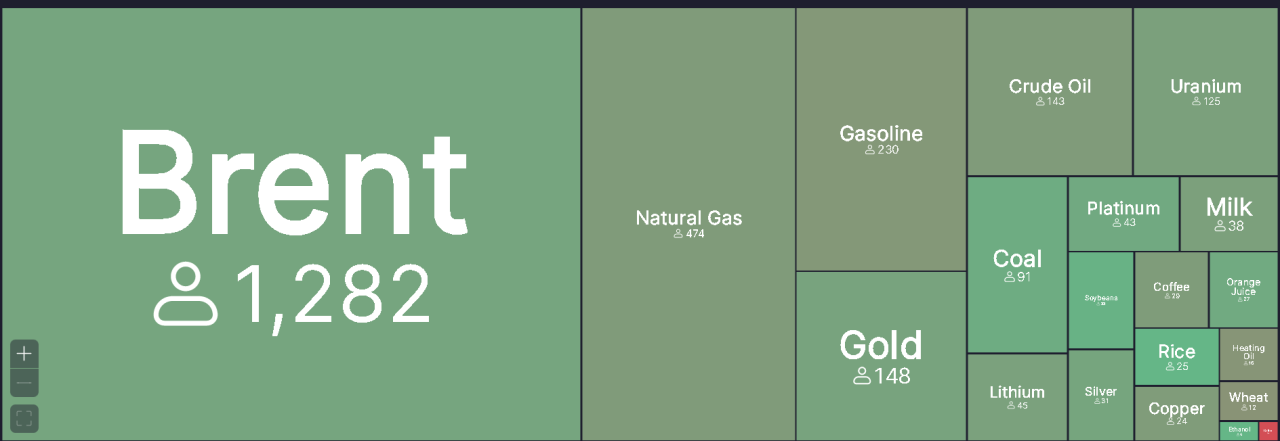

Reason 3: Social Media is one of the very few places where data on some less popular commodities is available. Commodities like Uranium, Lithium, or Lumber aren’t the most popular trading assets, at least compared to the major energy, precious metal, or agricultural commodities. Sources of reliable market intelligence on such assets might be limited, and those sources that are available are often hidden behind expensive paywalls.

There are dozens of such specialized commodity products on the market, staying in the shadows of the commodity market’s poster boys – gold, oil, and a few other very popular assets. At the same time, traders in these commodities need access to sufficient data to form their market strategies. This is when SM data on these assets becomes indispensable. SM is such a vast universe that discussions and sentiments on just about any asset in existence are available and relatively abundant.

Reason 5: The commodity market is dominated by large players with ready access to Social Media sentiment tools. In this environment, you risk falling behind if you don’t use a quality tool. While the stock market is also known for the prevalence of large institutional traders, nowhere else do you realize the sheer dominance of institutionals and big businesses more than on a commodity exchange. These large players, whether investment firms or commodity enterprises, are extremely well-resourced, with an abundance of the latest analytics tools at their disposal, including SM sentiment measurement tools.

In this kind of environment, not using a SM sentiment analytics tool is nothing other than falling behind the market.

Reason 6: Social Media sentiment data is an additional tool in dealing with the volatility of commodities trading. The commodities market is well-known for its high volatility. The majority of commodity segments are very volatile, at least by the standards of the stock market. Any additional data source that helps deal with this volatility is crucial for successful commodity trading. SM is an important additional data source in this regard. It helps complement technical analysis data, news-based fundamental data, and the estimates of supply and demand that are so cherished in commodities trading.

Reason 7: Social Media sentiment data has been proven to have a predictive power in the commodities market. If the reasons above haven’t convinced you that SM sentiment data is critical for profitable commodity trading, here’s the biggest of them all – research has found that SM sentiment has an effect on the price of commodities.

This is probably the best reason for any commodity trader to treat SM analytics as an indivisible part of a successful commodity trading strategy.

If you do wonder how you could best integrate SM analytics into your commodities trading process, check out Zenpulsar’s flagship analytics platform, PUMP – an indispensable tool for commodity, stock, and crypto traders both in the retail and institutional domains.

In this article, we cover seven reasons why SM sentiment data and its use in trading analytics are critical for commodity traders of all ilks.

Reason 1: Commodity trading is highly reliant on fundamental analysis. Many commodities are strongly affected by political and major economic events around the globe. This spells the particular importance of fundamental analysis for the commodities market. By 2023, carrying out quality fundamental analysis is no longer limited to official news, company announcements, and PR publications. SM has now become an important source of the fundamental analysis fact-finding process.

Reason 2: Some major commodities are strongly affected by emotions. Cryptocurrencies and popular high-tech stocks aren’t the only assets where emotion plays a crucial role. When it comes to the price of some major commodities, particularly precious metals and energy, there are significant emotional forces at play. Commodities like gold, oil, or gasoline are often affected by public sentiment, and SM is the place where this sentiment is most evident.

Reason 3: Social Media is one of the very few places where data on some less popular commodities is available. Commodities like Uranium, Lithium, or Lumber aren’t the most popular trading assets, at least compared to the major energy, precious metal, or agricultural commodities. Sources of reliable market intelligence on such assets might be limited, and those sources that are available are often hidden behind expensive paywalls.

There are dozens of such specialized commodity products on the market, staying in the shadows of the commodity market’s poster boys – gold, oil, and a few other very popular assets. At the same time, traders in these commodities need access to sufficient data to form their market strategies. This is when SM data on these assets becomes indispensable. SM is such a vast universe that discussions and sentiments on just about any asset in existence are available and relatively abundant.

Reason 5: The commodity market is dominated by large players with ready access to Social Media sentiment tools. In this environment, you risk falling behind if you don’t use a quality tool. While the stock market is also known for the prevalence of large institutional traders, nowhere else do you realize the sheer dominance of institutionals and big businesses more than on a commodity exchange. These large players, whether investment firms or commodity enterprises, are extremely well-resourced, with an abundance of the latest analytics tools at their disposal, including SM sentiment measurement tools.

In this kind of environment, not using a SM sentiment analytics tool is nothing other than falling behind the market.

Reason 6: Social Media sentiment data is an additional tool in dealing with the volatility of commodities trading. The commodities market is well-known for its high volatility. The majority of commodity segments are very volatile, at least by the standards of the stock market. Any additional data source that helps deal with this volatility is crucial for successful commodity trading. SM is an important additional data source in this regard. It helps complement technical analysis data, news-based fundamental data, and the estimates of supply and demand that are so cherished in commodities trading.

Reason 7: Social Media sentiment data has been proven to have a predictive power in the commodities market. If the reasons above haven’t convinced you that SM sentiment data is critical for profitable commodity trading, here’s the biggest of them all – research has found that SM sentiment has an effect on the price of commodities.

This is probably the best reason for any commodity trader to treat SM analytics as an indivisible part of a successful commodity trading strategy.

If you do wonder how you could best integrate SM analytics into your commodities trading process, check out Zenpulsar’s flagship analytics platform, PUMP – an indispensable tool for commodity, stock, and crypto traders both in the retail and institutional domains.