On 17 August, Bitcoin (BTC) experienced a significant drop in its value, leaving investors and analysts grappling with the reasons behind the latest slump. While recent events such as SpaceX's selloff of BTC, China's economic slowdown, and rising interest rates have been attributed to this decline, a deeper analysis suggests that the signs of Bitcoin's downturn had been brewing for months prior. What really caused the latest Bitcoin correction, and what is the outlook for the world’s top crypto over the following months? In this article, we deep-dive into this key ongoing market development.

Bitcoin’s Latest Correction

On 16 August, Bitcoin’s price hovered close to $30,000, after many weeks of a largely sideways pattern. Nothing seemingly predicted a major price move. Early on 17 August, BTC dipped below $29,000, still far from causing any major concerns. Then, the big drop started off! By the end of the following day, BTC had declined to around $26,000, an 11% correction within the space of just two days.

Since then, BTC has stabilised and largely moved sideways. It now trades at $25,814. This is the crypto’s steepest decline in more than 5 months.

Plethora of Fundamental Factors Blamed

The confluence of recent events undoubtedly had some impact on Bitcoin's price drop. Elon Musk’s SpaceX had sold $373 million worth of its Bitcoin holdings, prompting intense speculation on the market. Many pointed the finger at this event as a trigger for Bitcoin’s slump. Moreover, China's economic growth had shown signs of deceleration, another factor attributed to Bitcoin’s large correction. Finally, rising interest rates also joined the bandwagon of the fundamental factors blamed for BTC’s drop. However, it's essential to acknowledge that while these events might have played a role in the decline, Bitcoin's slump is more intricately linked to trading volume changes that had been developing for months.

Forewarning: Declining Trading Volumes

Technical analysts often posit that volume changes precede price movements. Anyone paying attention to Bitcoin’s trading volume changes over the past few months, and not just to its price movements, can now vouch for the accuracy of this statement.

Since late March, while Bitcoin enjoyed a modest price revival, curiously, its trading volumes have been in a gradual and relentless decline.

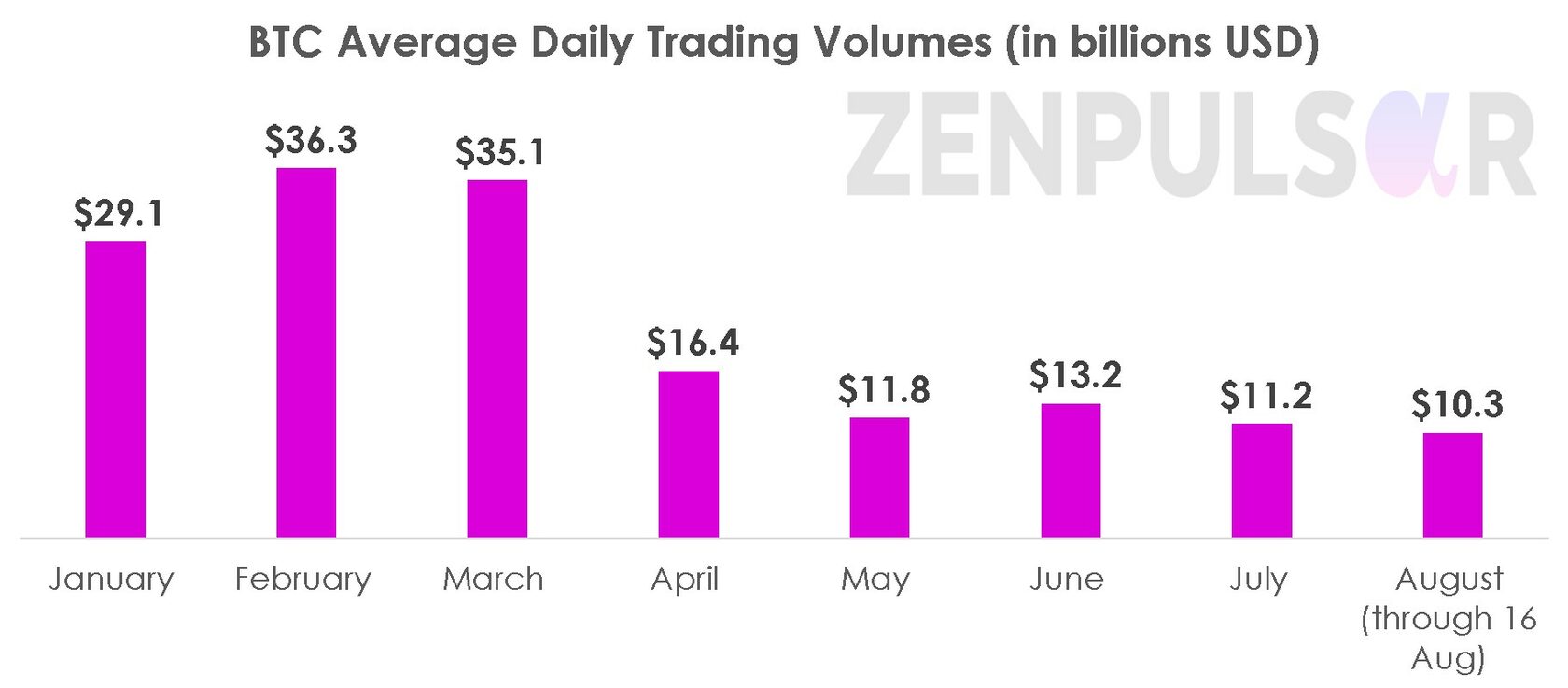

The chart below shows average daily trading volumes for the BTC cryptocurrency for each month of the year.

Data source: Coingecko.com

For the month of August, we have taken the daily average through 16 August, a day before the price slump started in full swing. However, the uncharacteristically low daily volumes continue in the same manner as of the time of writing on 25 August.

While Bitcoin had done reasonably well price-wise over the recent months (between late March, when the trading volumes started to decline, and 16 August, its price increased by 4.3%), the crypto’s trading volumes had been in a clear downward pattern.

The significant, multi-month average volume declines were bound to lead to a large correction or crash – something that eventuated on 17 August. This phenomenon, rather than the plethora of the recent fundamental factors described above, was the major contributing factor to the latest decline. The writing had been on the wall for months, and it’s somewhat surprising that it took Bitcoin so long to experience a correction.

Looking Ahead

As we move closer to the end of the year, the key question is whether the 17 August correction was a one-off event or a precursor for further declines. While it’s always difficult to speculate on the price of Bitcoin, an asset that has often rendered useless forecasts of the greatest among market pundits, one thing is clear – the cryptocurrency’s trading volumes are in a steady, and by now significant compared to early 2023, decline. This points in the direction of further downward moves.

For now, those who firmly believe in volumes being excellent predictors of prices can celebrate. Over the coming months, stay tuned in to the crypto’s trading volumes, not just its price moves. The writing on the wall keeps being drawn.