Timely insights into social media sentiment can make all the difference in the investment decision-making process. However, the landscape of social media sentiment can be as diverse as the assets it covers. The nature of discussions on X might be vastly different from what you’ll find on SeekingAlpha or LinkedIn. This is where ZENPULSAR's social media sentiment analytics tool, PUMP 2.0, sets itself apart. PUMP 2.0 provides a unique advantage by allowing users to filter sentiment measurements across 18 social media sources. This coverage includes all the major sources, such as X, Reddit, LinkedIn, SeekingAlpha, Weibo, Telegram, and Facebook. In this article, we will explore the difference in the nature of sentiment generated on the leading social media networks. By leveraging these differences, you can take your social sentiment analysis to a completely different level.

PUMP 2.0 Source-Specific Sentiment Analysis

Many social sentiment tools in the industry focus on one or a limited number of social media sources. In the world of finance-specific social sentiment, the platform being relied on is usually X. X offers a vast volume of discussions and is a go-to source for tracking reactions to the latest financial news and sentiment. However, the nature of social sentiment generated on X can be very specific and is often very slanted. An additional challenge lies in the prevalence of bots and spammers, which the network has been thoroughly saturated with. This issue creates what can only be described as “noisy” sentiment measurements.

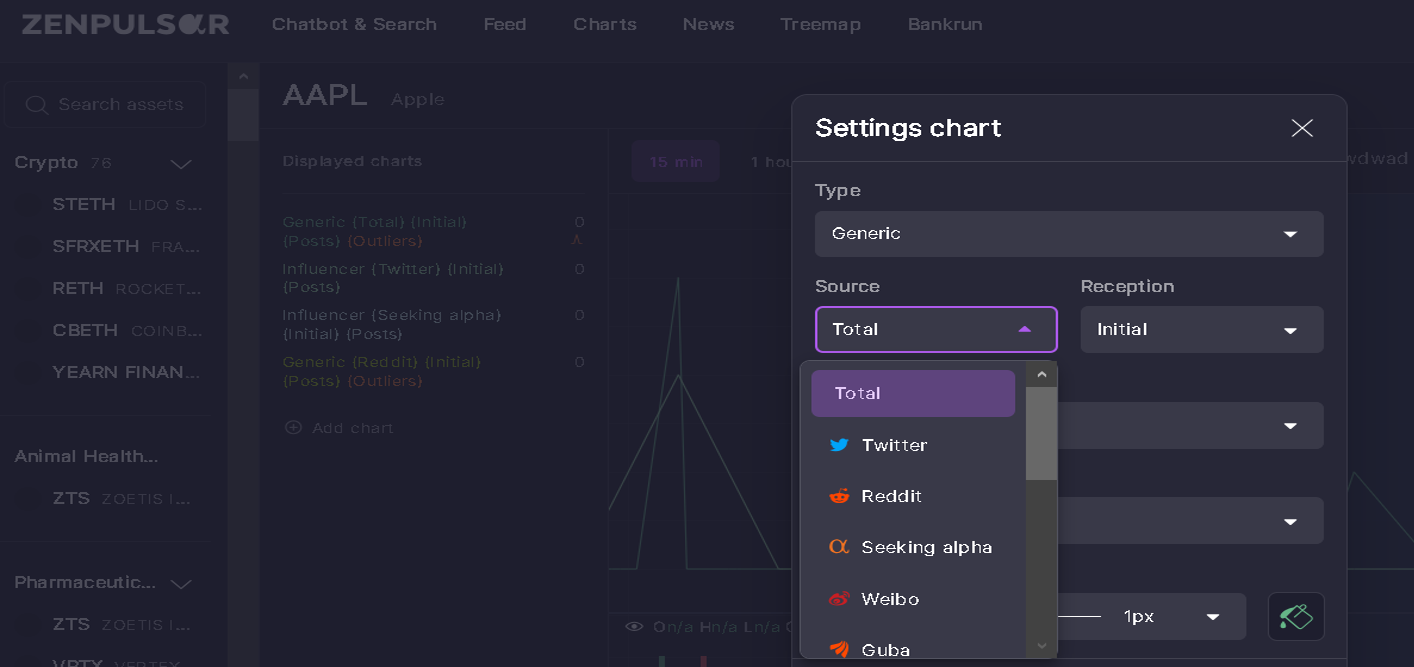

That’s why the ability of PUMP 2.0 to filter sentiment measurements by individual social media sources can contribute to getting finer insights from your social analytics. You can review social sentiment measurements by different platforms to form a better understanding of the overall prevalent sentiment instead of simply relying on the overall data, often dominated by X-generated signals.

Difference in Finance-Specific Social Sentiment by Source

Social Sentiment on X

Despite all its disadvantages described above, X is still an excellent social sentiment gauge for certain situations. The platform is great for promptly gauging reactions to breaking financial news. Early sentiment signals quickly emerge on X thanks to the vast volume of discussions. However, the sheer volume of activity, often driven by bots and spam accounts, can result in sentiment analytics that is far from reliable. While X excels at providing quick signals, the quality of sentiment analysis can be compromised due to these challenges.

Social Sentiment on SeekingAlpha

SeekingAlpha, in contrast, offers a platform where users, among whom are qualified financial analysts and investors, contribute high-quality content. This results in more insightful and valuable sentiment measures. However, the overall volume of discussions is relatively low on SeekingAlpha. Therefore, while the insights are of higher quality, they may lack the breadth necessary for comprehensive sentiment analysis.

SeekingAlpha might be great for identifying valuable investment ideas. However, the relatively lower volume of discussions makes it less useful as an overall sentiment gauge.

Social Sentiment on LinkedIn

LinkedIn often strikes a balance between the high volume of X and the depth of SeekingAlpha. The quality of sentiment on LinkedIn tends to be better than X, primarily due to the professional nature of the platform. However, discussions on the platform may not delve as deeply into financial insights as on SeekingAlpha.

Social Sentiment on Reddit

Reddit mirrors some characteristics of X in terms of high volumes and rapid responses to financial news. However, Reddit users tend to maintain a more discerning approach when it comes to the quality of financial ideas. Absurd or weak financial ideas are promptly challenged on Reddit, providing a more reliable sentiment source than X, where they might be propped up by bots and “shills”.

While Reddit isn’t entirely free of bots and shills, the prevalence of all these unfortunates on the platform is significantly lower than on X.

Social Sentiment on Weibo

When seeking insights into East Asia-specific markets and sentiment, sources like X or Reddit may not provide the depth required. Weibo, with its stronghold in East Asia, becomes an essential source for understanding the financial sentiment unique to this region. Weibo-specific sentiment is critical for any investor or fund manager evaluating China-bound or East Asia-bound investments.

Understanding the nuances of finance-related social sentiment across various platforms is crucial for making informed investment decisions. ZENPULSAR's PUMP 2.0 takes social analytics to the next level by providing source-specific sentiment analysis across 18 social media platforms. This is a width of coverage unmatched in the social listening industry.

When looking to use social sentiment in an in-depth way for your investment analysis, we suggest that you explore the source filter in our tool and derive source-specific social measurements to compare and evaluate. The overall finance-related social sentiment is often dominated by the noisy, voluminous data from X. Looking at other social sources as well will take your sentiment analytics to the next level.

PUMP 2.0 Source-Specific Sentiment Analysis

Many social sentiment tools in the industry focus on one or a limited number of social media sources. In the world of finance-specific social sentiment, the platform being relied on is usually X. X offers a vast volume of discussions and is a go-to source for tracking reactions to the latest financial news and sentiment. However, the nature of social sentiment generated on X can be very specific and is often very slanted. An additional challenge lies in the prevalence of bots and spammers, which the network has been thoroughly saturated with. This issue creates what can only be described as “noisy” sentiment measurements.

That’s why the ability of PUMP 2.0 to filter sentiment measurements by individual social media sources can contribute to getting finer insights from your social analytics. You can review social sentiment measurements by different platforms to form a better understanding of the overall prevalent sentiment instead of simply relying on the overall data, often dominated by X-generated signals.

Difference in Finance-Specific Social Sentiment by Source

Social Sentiment on X

Despite all its disadvantages described above, X is still an excellent social sentiment gauge for certain situations. The platform is great for promptly gauging reactions to breaking financial news. Early sentiment signals quickly emerge on X thanks to the vast volume of discussions. However, the sheer volume of activity, often driven by bots and spam accounts, can result in sentiment analytics that is far from reliable. While X excels at providing quick signals, the quality of sentiment analysis can be compromised due to these challenges.

Social Sentiment on SeekingAlpha

SeekingAlpha, in contrast, offers a platform where users, among whom are qualified financial analysts and investors, contribute high-quality content. This results in more insightful and valuable sentiment measures. However, the overall volume of discussions is relatively low on SeekingAlpha. Therefore, while the insights are of higher quality, they may lack the breadth necessary for comprehensive sentiment analysis.

SeekingAlpha might be great for identifying valuable investment ideas. However, the relatively lower volume of discussions makes it less useful as an overall sentiment gauge.

Social Sentiment on LinkedIn

LinkedIn often strikes a balance between the high volume of X and the depth of SeekingAlpha. The quality of sentiment on LinkedIn tends to be better than X, primarily due to the professional nature of the platform. However, discussions on the platform may not delve as deeply into financial insights as on SeekingAlpha.

Social Sentiment on Reddit

Reddit mirrors some characteristics of X in terms of high volumes and rapid responses to financial news. However, Reddit users tend to maintain a more discerning approach when it comes to the quality of financial ideas. Absurd or weak financial ideas are promptly challenged on Reddit, providing a more reliable sentiment source than X, where they might be propped up by bots and “shills”.

While Reddit isn’t entirely free of bots and shills, the prevalence of all these unfortunates on the platform is significantly lower than on X.

Social Sentiment on Weibo

When seeking insights into East Asia-specific markets and sentiment, sources like X or Reddit may not provide the depth required. Weibo, with its stronghold in East Asia, becomes an essential source for understanding the financial sentiment unique to this region. Weibo-specific sentiment is critical for any investor or fund manager evaluating China-bound or East Asia-bound investments.

Understanding the nuances of finance-related social sentiment across various platforms is crucial for making informed investment decisions. ZENPULSAR's PUMP 2.0 takes social analytics to the next level by providing source-specific sentiment analysis across 18 social media platforms. This is a width of coverage unmatched in the social listening industry.

When looking to use social sentiment in an in-depth way for your investment analysis, we suggest that you explore the source filter in our tool and derive source-specific social measurements to compare and evaluate. The overall finance-related social sentiment is often dominated by the noisy, voluminous data from X. Looking at other social sources as well will take your sentiment analytics to the next level.