In our previous article, the first on the Metaverse investment options, we covered one of the major Metaverse investment products – the Metaverse Index Fund (MVI) by Index Coop. In our 2nd article of the series, we are having a detailed look at another major index-based Metaverse product – the Metaverse ETF (METV) by Roundhill Investments.

What is the Metaverse Index ETF (METV)?

METV is an ETF product by Roundhill Investments, an investment advisory specializing in crypto and Metaverse-related financial products. METV tracks the Ball Metaverse Index, a popular niche index based on the stocks of companies at the forefront of the Metaverse development.

Unlike MVI, METV is an exchange-traded product. It is listed on the NYSE Arca, a subsidiary of the NYSE that specializes in ETF products. A number of big-name brokerages, including Fidelity, Vanguard, and Charles Schwab, offer this ETF. METV’s expense ratio is a rather modest 0.59%.

Brokerages where the Metaverse Index ETF (METV) is available from

What is the Metaverse Index ETF (METV)?

METV is an ETF product by Roundhill Investments, an investment advisory specializing in crypto and Metaverse-related financial products. METV tracks the Ball Metaverse Index, a popular niche index based on the stocks of companies at the forefront of the Metaverse development.

Unlike MVI, METV is an exchange-traded product. It is listed on the NYSE Arca, a subsidiary of the NYSE that specializes in ETF products. A number of big-name brokerages, including Fidelity, Vanguard, and Charles Schwab, offer this ETF. METV’s expense ratio is a rather modest 0.59%.

Brokerages where the Metaverse Index ETF (METV) is available from

For investors unfamiliar with or wary of the crypto market, METV could be a better choice than MVI.

What Is the Composition of METV?

METV maintains holdings in the stock of companies that have a close association with the Metaverse and its development. There are 7 categories of companies included – Hardware, Computing, Networking, Virtual Platforms, Interchange Standards, Payments, and Content/ Asset/Identity Services.

At the moment, METV has holdings in 52 stocks, with the top 5 stocks being NVIDIA (NVDA), Roblox (RBLX), Apple (AAPL), Meta (META), and Microsoft (MSFT). The top 10 holdings list features other technology giants as well, e.g., Sony and Amazon.

The top 10 current holdings of METV

What Is the Composition of METV?

METV maintains holdings in the stock of companies that have a close association with the Metaverse and its development. There are 7 categories of companies included – Hardware, Computing, Networking, Virtual Platforms, Interchange Standards, Payments, and Content/ Asset/Identity Services.

At the moment, METV has holdings in 52 stocks, with the top 5 stocks being NVIDIA (NVDA), Roblox (RBLX), Apple (AAPL), Meta (META), and Microsoft (MSFT). The top 10 holdings list features other technology giants as well, e.g., Sony and Amazon.

The top 10 current holdings of METV

With over $400 million in assets under management (AUM), METV towers head and shoulders above all of its competitor products in the Metaverse niche.

What Is the Performance History of METV?

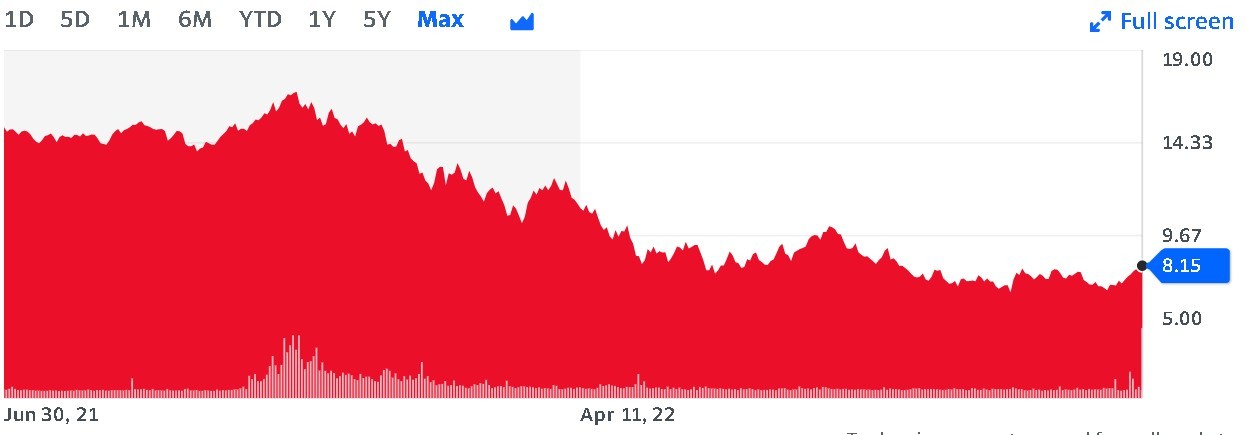

METV was launched in late June 2021, initially trading at around $15 per share. As of now, it trades at $8.15. A year ago, METV was worth $13.55 per share, giving it a 12-month return rate of -40%. Given the abysmal performance of the broader market in 2022, this is far from the worst result among crypto and technology-related investment products.

In the last 30 days, METV has grown by 13% ($7.21 to $8.15), in line with the broader growth pattern in the stock market.

METV price per share from its inception in June 2021 to January 17, 2023

What Is the Performance History of METV?

METV was launched in late June 2021, initially trading at around $15 per share. As of now, it trades at $8.15. A year ago, METV was worth $13.55 per share, giving it a 12-month return rate of -40%. Given the abysmal performance of the broader market in 2022, this is far from the worst result among crypto and technology-related investment products.

In the last 30 days, METV has grown by 13% ($7.21 to $8.15), in line with the broader growth pattern in the stock market.

METV price per share from its inception in June 2021 to January 17, 2023

What Are the Pros and Cons of Investing in METV?

Major pros of investing in METV include:

1. An opportunity to invest in a forward-looking concept, the Metaverse, that is predicted to grow massively over the next few years.

2. A Metaverse-focused product that, unlike some of its purely crypto-based competitors, has the typical protections afforded to stock exchange products.

3. Relatively low volatility. METV, being an index product, benefits from the lower overall volatility compared to the individual stocks it is based on. Additionally, it is considerably less volatile than any index product based on cryptocurrencies rather than stocks.

Key cons of investing in METV are:

1. Lower potential returns vs investing in individual high-growth technology and blockchain stocks. As the Metaverse and blockchain technology develop, some of the companies included in METV are bound to experience strong growth over the coming years. By investing in these stocks individually, you might achieve better overall returns compared to holding on to METV shares.

2. Lower potential returns vs investing directly in crypto-based indices like MVI. METV is a product based on stocks, and the stock market features considerably lower volatility than cryptocurrencies. As we all know, with higher volatility/risk comes the potential for higher returns. For investors with a penchant for risk, direct investment in crypto or crypto-based indices like MVI might be a preferred option over allocating your funds to METV.

Major pros of investing in METV include:

1. An opportunity to invest in a forward-looking concept, the Metaverse, that is predicted to grow massively over the next few years.

2. A Metaverse-focused product that, unlike some of its purely crypto-based competitors, has the typical protections afforded to stock exchange products.

3. Relatively low volatility. METV, being an index product, benefits from the lower overall volatility compared to the individual stocks it is based on. Additionally, it is considerably less volatile than any index product based on cryptocurrencies rather than stocks.

Key cons of investing in METV are:

1. Lower potential returns vs investing in individual high-growth technology and blockchain stocks. As the Metaverse and blockchain technology develop, some of the companies included in METV are bound to experience strong growth over the coming years. By investing in these stocks individually, you might achieve better overall returns compared to holding on to METV shares.

2. Lower potential returns vs investing directly in crypto-based indices like MVI. METV is a product based on stocks, and the stock market features considerably lower volatility than cryptocurrencies. As we all know, with higher volatility/risk comes the potential for higher returns. For investors with a penchant for risk, direct investment in crypto or crypto-based indices like MVI might be a preferred option over allocating your funds to METV.