The first half of the year featured a number of high-profile bank runs and banking collapses. Gold, a key financial asset universally valued for its “safe-haven investment” status, has always attracted the attention of institutional and retail investors during such market developments.

However, the price of gold didn’t indicate a major reaction to these events earlier this year. On the surface, the demand for gold wasn’t strongly affected by the banking crisis. We at ZENPULSAR decided to take a deeper look into this development, and beneath gold’s calm reaction on the price chart, we have uncovered a massive segment of investors who have made a rush towards gold as if there is no tomorrow.

Gold Price During 2023 Bank Runs

In early March, rumours of the start-up friendly Silicon Valley Bank (SIVB) being in trouble started to circulate on then Twitter (now X). The Twitter-fueled panic led to a 2-day bank run on SIVB that eventually resulted in its collapse on 10 March. Two days later, another startup-oriented bank, Signature Bank New York (SBNY) also collapsed as a result of a panic-driven run.

The two banking collapses, some of the largest in US history, immediately led to significant market sentiment deterioration. Typical for such a setting, gold reacted with a price jump due to increased demand for the safe-haven asset. However, the scale of gold’s price jump was surprisingly mild compared to the big market sentiment deterioration.

Between 10 March (SIVB’s collapse date) and 4 April (when gold’s uptrend had evaporated), the price of gold futures increased only by 8.6% ($1,862 to $2,022). While this was a substantial rise, it was far milder than expected by many market observers. After 4 April, gold slowly lost most of these gains and now trades at $1,903. This is only 2.2% higher than its pre-bank run period price.

Similarly, when the First Republic Bank (FRC) collapsed on 1 May, gold futures reacted with only a modest, temporary jump – between 1 May and 5 May, gold increased by 3.2% before losing most of these small gains in the following days.

Judging by the very mild reaction the gold price has shown to these bank collapses, one might assume that the investor community remained largely ambivalent about these events. While this might be the case with institutional investors, things were drastically different within another group – tech-savvy retail investors that are active in the domains of crypto and FinTech.

Retail Crypto Investors Rush to Gold

Individual investors active in the cryptocurrency sphere are the leading force behind investments in crypto, FinTech, and other technology-supported financial products. These investors are typically very tech-savvy and don’t restrict themselves only to the stock market and other regulated markets.

They are also spread all over the world and represent the widest base of investors that the FinTech industry typically targets. It is within this vast segment that we have observed a very sensitive and sharp reaction to the bank runs that unfolded earlier this year.

Our analysis is based on probably the best known gold-related cryptocurrency project in existence – Tether Gold (XAUT). XAUT is the 89th largest cryptocurrency overall and the largest gold-related crypto project by market cap.

Tether, the company behind the world’s most actively traded crypto asset, USDT, introduced Tether Gold in January 2020. Using the XAUT cryptocurrency, anyone can invest in physical gold locked in a Swiss vault. XAUT represents a tokenised form of that investment, essentially acting as a certificate of ownership for the physical asset. One XAUT is always equal to the price of one ounce of gold.

Immediately following the bank runs on SIVB/SBNY and FRC, we observed large spikes in trading volumes for XAUT, as detailed below.

However, the price of gold didn’t indicate a major reaction to these events earlier this year. On the surface, the demand for gold wasn’t strongly affected by the banking crisis. We at ZENPULSAR decided to take a deeper look into this development, and beneath gold’s calm reaction on the price chart, we have uncovered a massive segment of investors who have made a rush towards gold as if there is no tomorrow.

Gold Price During 2023 Bank Runs

In early March, rumours of the start-up friendly Silicon Valley Bank (SIVB) being in trouble started to circulate on then Twitter (now X). The Twitter-fueled panic led to a 2-day bank run on SIVB that eventually resulted in its collapse on 10 March. Two days later, another startup-oriented bank, Signature Bank New York (SBNY) also collapsed as a result of a panic-driven run.

The two banking collapses, some of the largest in US history, immediately led to significant market sentiment deterioration. Typical for such a setting, gold reacted with a price jump due to increased demand for the safe-haven asset. However, the scale of gold’s price jump was surprisingly mild compared to the big market sentiment deterioration.

Between 10 March (SIVB’s collapse date) and 4 April (when gold’s uptrend had evaporated), the price of gold futures increased only by 8.6% ($1,862 to $2,022). While this was a substantial rise, it was far milder than expected by many market observers. After 4 April, gold slowly lost most of these gains and now trades at $1,903. This is only 2.2% higher than its pre-bank run period price.

Similarly, when the First Republic Bank (FRC) collapsed on 1 May, gold futures reacted with only a modest, temporary jump – between 1 May and 5 May, gold increased by 3.2% before losing most of these small gains in the following days.

Judging by the very mild reaction the gold price has shown to these bank collapses, one might assume that the investor community remained largely ambivalent about these events. While this might be the case with institutional investors, things were drastically different within another group – tech-savvy retail investors that are active in the domains of crypto and FinTech.

Retail Crypto Investors Rush to Gold

Individual investors active in the cryptocurrency sphere are the leading force behind investments in crypto, FinTech, and other technology-supported financial products. These investors are typically very tech-savvy and don’t restrict themselves only to the stock market and other regulated markets.

They are also spread all over the world and represent the widest base of investors that the FinTech industry typically targets. It is within this vast segment that we have observed a very sensitive and sharp reaction to the bank runs that unfolded earlier this year.

Our analysis is based on probably the best known gold-related cryptocurrency project in existence – Tether Gold (XAUT). XAUT is the 89th largest cryptocurrency overall and the largest gold-related crypto project by market cap.

Tether, the company behind the world’s most actively traded crypto asset, USDT, introduced Tether Gold in January 2020. Using the XAUT cryptocurrency, anyone can invest in physical gold locked in a Swiss vault. XAUT represents a tokenised form of that investment, essentially acting as a certificate of ownership for the physical asset. One XAUT is always equal to the price of one ounce of gold.

Immediately following the bank runs on SIVB/SBNY and FRC, we observed large spikes in trading volumes for XAUT, as detailed below.

SIVB/SBNY Collapses and Massive Tether Gold Volume Spikes

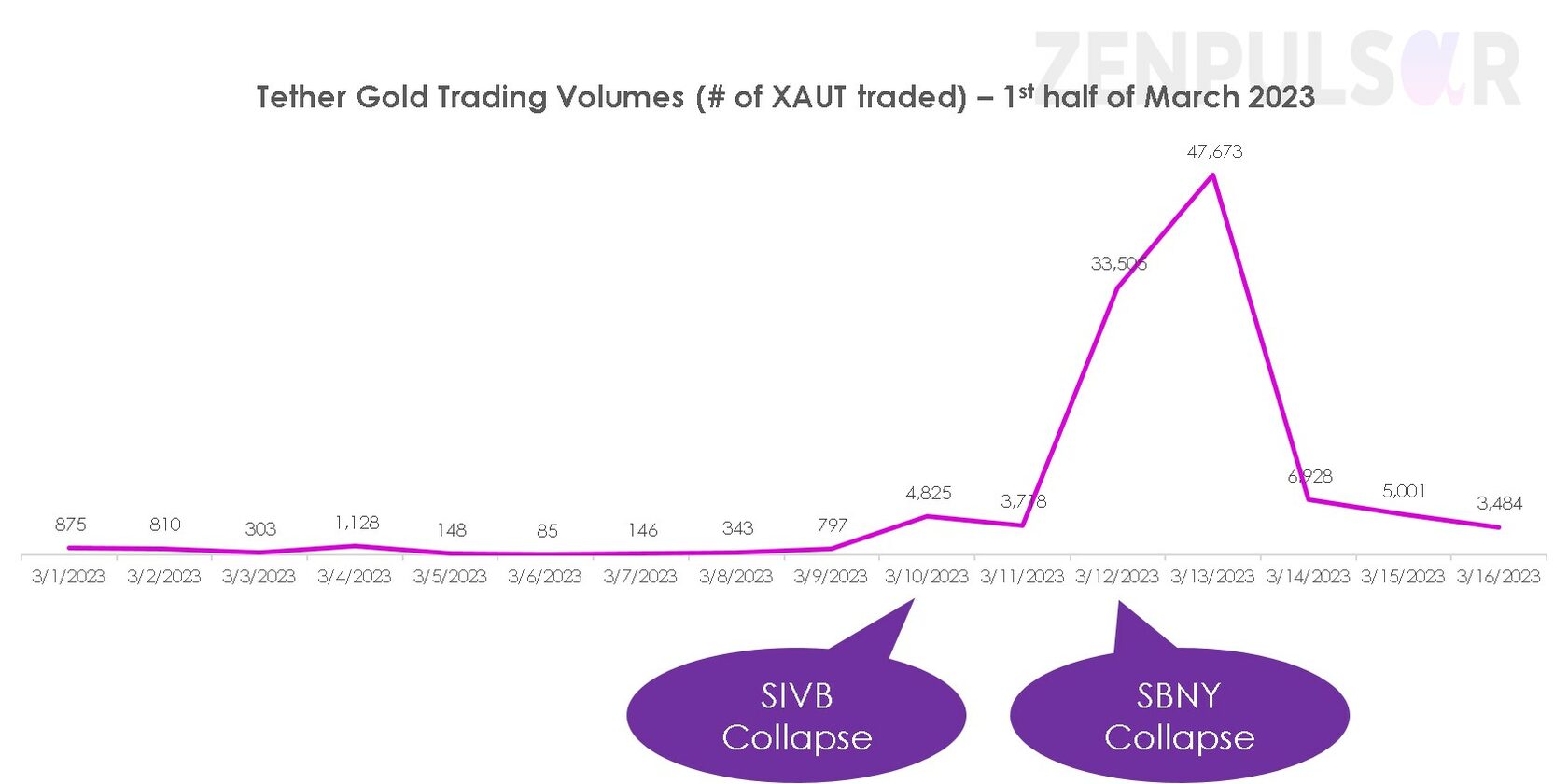

The number of XAUT units traded experienced a stratospheric rise in the days following the 2-day (10 March to 12 March) period when SIVB and SBNY were taken over by administrators.

The chart shows XAUT trading volumes in the first half of March.

Before the news of SIVB being in trouble gained traction on 8 March, XAUT typically had volumes of daily trade in the few hundreds. The daily average of XAUT traded in the first seven days of March was nearly 500 (499). On the day of SIVB’s collapse, 10 March, this volume spiked to 4,825 XAUT, a nearly 10-fold increase from the typical volumes.

Things turned even more drastic on 12 and 13 March, when the amount of XAUT traded reached tens of thousands (>33,000 and >47,000, respectively).

By mid-March, the immediate frenzy subsided, and the daily volume stabilised at between 3,000 and 4,000, still around 6 to 8 times higher than in the pre-bank run times.

FRC Collapse and Tether Gold Volume Spike

FRC was another high-profile casualty of the 2023 banking crisis. The bank was taken over by administrators on 1 May. Although its collapse didn’t generate as much panic as the earlier crashes of SIVB and SBNY, it still led to a marked increase in market nervousness. On the futures market, gold reacted with a modest 3% jump in four days between 1 May and 5 May and then shed the majority of these small gains, hardly a big development.

Yet, in the shadow of these developments, gold-minded crypto investors staged another rush, albeit of more modest proportions, towards XAUT.

By the 1st of May, the day of FRC’s collapse, XAUT’s daily volumes had been averaging about 3,000 units, based on the previous 7-day figures. On May 4, the daily volume jumped to 6,815 before moderating back to around 3,000 to 4,000 in the following days.

While nowhere near the level of post-SIVB/SBNY volume spikes, this more than 100% volume increase between 1 May and 4 May also demonstrated crypto investors sensitivity to the troublesome developments in the banking sector.

The Tether Gold (XAUT) drastic volume spikes, particularly after the March banking collapses, were in stark contrast to gold’s subdued moves on the price chart. The price of gold is strongly affected by large institutional players like national central banks, and the yellow metal showed a very measured reaction. Clearly, national banks and other large institutionals were not looking for gold as a shield against the banking sector turmoil.

However, among tech-savvy retail investors, the mood was very different. Wild rushes towards XAUT clearly show that these investors were unnerved by the banking collapses and actively sought the safety of gold, in this case in the form of tokenised gold-linked asset, Tether Gold (XAUT).

Get access to the best insights from social media data with ZENPULSAR.