Biofuels are an important and growing sector within the energy industry. They are renewable, domestically produced, and have the potential to reduce greenhouse gas emissions compared to fossil fuels. However, the production of biofuels relies heavily on agricultural commodities such as corn, soybeans, and sugarcane. As a result, the biofuel industry is tightly connected to the agricultural commodities market, and shifts in one sector can have a significant impact on the other. In this article, we will explore the dynamic relationship between the biofuel industry and agricultural commodities, and the investment opportunities that exist within this space.

Biofuel Production and Agricultural Commodities

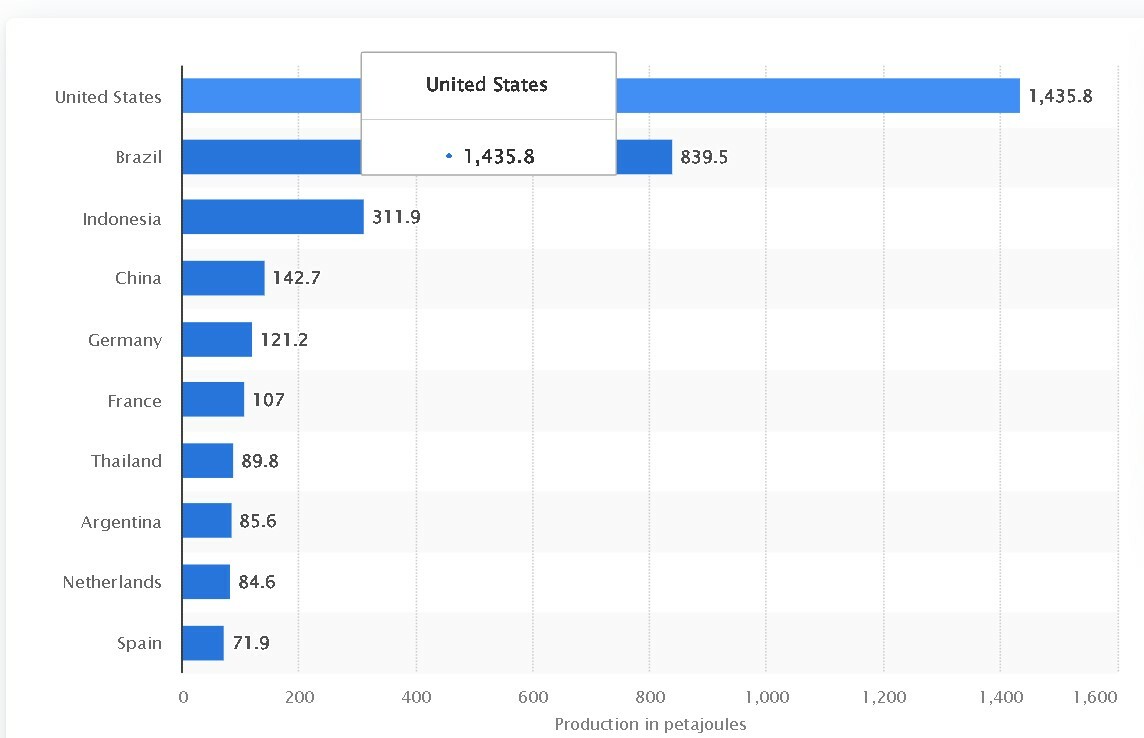

The biofuel industry uses agricultural commodities as the primary feedstock for the production of biofuels. Two countries dominate the biofuel production rankings, the US and Brazil.

The largest biofuel producing countries (in petajoules)

Image source: Statista.com

Corn is the primary feedstock for ethanol production in the United States, while sugarcane is the primary feedstock used in Brazil. Soybeans are also a commonly used agricultural product for biodiesel production. As a result, the prices of these commodities are closely tied to developments in the biofuel industry.

Corn is the primary feedstock for ethanol production in the United States, while sugarcane is the primary feedstock used in Brazil. Soybeans are also a commonly used agricultural product for biodiesel production. As a result, the prices of these commodities are closely tied to developments in the biofuel industry.

Government Mandates and Subsidies

The biofuel industry is heavily influenced by government mandates and subsidies. In the United States, the Renewable Fuel Standard (RFS) requires a certain volume of renewable fuels, including biofuels, to be blended into the transportation fuel supply each year. This mandate has helped drive demand for corn-based ethanol in the United States. Similarly, in Brazil, the government has implemented policies to encourage the production and use of sugarcane-based ethanol, including subsidies for production and tax incentives for consumers.

Shifts in Demand and Production

Shifts in demand and production of biofuels can have a significant impact on the agricultural commodities market. For example, changes in the RFS volume requirements or shifts in consumer demand for biofuels can impact the demand for corn-based ethanol, which will inevitably have an effect on the price of corn.

Thus, for agricultural commodity traders, tracking the RFS requirements and other key indicators within the biofuel market is as important as evaluating the general supply and demand forecasts.

Common Biofuel-Related Investment Opportunities

Given the tight connection between the biofuel industry and some agricultural commodities, there are a number of investment opportunities within this space. If your portfolio requirements include biofuel-related investments, below are some of the key products to consider.

Agricultural Commodities Futures

Corn, soybeans, and sugarcane futures are probably the most obvious and standard financial products linked to the biofuel industry. These agricultural commodities are used as the key source of biofuel production. Growth in biofuel production and consumption is likely to support prices for these commodities.

Biofuel Stocks

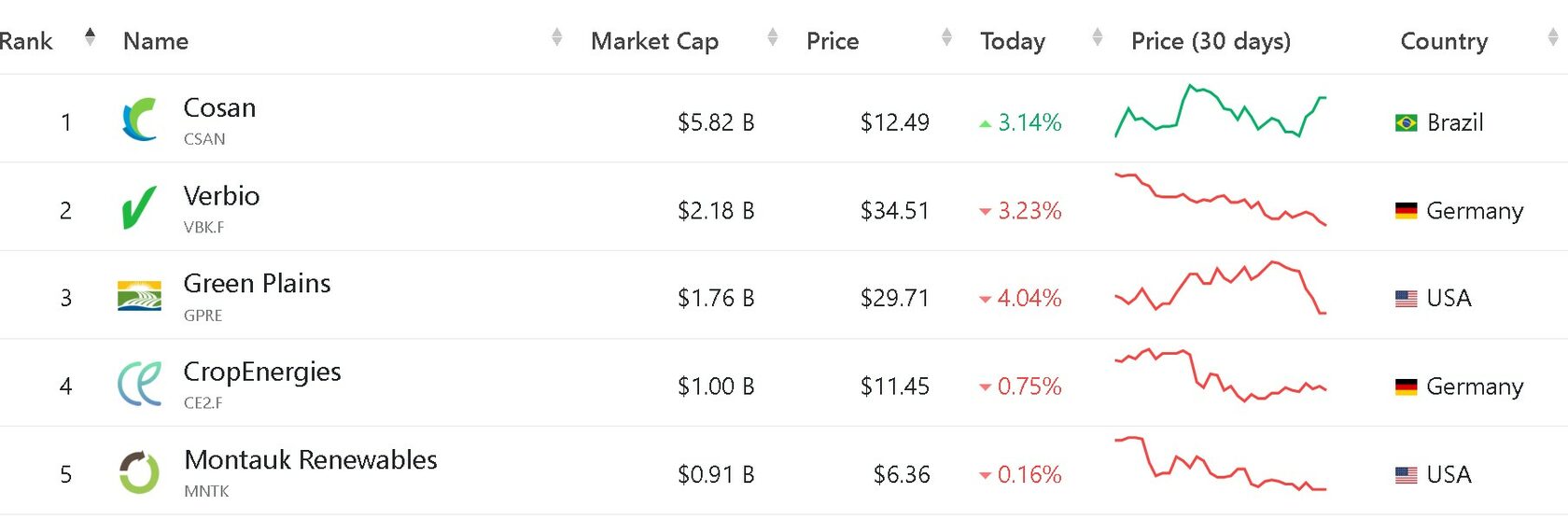

You might also consider stocks of biofuel producers, such as ethanol or biodiesel producers, to gain exposure to the growth potential of the biofuel industry. However, it is important to note that these stocks can be volatile and may be impacted by a variety of factors beyond just the price of agricultural commodities. Below are the five largest (by market cap) public companies in the biofuel production industry.

The top 5 largest companies/stocks in biofuel production

Image source: Companiesmarketcap.com

Agricultural Technology Stocks

Agricultural Technology Stocks

Another option is stocks of companies that provide technology solutions for the agricultural sector, such as precision agriculture technology or biotechnology. These companies can benefit from increased demand for agricultural commodities and improved agricultural efficiency. Naturally, investments in these stocks provide less direct exposure to the biofuel industry compared to stocks of biofuel producers.

The biofuel industry is an important and growing sector within the energy industry, and it is intimately tied to some agricultural commodities. When considering investments in corn, soybeans, or sugar futures, or in biofuel-related stocks, ensure that you integrate into your analysis the current and forecast regulatory requirements, consumption trends, and production levels within this industry.