Investor sentiment is one of the most valuable pieces of data in the world of finance. It provides a fundamental piece of information to traders, fund managers, investment analysts, and more. In the past, sentiment surveys were traditionally used as a major way to keep your finger on the pulse of market sentiment. With the arrival of Social Media (SM) sentiment measurement tools, this has changed drastically. In this article, we are comparing SM sentiment data with surveys as a means of measuring the ever important market sentiment.

Surveys as a Market Sentiment Measurement Tool

Surveys have been used for measuring investor sentiment for at least the last several decades. Most of these surveys are custom-designed and carried out by specific market actors – investment funds, research agencies, trading associations – with the goal of sensing the market sentiment among specific target groups.

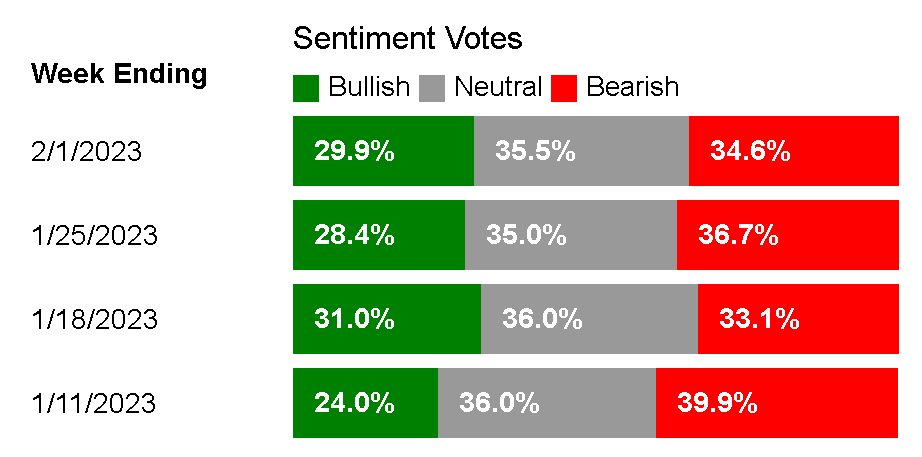

However, some surveys have a more generalized focus. Perhaps the best known standardized market sentiment survey in the world is the weekly investor surveyby the American Association of Individual Investors (AAII). The survey measures sentiment among retail investors with regard to the stock market. It asks survey participants to provide their opinion on how the stock market will develop over the next 6 months. Respondents have three answer options to choose from – bullish, bearish, and neutral.

The latest weekly result for the AAII Investor Sentiment Survey

The majority of other financial surveys are customized and are far less popular as an overall gauge of the market sentiment. The AAII survey has been running on a rolling weekly basis and dates back to 1987. In the world of market sentiment surveys, it is an absolute giant, with hardly any competitor in sight. The AAII has commented that the survey results represent a contrarian indicator.

Social Media Data as a Market Sentiment Measurement Tool

For decades, the AAII survey and other sentiment surveys ruled supreme in terms of informing traders and analysts about market sentiment. With the recent rise in SM usage and the increasing sophistication of SM sentiment measurement tools, surveys are no longer the primary gauge of investor sentiment.

Social Media platforms now have the richness of data that surveys could never achieve simply due to being based on respondent opinion. However, that doesn’t mean that surveys have become obsolete. Instead, SM sentiment analytics and sentiment surveys are now complementary tools in a smart trader’s toolbox.

Both surveys and SM sentiment data have their relative pros and cons, though the depth and sophistication of SM data ensure that it has a certain upper hand over surveys when it comes to accurately predicting market sentiment.

Surveys vs Social Media Sentiment Data – Pros and Cons for Gauging the Market Mood

Let’s start with the relative pros of surveys for measuring market sentiment and predicting future market developments. Surveys largely possess two specific advantages here over SM data:

1. Surveys, at least the highly popular AAII Sentiment Survey, might be better at predicting the market over long-term periods – a few months and up to half a year. Research has shown that SM sentiment data holds the best predictive power in short-term (same day, next day) time spans.

2. Surveys, specifically custom-designed ones, can be tailored to target very specific audiences. The survey sponsoring organization also has the advantage of adding very specific custom questions. This advantage is somewhat attenuated for users of the survey who have no say in the questionnaire design. I.e., you might access a survey done by a leading consultancy, but if a specific question that interests you is not included, the survey would have a more limited use for you.

Now, let’s cover the relative pros of using SM sentiment analysis tools vs surveys:

1. SM sentiment data is much better for shorter-term trading intervals – days and even a few weeks. Most surveys, including the AAII survey, are better at gauging generalized long-term sentiment. The AAII survey specifically asks investors to think about a full 6-month time interval. Thus, if you are a day trader, SM sentiment data is more useful for you. The same applies to other market participants who are involved in relatively frequent and active trading – fund managers and most retail traders.

2. SM sentiment is behavioural data, while surveys are opinion-based data. The former has been shown to be much more predictive than the latter.

3. SM sentiment data can be analyzed in more detail. While surveys can be customized, there is a limit to how many questions you can ask a respondent without sacrificing the quality of the answers – respondent fatigue is a real issue in the world of surveying! This limits the amount and depth of data you can collect in a survey. On the other hand, modern SM sentiment analytics tools have grown to a level of sophistication where they can capture very detailed data. With the richness of the data, you get much better drill-down opportunities.

4. SM sentiment analysis tools can be applied to more specific markets. The primary standardized market sentiment survey – the AAII Sentiment Survey – is limited to measuring stock market opinion. If you are a commodity or crypto trader, let alone someone in an even more specialized field, there is no widely available standard gauge of your market. On the other hand, SM sentiment tools are well capable of measuring sentiment across different markets. For instance, Zenpulsar’s PUMP SM analytics platform measures sentiment in stocks, commodities, crypto, forex, and bond markets.

5. SM sentiment data can be measured in a very responsive way, down to minutes and hours. Most quality SM analysis tools are continually monitoring the net in real-time to pick up signals. Surveys are much less responsive in that regard.

In conclusion, we should stress that surveys and SM sentiment could be used in a complementary rather than exclusive way, at least by long-term oriented investors. However, if you are an active trader, fund manager, or analyst who needs to continually keep their eye on the market, SM data should definitely be more relevant for you than surveys to gauge the ongoing market sentiment.