The virtual world of the future – the Metaverse – is not here yet in the true sense of it. However, leading technology and crypto companies are working hard on the advancement of the concept. In this article, the first in our series on Metaverse-based investment, we cover the topics of the Metaverse and index-based investment in the Metaverse. Read on if you are curious about investing in literally the future of our day-to-day reality.

What Is Actually the Metaverse?

The Metaverse is a digital environment based on blockchain technology that uses the elements of virtual reality (VR) and augmented reality (AR) to create an immersive, highly realistic digital world where any person can participate using their own avatar.

The Metaverse is predicted to become the default way of gaming, entertainment, communication, and even work within a few years. Based on blockchain technology, the Metaverse would let users earn, spend, and trade virtual world assets using NFTs and cryptocurrencies.

The Metaverse emerged as a concept similar to Second Life, the hugely popular gaming platform where you create your digital avatar and live in the virtual world via the avatar.

Despite the hype surrounding it, the Metaverse is not an established technology yet. There is a large variety of virtual worlds right now. They belong to various companies and gaming platforms. Some are blockchain-based, while others are not. However, these virtual worlds are not inter-connected in a unified digital universe, which the Metaverse is aspiring to become.

The blockchain-based virtual world environments have limited inter-connectivity and, thus, cannot be described as part of a larger digital universe.

However, since late 2021, the Metaverse concept has been growing in popularity. In October 2021, witnessing the massive growth in interest in the Metaverse, Facebook Inc. made a cheeky move to re-brand itself as “Meta”, a name that, no doubt, was designed to create a certain ownership aura between the company and the Metaverse concept.

Needless to say, Meta is neither the owner nor the sole developer of a Metaverse environment. A large number of companies are currently developing Metaverse environments of their own. However, the problem of limited inter-connectivity remains. The true Metaverse revolution will come about when this inter-connectivity problem is resolved.

What Metaverse Investment Options Are on the Market?

Investing in the Metaverse is possible via:

1. Metaverse-based index products. Two major products in this niche are the Metaverse Index Fund (MVI) and the Ball Metaverse Index (METV). The former is a crypto-based product you can invest in via the purchase of MVI crypto tokens, while the latter is a stocks-based product available via the NYSE Arca. Further in the article, we will cover the MVI index. Our next Metaverse investment series article will focus on METV.

2. Stocks of technology and blockchain companies active in the Metaverse development space. We will cover this category in our 3rd article on Metaverse investment.

3. Cryptocurrencies that belong to the projects at the forefront of the Metaverse development. The leading category of Metaverse crypto coins is the play-to-earn (P2E) sector, represented by cryptos such as Decentraland (MANA), The Sandbox (SAND), and Axie Infinity (AXS). This will be covered in our 4th article in the Metaverse investment series.

What Is the Metaverse Index Fund (MVI)?

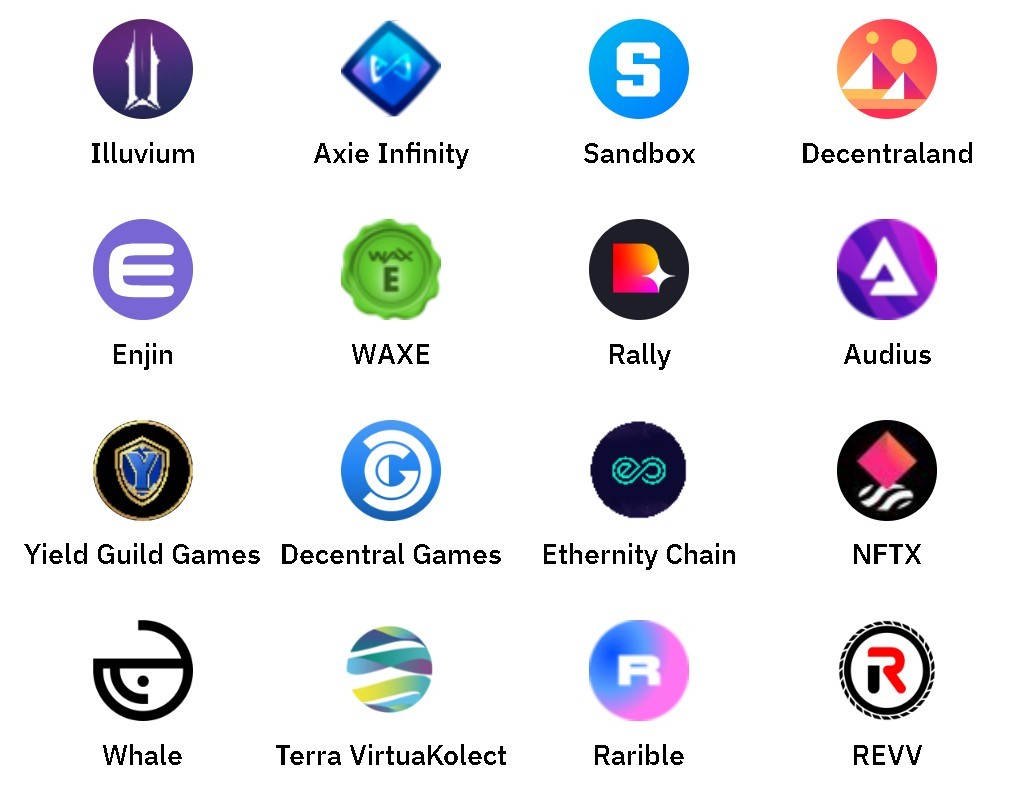

The Metaverse Index Fund is based on 16 leading Metaverse-related cryptocurrencies. The current cryptos included in the fund are shown in the image below:

What Is Actually the Metaverse?

The Metaverse is a digital environment based on blockchain technology that uses the elements of virtual reality (VR) and augmented reality (AR) to create an immersive, highly realistic digital world where any person can participate using their own avatar.

The Metaverse is predicted to become the default way of gaming, entertainment, communication, and even work within a few years. Based on blockchain technology, the Metaverse would let users earn, spend, and trade virtual world assets using NFTs and cryptocurrencies.

The Metaverse emerged as a concept similar to Second Life, the hugely popular gaming platform where you create your digital avatar and live in the virtual world via the avatar.

Despite the hype surrounding it, the Metaverse is not an established technology yet. There is a large variety of virtual worlds right now. They belong to various companies and gaming platforms. Some are blockchain-based, while others are not. However, these virtual worlds are not inter-connected in a unified digital universe, which the Metaverse is aspiring to become.

The blockchain-based virtual world environments have limited inter-connectivity and, thus, cannot be described as part of a larger digital universe.

However, since late 2021, the Metaverse concept has been growing in popularity. In October 2021, witnessing the massive growth in interest in the Metaverse, Facebook Inc. made a cheeky move to re-brand itself as “Meta”, a name that, no doubt, was designed to create a certain ownership aura between the company and the Metaverse concept.

Needless to say, Meta is neither the owner nor the sole developer of a Metaverse environment. A large number of companies are currently developing Metaverse environments of their own. However, the problem of limited inter-connectivity remains. The true Metaverse revolution will come about when this inter-connectivity problem is resolved.

What Metaverse Investment Options Are on the Market?

Investing in the Metaverse is possible via:

1. Metaverse-based index products. Two major products in this niche are the Metaverse Index Fund (MVI) and the Ball Metaverse Index (METV). The former is a crypto-based product you can invest in via the purchase of MVI crypto tokens, while the latter is a stocks-based product available via the NYSE Arca. Further in the article, we will cover the MVI index. Our next Metaverse investment series article will focus on METV.

2. Stocks of technology and blockchain companies active in the Metaverse development space. We will cover this category in our 3rd article on Metaverse investment.

3. Cryptocurrencies that belong to the projects at the forefront of the Metaverse development. The leading category of Metaverse crypto coins is the play-to-earn (P2E) sector, represented by cryptos such as Decentraland (MANA), The Sandbox (SAND), and Axie Infinity (AXS). This will be covered in our 4th article in the Metaverse investment series.

What Is the Metaverse Index Fund (MVI)?

The Metaverse Index Fund is based on 16 leading Metaverse-related cryptocurrencies. The current cryptos included in the fund are shown in the image below:

The calculation of the total index is based on two basic parameters for each coin – market cap and liquidity. If you are interested in the exact calculations, they are detailed on the website of the fund’s provider, Index Coop.

Index Coop uses a basic set of criteria to select cryptocurrencies for inclusion in the index. These are:

How to Invest in MVI?

Unlike its major index-based competitor, METV, MVI is not a stock exchange-based product. It is based solely on the Ethereum blockchain. If you want to invest in the fund, you can purchase the MVI cryptocurrency.

What Are the Pros and Cons of Investing in MVI?

The major pros of investing in MVI are:

1. A forward-looking, long-term investment in the Metaverse concept. If the Metaverse achieves even a fraction of the success many pundits predict, investment in MVI might make you rich in a few years’ time. Don’t count on quick wins here, though.

2. Diversification. Instead of investing in individual Metaverse-related cryptos, you can diversify by choosing MVI. This should reduce the overall volatility of your investment – a major pro given how volatile cryptos are in general.

The key cons of investing in MVI include:

1. Volatility. Even though MVI is less volatile than the individual cryptocurrencies it is based on, it is still far from being a low-risk product. Any cryptocurrency investment is going to be relatively volatile, at least by the standards of someone used to investing only in the stock market.

2. Lower potential rewards vs investing in individual Metaverse-related crypto tokens. The Metaverse is among the hottest topics in the world of crypto. Thus, the leading coins in MVI will always carry the potential to become tomorrow’s big gainers. Investing in them individually might lead to better returns than keeping your funds in MVI.

3. No regulation. MVI is a crypto-based product and doesn’t have the regulatory protections of exchange-based financial products. If you are intent on using only exchange-based, traditional finance products, stay tuned for our upcoming coverage of the METV index fund.

Index Coop uses a basic set of criteria to select cryptocurrencies for inclusion in the index. These are:

- The crypto must be based on the Ethereum (ETH) blockchain

- The token’s project must belong to one of the following categories on Coingecko.com, a leading crypto data portal – NFT, Entertainment, Virtual or Augmented Reality, or Music

- The token’s market cap must be at least $50 million

- The token’s underlying protocol must have at least 3 months of operational history

- There must be adequate liquidity and transaction history for the protocol on Ethereum

- The protocol must have been independently audited

How to Invest in MVI?

Unlike its major index-based competitor, METV, MVI is not a stock exchange-based product. It is based solely on the Ethereum blockchain. If you want to invest in the fund, you can purchase the MVI cryptocurrency.

What Are the Pros and Cons of Investing in MVI?

The major pros of investing in MVI are:

1. A forward-looking, long-term investment in the Metaverse concept. If the Metaverse achieves even a fraction of the success many pundits predict, investment in MVI might make you rich in a few years’ time. Don’t count on quick wins here, though.

2. Diversification. Instead of investing in individual Metaverse-related cryptos, you can diversify by choosing MVI. This should reduce the overall volatility of your investment – a major pro given how volatile cryptos are in general.

The key cons of investing in MVI include:

1. Volatility. Even though MVI is less volatile than the individual cryptocurrencies it is based on, it is still far from being a low-risk product. Any cryptocurrency investment is going to be relatively volatile, at least by the standards of someone used to investing only in the stock market.

2. Lower potential rewards vs investing in individual Metaverse-related crypto tokens. The Metaverse is among the hottest topics in the world of crypto. Thus, the leading coins in MVI will always carry the potential to become tomorrow’s big gainers. Investing in them individually might lead to better returns than keeping your funds in MVI.

3. No regulation. MVI is a crypto-based product and doesn’t have the regulatory protections of exchange-based financial products. If you are intent on using only exchange-based, traditional finance products, stay tuned for our upcoming coverage of the METV index fund.