Tech Stocks as Poster Boys of the Stock Market

Join in on any discussion of the stock market, and there is a good chance you will hear about the top technology stocks being the key topic of debate. The likes of Tesla, Google, Apple, and Meta dominate the discourse and, importantly, attract massive amounts of investor capital.

However, the top technology giants have largely underperformed when it comes to delivering returns to their investors, at least judging by the ROI figures over the last year. Sure, some of these tech glamour boys of the stock market have recently had impressive runs. For instance, Tesla is up by nearly 50% in the last 3 months. However, short-term ups and downs come and go, and these fluctuations are less relevant for long-term oriented investors.

What happens on the scale of a year or more is more relevant for those thinking long term. The same Tesla stock has delivered an abysmal -46% ROI on a yearly basis. To be frank, Tesla is probably a poor example to judge about the top tech stocks in general. Its popularity is affected by the antics of its flamboyant boss and the massive waves the company stirs up in social media discussions. It has become hip to invest in something like electric cars, especially if the business is driven by such a “visionary” as Musk.

Instead, the overall sector’s investment attractiveness is better judged by the leading stocks that are less prone to the roller-coaster changes peculiar to Tesla.

In order to assess the stock market performance of tech stocks, we have looked at the yearly return data for the top 3 US companies by market capitalisation within the sector. We have analysed a number of industry sectors in this way to assess whether the tech industry is worth the hype it is creating, and if not, what other sectors have delivered good returns.

The industry data and ranking by market capitalization were based on the info sourced from CompaniesMarketCap.com, while the return figures were based on the info from Yahoo Finance. We have decided to analyse US-based stocks only, rather than include relevant stocks worldwide, since every regional market might have a different context. For instance, performance of tech or manufacturing stocks in one market might differ completely, depending on the country or region. Thus, our sector analysis is relevant for the US market.

Technology Stocks’ Performance – Reality Meets the Hype

Based on our methodology, below is the data for yearly returns (to 10 April 2023) for the top 3 US technology stocks – Apple, Microsoft, and Google – and, for comparison purposes, the yearly returns of S&P 500 and NASDAQ – the two primary overall gauges of the stock market. We have also listed Tesla’s figures for illustration purposes, although the company is just the 6th largest by market cap.

The tech’s rather uninspiring performance over the year is clearly seen from the table. Google slipped up, crashing nearly 18%, Apple is nearly 3% down, while Microsoft posted a miniscule 1% return. The average for the top 3 tech stocks, -6.5%, is roughly similar to S&P 500’s 7% yearly loss. Nothing exciting to see here.

These tech giants have failed to deliver despite the sector’s intimate involvement in promising technologies such as AI and Web3.

What about other sectors’ performance? Which niches cheered their investors up over the last 12 months?

The Renewable Energy Sector – Hip but Uneven

If there is a segment of the market that can rival the tech in terms of hip and trendiness, that is the renewable energy sector. Who’s going to save the planet other than these guys? The only thing more in-vogue than investing in the top tech is ploughing your money into green technologies.

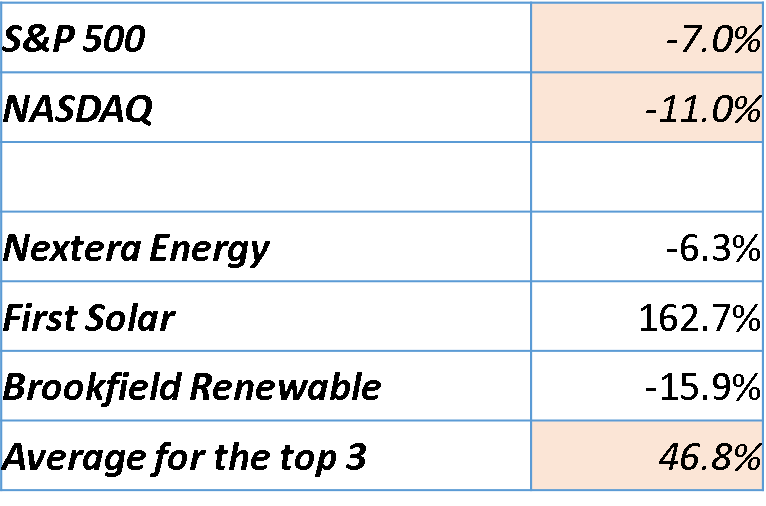

How has this sector performed? The table below shows the yearly returns for the top 3 US renewable energy stocks.

Looking merely at the average for the 3 stocks paints a very rosy picture – the top companies of the sector, on average, have delivered a nearly 50% ROI. Of course, it is easy to see that this impressive figure is achieved only thanks to First Solar’s whopping 163% growth. The other two sector leaders have delivered negative returns.

Thus, the renewable energy sector overall is not a good performer at all. Performance of this sector is largely company-specific rather than industry-specific. While First Solar’s investors can celebrate and raise champagne glasses, the sector in general hasn’t done uniformly well. Just like the case with the Big Tech, this industry hasn’t converted hip and glamour into solid returns.

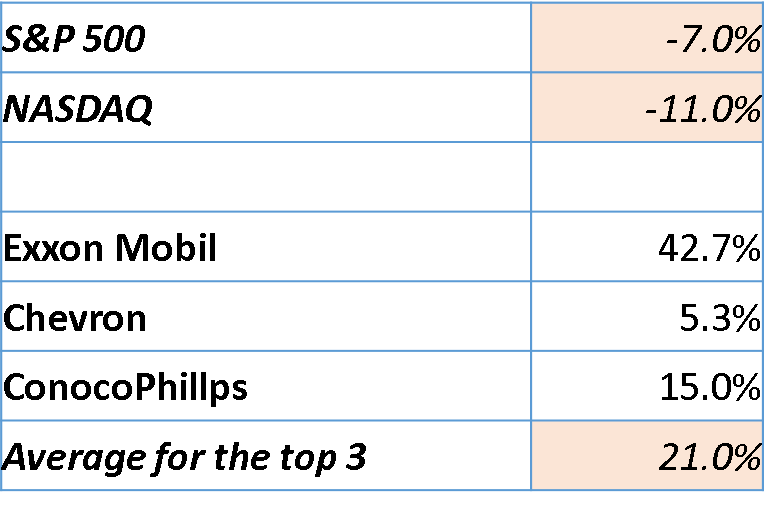

Oil & Gas – Uneven but Still Positive

Unlike the renewable energy sector, Oil & Gas isn’t likely to be a target for investors from Greta Thunberg’s fan club. However, just like the case with the renewable energy, Oil & Gas features an uneven performance of its top stocks.

Exxon Mobil has posted a much higher growth rate than the other two top stocks – Chevron and ConocoPhillips. However, these uneven results are still all positive. Thus, the sector overall has shown decent, even if not fantastic, performance. Even Chevron’s modest 5% growth is a much better outcome than S&P 500’s -7% or NASDAQ’s -11%.

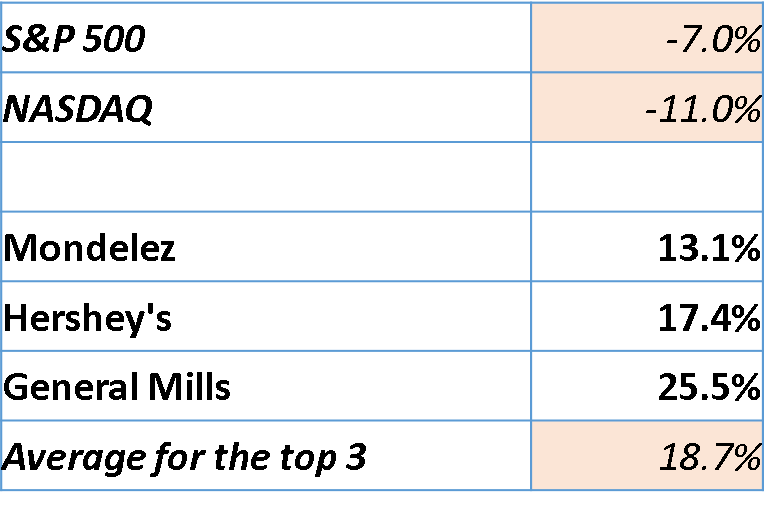

The Food Sector – A Quiet Achiever

The food sector, represented in its top 3 by Mondelez, Hershey’s, and General Mills, has been the sector that put food, not much pun intended, on the table for its investors.

All the top players of the food industry have delivered great returns. Unlike the Oil & Gas sector, the top trios’ results have all been impressive. The lowest ROI here was delivered by the sector leader Mondelez. The company’s 13% yearly return is nothing short of an excellent result at a time when S&P 500 and NASDAQ posted negative growth figures.

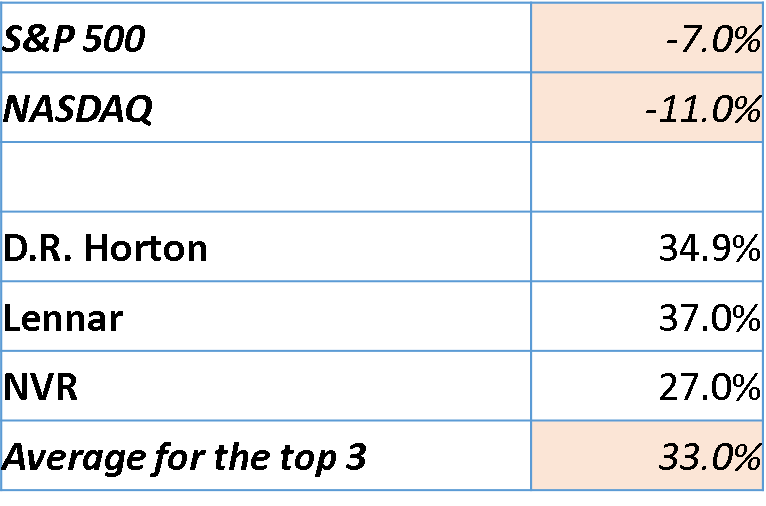

The Construction Sector – The Top Dog

A roof over your head is another basic need of ours, besides food. The construction industry has done even better than the food industry when it comes to yearly ROIs. While the food sector’s returns are impressive, they are a notch lower than what the top US construction stocks have achieved.

The construction sector’s 33% average ROI for the top 3 confidently trumps the food sector’s 19%. As is the case with the food, there is no uneven performance among the top 3 – all three US construction giants have done very well, with NVR’s 27% being the lowest result.

While Big Tech and the renewable sector get all the attention and love, in the backdrop of all this noise, a number of down-to-earth sectors catering to people’s basic needs have delivered very impressive returns over the last year. The food industry and especially the construction industry are the areas which delivered in terms of ROI rather than hip. Naturally, past performance doesn’t ensure future success. Yet, our analysis aims to demonstrate that for a strategically thinking investor, there are great opportunities away from the main street’s lights.