Over the last 12 months, Bitcoin (BTC) has demonstrated markedly superior returns compared to the vast majority of other high-cap cryptos. Historically, major altcoins closely tracked Bitcoin's price movements and exhibited high correlations with the world's leading cryptocurrency. However, their divergence from Bitcoin's performance in terms of ROI raises questions about whether they still maintain a close link to BTC on the price charts. At the same time, a second question arises – is Bitcoin now more in tune with the stock market than with high-cap altcoins when it comes to returns? In this article, we present the results of our analysis aimed at answering these questions.

Bitcoin vs Major Altcoins – Divergent Fates

Based on a 12-month period between 26 September 2022 and 25 September 2023, Bitcoin posted a yearly growth rate of 37%, a very solid result by all standards. Yet, many other high-cap cryptocurrencies featured significantly poorer performance during the same time. For instance, Binance’s BNB Coin is down 24%, while XRP is up by a relatively modest, at least by the standards of the crypto market, 8%. The leading altcoins that performed better than these cryptos still fell well short of Bitcoin’s result. Ethereum (ETH) is up 19%, and Litecoin (LTC), a crypto that has traditionally correlated highly with Bitcoin, gained 20% over the same 12-month period. While the 19%-20% growth rates are impressive, they are markedly lower than Bitcoin’s 37% ROI.

At the same time, there are some rare high-cap cryptocurrencies that performed vastly better than Bitcoin. For instance, Bitcoin Cash (BCH), a fork of Bitcoin that, similar to Litecoin, often featured high correlations with BTC, is up by a whopping 81% over the year. For reference, BCH is one of the oldest high-cap cryptos and, unlike memecoins and other hype-driven cryptocurrencies, hasn’t been a popular asset for market manipulators or pump-and-dump scheme operators. In light of this, its 81% growth rate can be described as nothing less than a spectacular achievement.

These sharp divergences in price trajectories between BTC and other big cryptos raise an important question – are high-cap altcoins still tightly correlated with Bitcoin at all? If they don’t, has BTC become an asset more aligned with the stock market than the rest of the crypto market?

Our Analysis Methodology

To answer these two critical questions, we have analysed return correlations between BTC and a number of high-cap altcoins, as well as between BTC and the two main stock market indices – S&P500 and NASDAQ Composite. The analysis covers a period between 26 September 2022 and 25 September 2023 and is based on weekly returns for the assets.

The price data to calculate the returns was sourced from Yahoo Finance. We chose weekly returns (as of each Monday) instead of monthly return data as the former gives us more data points (52) for a robust correlation analysis.

The cryptocurrencies whose return correlations with BTC we have looked at included:

1. Ethereum (ETH). As the second-largest crypto, ETH has always been one of the most tightly linked assets to Bitcoin. It often features some of the highest correlations in the world of crypto with its larger counterpart.

2. BNB Coin (BNB). Excluding the stablecoin Tether (USDT), BNB is the third-largest cryptocurrency by market cap. Its prominent status in the crypto world and the disastrous yearly performance (-24%), which was so starkly different from Bitcoin’s solid yearly growth, made it an interesting case to investigate.

3. XRP. Right behind BNB in the market cap rankings, XRP is also a major altcoin. In recent times, it has been in the news a lot thanks to its developer company Ripple’s court victory over the Securities and Exchange Commission (SEC).

4. Litecoin (LTC). In addition to the biggest altcoins, ETH, BNB, and XRP, we decided to also look at some high-cap cryptocurrencies that in the past were reported to share very strong correlations with Bitcoin. LTC, forked from Bitcoin back in 2011 and currently ranked 15th by market cap, is one of them.

5. Bitcoin Cash (BCH). BCH, also an early fork of Bitcoin and currently the 16th crypto by market cap, is another coin that in the past featured strong correlations with BTC.

Bitcoin & Altcoins Return Correlations

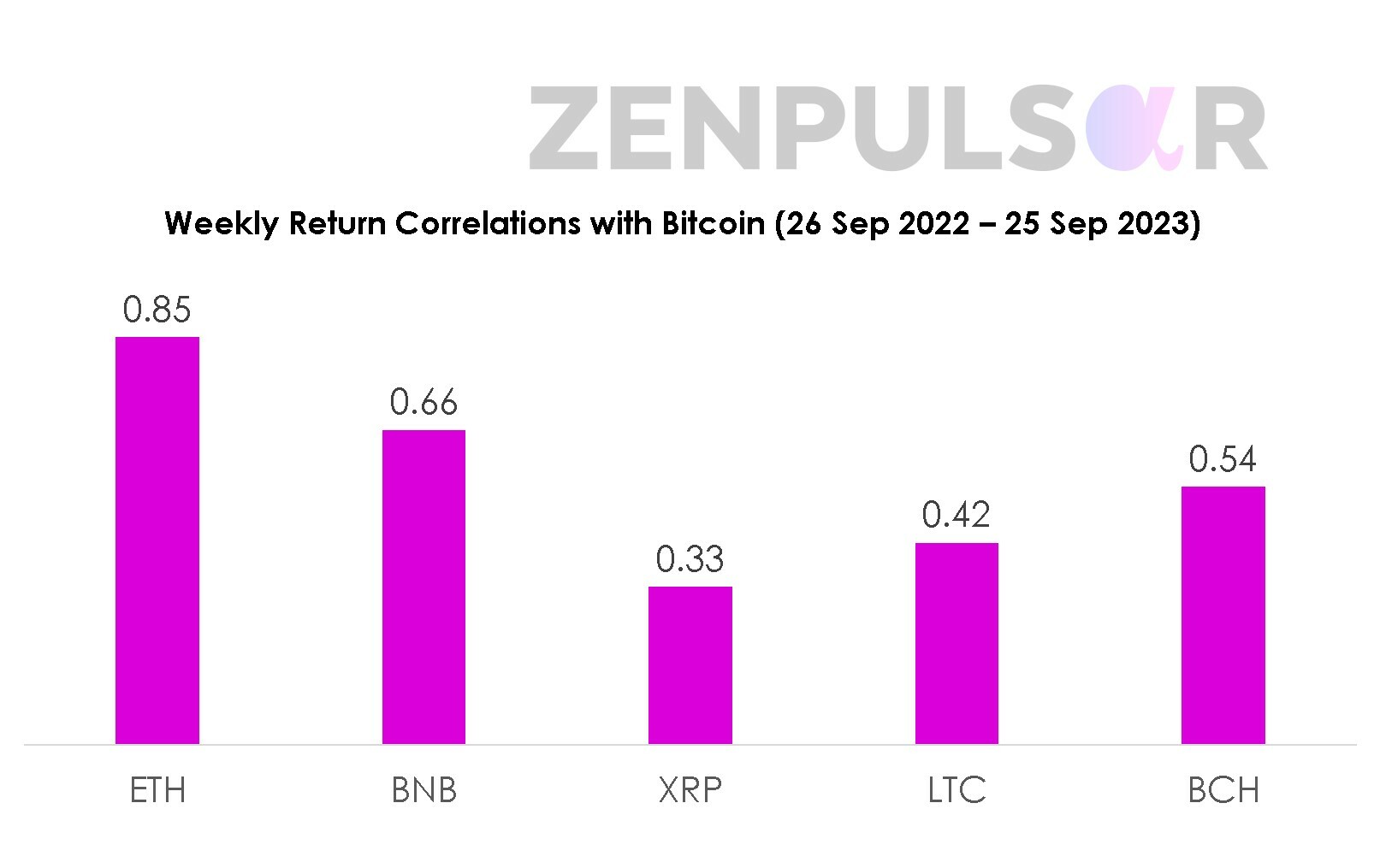

Based on the weekly returns data over the yearly analysis period, BTC demonstrated a strong correlation only with ETH. The chart below shows return correlations for BTC vs all the altcoins included in our analysis.

We would typically consider correlations in excess of 0.8 or at least 0.7 to be “strong” or “very strong”. Based on the cutoff figures, only ETH’s returns can be considered strongly associated with BTC returns. The correlation with BNB (0.66) might at best be described as “moderate-to-strong”, while the correlations with the remaining coins – XRP (0.33), LTC (0.42), and BCH (0.54) – are weak or moderate.

These results demonstrate that when it comes to return correlations, only ETH follows BTC very tightly. Even the coins that in the past were known for high or extreme correlations with BTC – LTC and BCH – are no longer tightly associated with it.

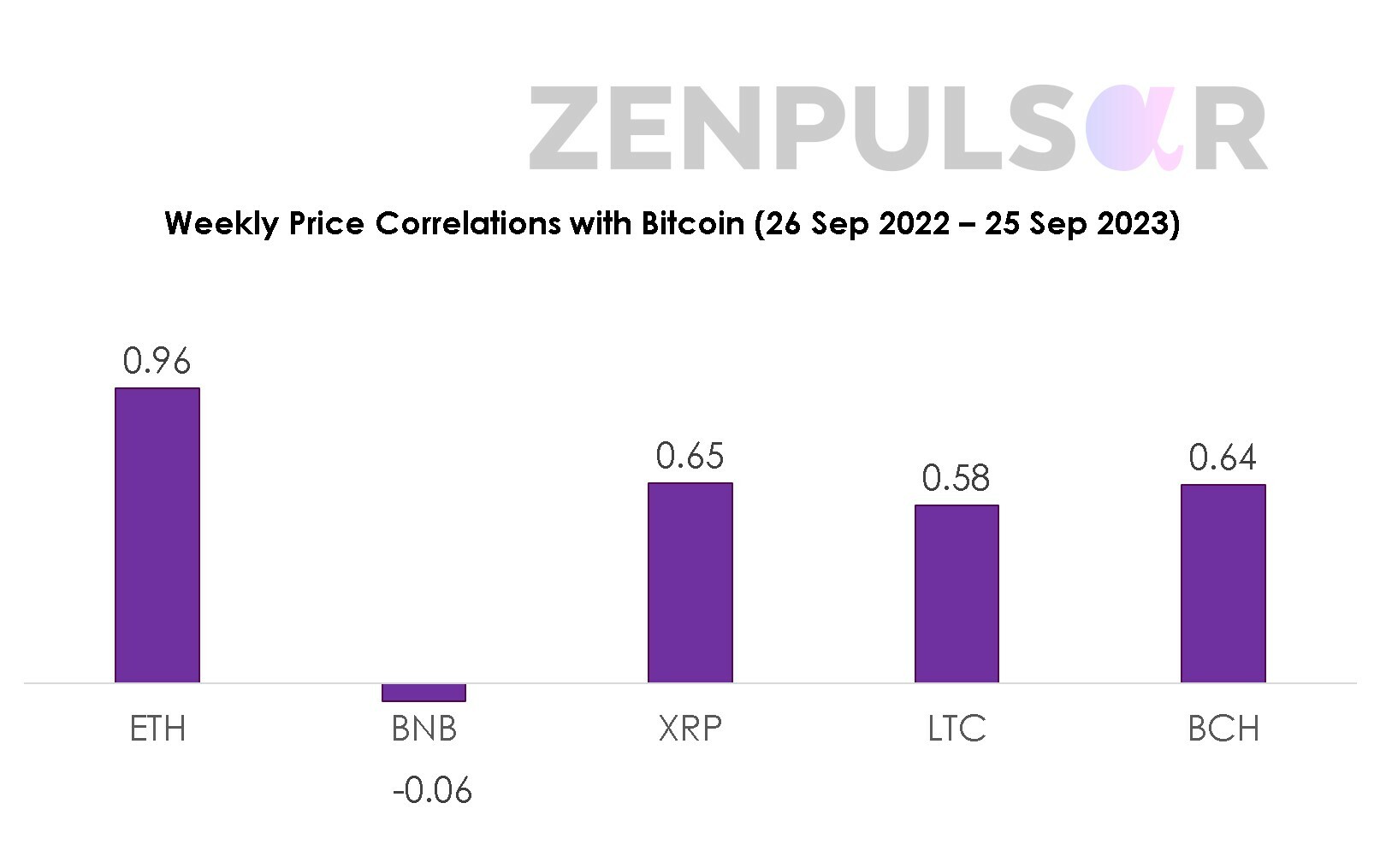

This de-linking of the association between BTC and the high-cap cryptos is reflected not only in return correlations but in price correlations as well. The chart below shows price correlations rather than return correlations based on weekly (Monday) prices for the same yearly period. While we are not big fans of using price correlations, we demonstrate the chart to provide further evidence of the relationship split between BTC and the major altcoins (excl. ETH).

The price-based correlations paint the same picture – a tight association of BTC with ETH but only moderate associations with the price moves of XRP, LTC, and BCH. In the case of BNB, there is virtually no correlation.

In the past, high-cap altcoins followed BTC’s moves religiously, which was often reflected in high or very high correlations based on both returns and prices. This kind of relationship between Bitcoin and Ethereum seems to be continuing. However, when it comes to other high-cap cryptos, it looks like their tight link to Bitcoin is in the process of getting weakened.

Bitcoin & Stock Market Return Correlations

Bitcoin’s apparent divergence from the rest of the crypto market, with the exception of Ethereum, poses another interesting question: Has the world’s top coin become more aligned with the stock market than with the rest of the crypto market?

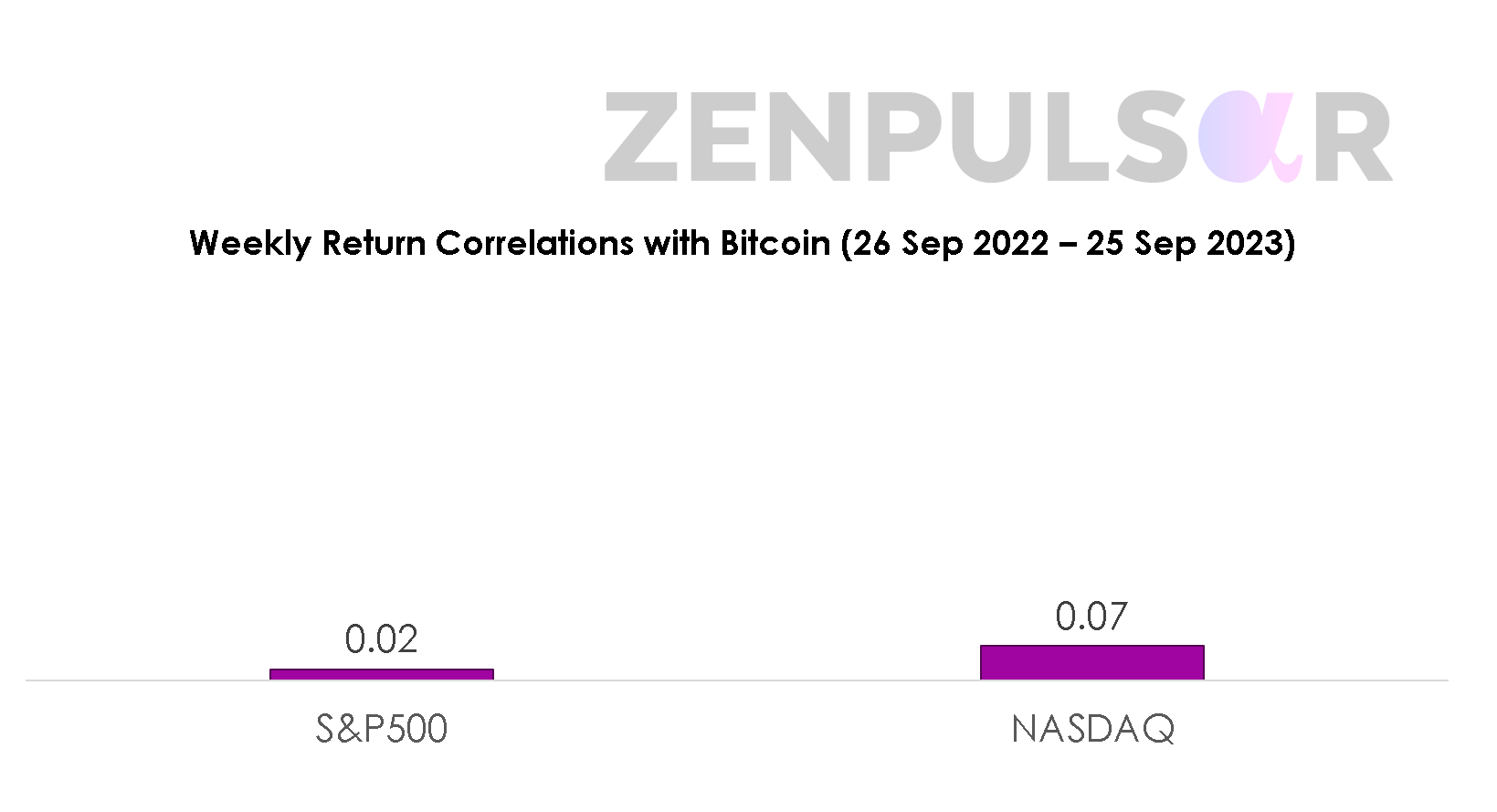

To answer this question, we have looked at BTC’s return correlations with the two primary stock market indices – S&P500 and NASDAQ Composite.

As the chart above demonstrates, Bitcoin’s return correlation with the stock market is virtually zero. While Bitcoin’s correlations with major altcoins beyond Ethereum have weakened in recent times, this hasn’t made the crypto any more aligned with the stock market.

These close-to-zero correlations in returns are masked by the fact that price correlations between BTC and the two stock market indices have been quite strong in recent times. Using the same weekly price data, we have found BTC’s price correlations with S&P500 and NASDAQ to be quite strong, at 0.75 and 0.81, respectively. Yet, masked away by the price-based data, returns for Bitcoin and the stock market have been totally uncorrelated.

The close-to-zero return correlations that Bitcoin shares with S&P500 and NASDAQ indicate that the crypto coin might still be an excellent diversifier for stock market investments. As the investment world awaits the launch of the first US Bitcoin spot ETFs as early as this month, Bitcoin’s utility as an equities portfolio diversifier should, therefore, not be overlooked.

Summary

As a summary of our analysis, our key findings are as follows:

1. Bitcoin is still strongly correlated with ETH. Both return correlations and price correlations between the two largest cryptocurrencies are very substantial.

2. Large-cap altcoins, apart from ETH, no longer share strong correlations with Bitcoin. Even coins like LTC and BCH, which used to feature strong or very strong correlations, particularly price-based correlations, with Bitcoin, are no longer closely following its moves. The last 12-month data shows that both the return and price correlations of these assets with Bitcoin are at best moderate.

3. Bitcoin’s decoupling from much of the crypto world hasn’t resulted in its alignment with the stock market. While price-based correlations between BTC and the major stock market indices are high, the actual return correlations are at a level of nearly zero. As such, Bitcoin remains an excellent diversification material for portfolios focusing on stocks.