Low-Risk Financial Assets During a Flight to Quality

A flight to quality, also known as a flight to safety, is a common market phenomenon whereby investors shift their funds from higher-risk investments to low-risk asset classes during times of market uncertainty or fear. Typically, during a flight to quality, assets such as cryptocurrencies, derivatives, and volatile stocks suffer outflows, while the primary assets that benefit are gold, treasury bonds, and real estate.

Starting from early 2022, financial markets have been in a less than optimistic state. The outbreak of the war in Ukraine in particular hit investor confidence hard. Closer to the end of the year, the IMF was busy predicting an upcoming large-scale global recession.

The stock market went into decline in January 2022, and despite recent gains, hasn’t recovered to its December 2021 levels as of today.

Earlier this year, a quartet of banks, Silicon Valley Bank, Signature Bank, First Republic Bank, and Credit Suisse bit the dust, with social media-driven panic causing fatal bank runs on these institutions.

By all accounts, the period from early 2022 till now has been very conducive to a flight to quality. Under these conditions, one would expect the trio of the low-risk asset classes – gold, US Treasury bonds, and real estate – to flourish. Has that been the case?

Performance of the US Government Fixed-Income Products

Over the last one year to 23 May, the 1-year US Treasury Bills’ yield has grown from 2% to 5%. During the same period, the yield rate of the 6-month Treasury Bills has grown from 1.5% to nearly 5.4%, while the yield rate of the 2-year Treasury Notes has increased from 2.5% to 4.4%.

US Treasury Bills’ yield rates rise when the demand for these fixed-income products declines. The yield rate increases demonstrate that despite the recent unsettling economic and geopolitical events, there has been no uptick in demand for US government fixed-income bond products.

Performance of Real Estate

Real Estate (RE) is another asset class that is considered a safe haven during times of market uncertainty or fear, perhaps just not to the same level as gold or US bonds. With the exception of cases where RE markets are hit directly and act as the main cause of the wider market decline (as happened during the US sub-prime mortgage crisis of 2007/2008), investments in RE are considered a low-risk option.

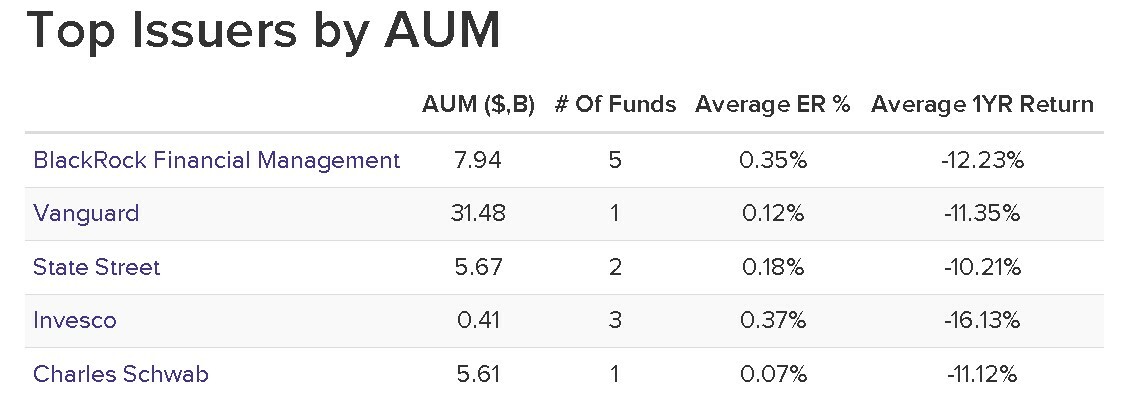

The image below shows the top 5 US RE ETFs by Assets under Management (AuM), with their yearly returns indicated in the last column.

Image source: ETFdb.com

All five of the largest US ETFs focused on RE investments posted double-digit negative returns. The largest RE ETF in the world, Vanguard RE ETF (VNQ), has shed 11.35% over the year.

Similar to US Treasury Bills, RE as an investment class has failed to attract sufficient investor interest despite market uncertainty and geopolitical instability.

Performance of Gold

Unlike US Treasury Bills and RE, gold has done well in recent times, proving its status as a great safe heaven asset. Over the last one year, the price of gold has grown by 6%. More notably, gold has jumped 12% in the last 6 months.

Evidently, the recent market uncertainty, war in Ukraine, overall recessionary mood, banking collapses, and geopolitical tensions have benefited gold but not US Treasury Bills or RE investments.

Why Gold?

Out of the three key low-risk assets, why has gold, and only gold, seen demand for it grow? The answer to this question is found in the meeting rooms of central banks around the globe. Since the rise of political tensions around Ukraine, national central banks in some countries have been busy buying gold in unprecedented amounts for recent times, pushing the price of the precious metal higher.

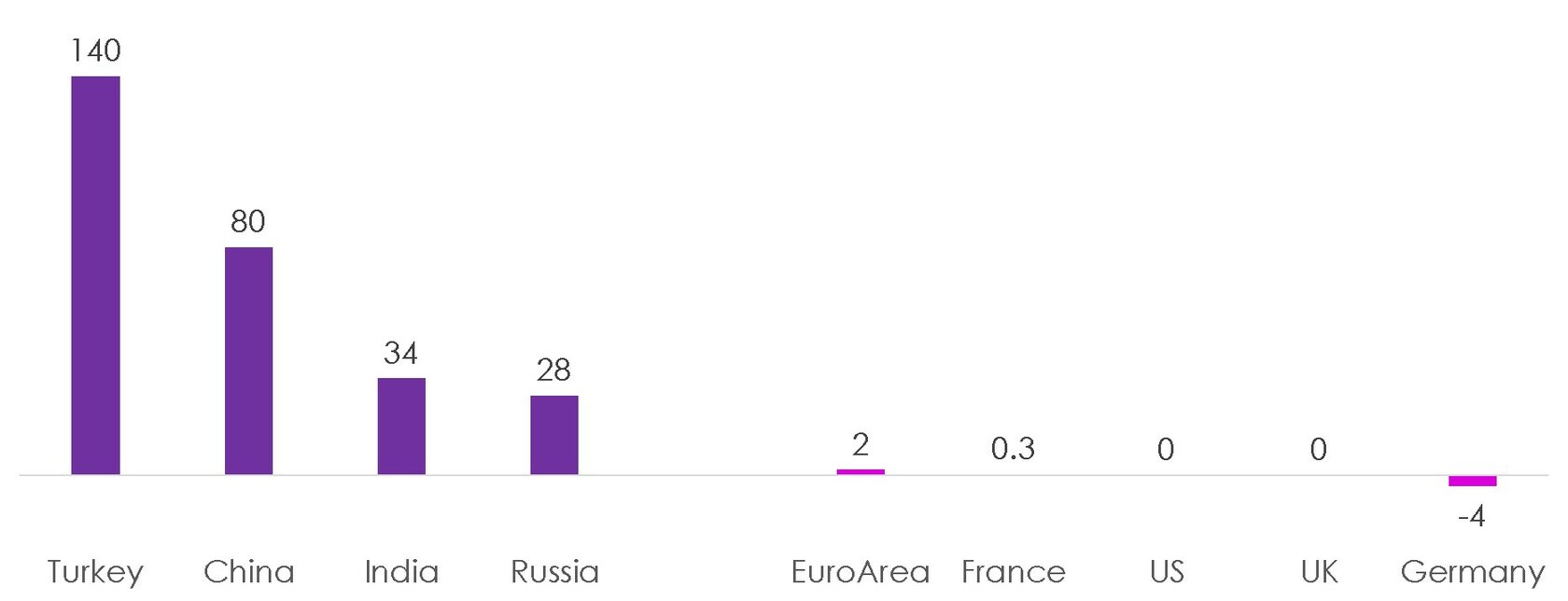

Central banks have been hoarding gold at rates not seen since 1974. However, there is a clear political divide between nations with regard to the gold-buying behavour. The US and its traditional European allies – UK, France, and Germany – have hardly increased their gold reserves between January 2022 and January 2023, with Germany’s reserves declining by 4 tonnes. On the other hand, Russia and the major developing economies that have largely refrained from imposing sanctions on Russia – Turkey, China, and India – have driven the gold-hoarding trend.

The amount of gold reserves’ increase/decrease (in tonnes) between January 2022 and January 2023

Source of figures: Tradingeconomics.com

Retail investors haven’t been the major force behind the recent popularity of gold. It’s the central banks of countries that have most actively raised objections to the global dependence on the US and its currency, the all-mighty USD, that have contributed to gold’s strong performance.

This phenomenon explains why gold, but not US Treasury products or RE, has behaved as a classic flight to safety asset. While the central banks of Turkey, China, India, and Russia have sought to reduce the reliance on the US via gold hoarding, they have naturally avoided investing in the US Treasury bonds or US-based RE products.