Conventional investment logic posits that gold shares either strong or at least reasonable correlations with the other key precious metals – silver, platinum, and palladium. As such, these metals aren’t a good choice to diversify a portfolio that has gold. However, in recent years, the dynamics of the relationship within this segment of the commodity market has been less clear-cut. We have run some correlation analyses on returns data, comparing gold with silver, platinum, and palladium. We have encountered some surprising results that might challenge conventional assumptions.

Gold as Risk Hedge Asset

Precious metals as part of your portfolio has always been regarded as a great hedge against market turbulences and downturns. However, when considering adding these metals to a portfolio, the discussion often turns to gold only. Yet, using only gold in a portfolio might lead to some potential issues down the line.

Firstly, when markets are optimistic, gold might not only deliver low returns, but it can also enter extended periods of negative returns. Secondly, when the market mood turns bearish, gold might still fail to thrive. In the past, gold’s status as a sure bet in times of market downturns has been questioned on numerous occasions.

Other Precious Metals as Companion for Gold – Our Analysis Methodology

Investors interested in strengthening the precious metal part of their portfolio often wonder if the other three metals of this commodity group – silver, platinum, or palladium – could be mixed with gold to further hedge against risks or realise unique return opportunities.

We have run an analysis of the four key precious metals to answer these questions. Our analysis is based on researching the returns and return correlations for these assets over the last 10 years. Sometimes, particularly in the academic research field, returns and correlations data is analysed for periods of many years and even decades.

However, the dynamics of the financial markets has been going through significant changes in the last few years, rendering these multi-decade studies less relevant to today’s realities. For instance, decades ago, gold’s status as a risk hedge was largely undisputed. In more recent times, this dogmatic assumption has come under scrutiny.

Therefore, we have limited our analysis to the last 10 years (from around mid-2013 to the end of July 2023). We have looked at monthly and quarterly returns for the four precious metals’ futures and ran some correlation analyses on these returns. Here is what we have found.

Gold vs Silver

Silver is believed to have a strong correlation with gold and is often viewed as gold’s more volatile proxy. The assumption is that silver moves in line with gold but might provide better returns during periods when gold is rising, while falling more dramatically when gold also goes down.

We ran correlations on monthly returns between gold and silver. When discussing the actual return figures further on, we will focus on quarterly returns. However, for correlational analyses, we used monthly rather than quarterly results, as the former provide more data points for robust analysis.

The difference in correlations between monthly and quarterly returns is minor, but the monthly data provides three times more data points, which is better for the reliability of our analysis and conclusions.

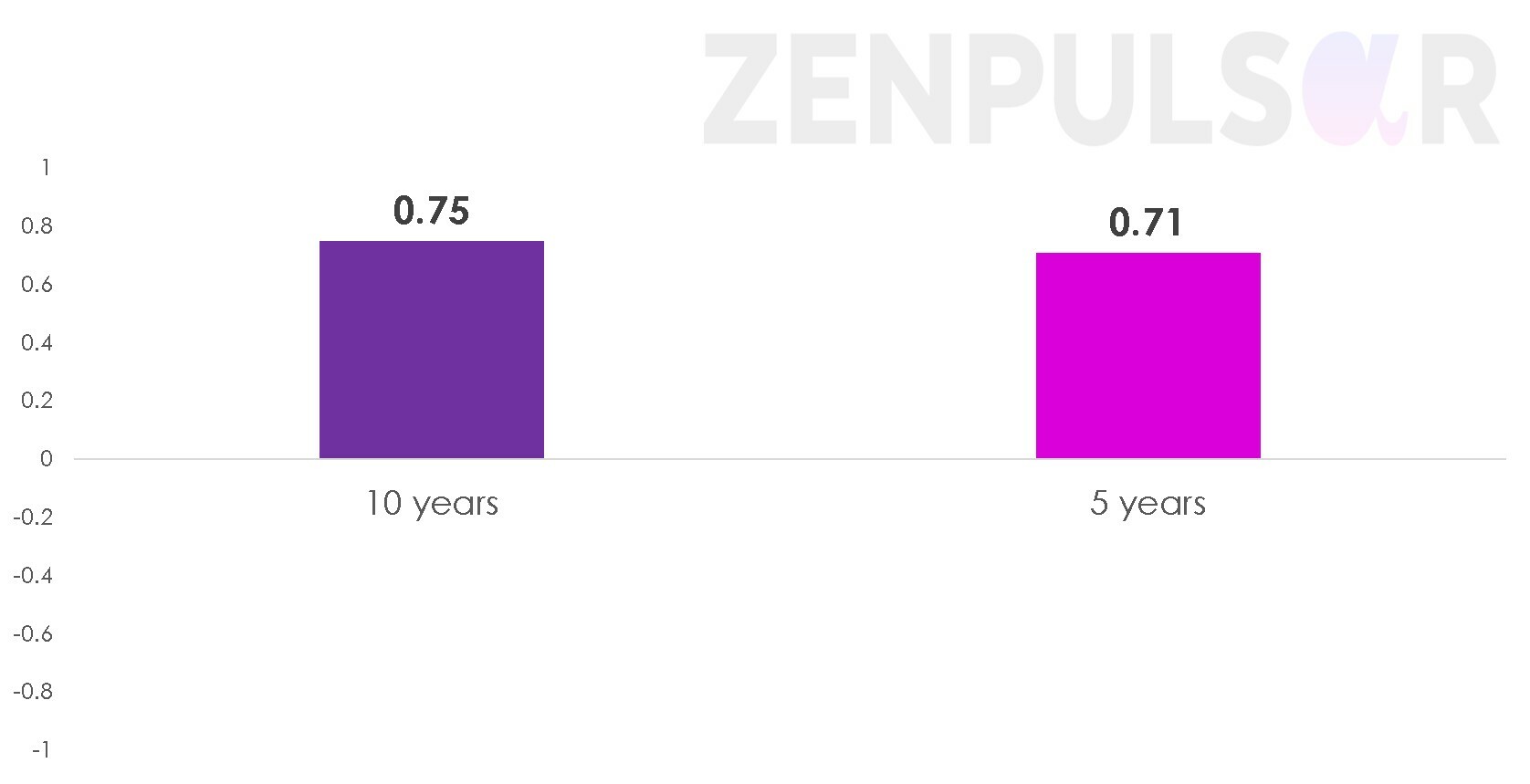

The monthly return correlation between gold and silver, based on the last 10-year period, was 0.75. For reference, the quarterly return correlation was 0.72, a very minor difference from the monthly figure.

The monthly return correlation based on the last 5 years only was 0.71.

Monthly return correlations – Gold vs Silver

These correlations are reasonably strong, though not as strong as expected. In the past, correlations between gold and silver as high as 0.9 or above were reported. It is possible that such strong correlations were based on prices, not returns. However, for an investor considering correlations for portfolio diversification, price-based data has little usefulness. Price-based correlations might be more relevant for day traders or high-frequency traders, who typically base their strategies on executing one or more trades every day.

For an investor whose investment horizon lasts as little as one week, and definitely for those involved in monthly, quarterly, bi-yearly, or annual investments, it is the returns data and return-based correlations that matter.

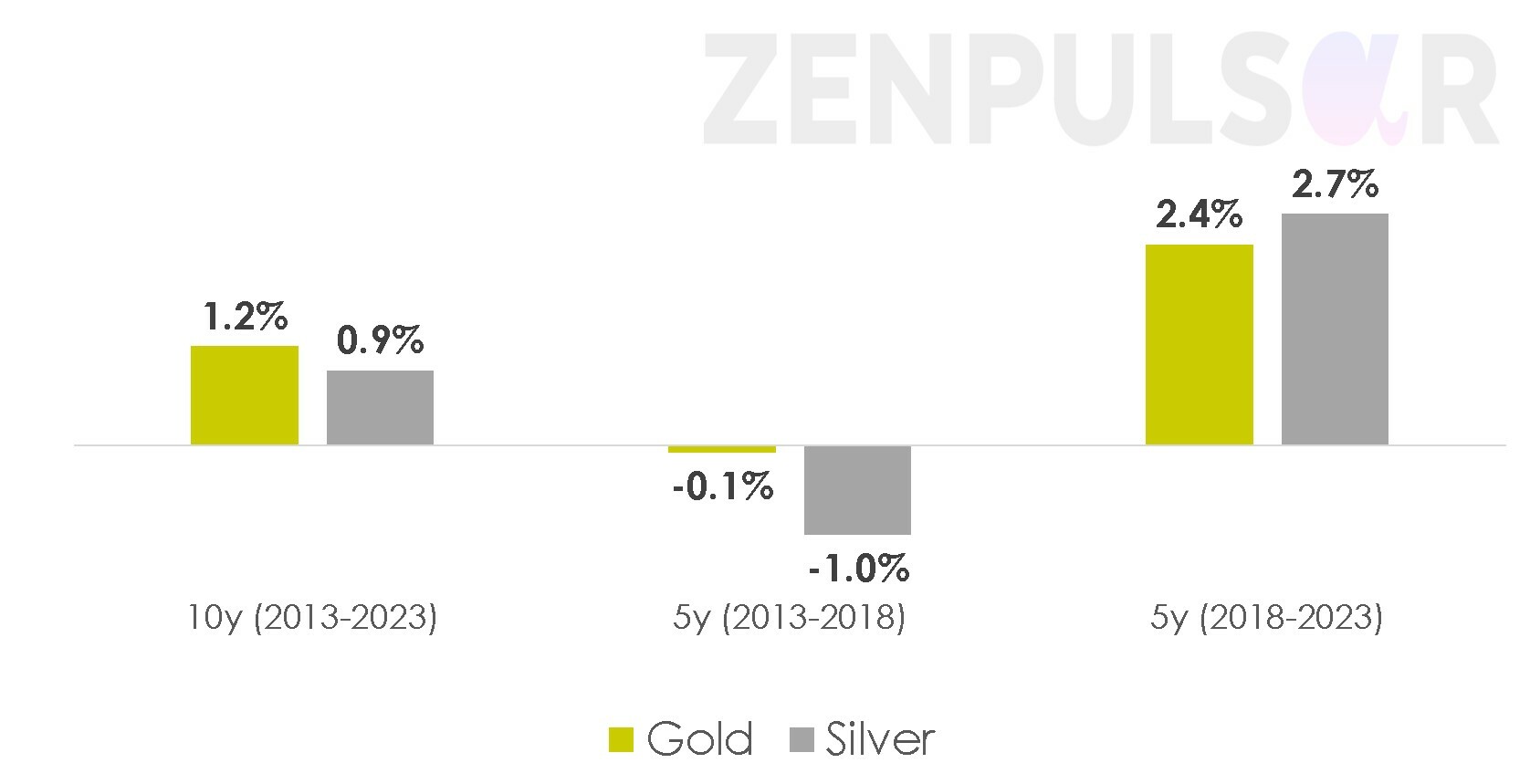

We then looked at the actual average quarterly return figures for these metals over the last 10 years (mid-2013 to mid-2023), as well as over two equal 5-year periods within the overall 10-year interval (mid-2013 to mid-2018 and mid-2018 to mid-2023).

Average quarterly returns – Gold vs Silver

The return figures are consistent with the reasonably strong correlation we found between the metals. Over the last 10 years, gold has registered an average quarterly return of 1.2%. The returns for silver were also positive, though somewhat lower, at 0.9%. In the last 5 years, average returns for gold and silver were also quite similar, at 2.4% and 2.7%, respectively.

In the chart above, the most interesting period for our analysis is the 5-year interval between 2013 and 2018, as it was during this time that gold was slowly losing out. A good complementary asset in a portfolio with gold should ideally negate the losses by posting positive returns during such periods.

During that period, silver performed even worse than gold, losing about 1% per quarter on average.

We conclude that silver, given its reasonably strong correlation with gold, is not an ideal asset to mix into a gold-containing portfolio.

Gold vs Platinum

Platinum and palladium are much less popular choices in an investment portfolio than gold and silver. While gold and silver are used by a wide variety of institutional and retail investors, platinum and palladium are typically chosen by seasoned commodity investors.

At the same time, unlike silver, platinum and palladium normally don’t share very strong correlations with gold. This factor makes these two metals potentially a better complement to gold in a portfolio.

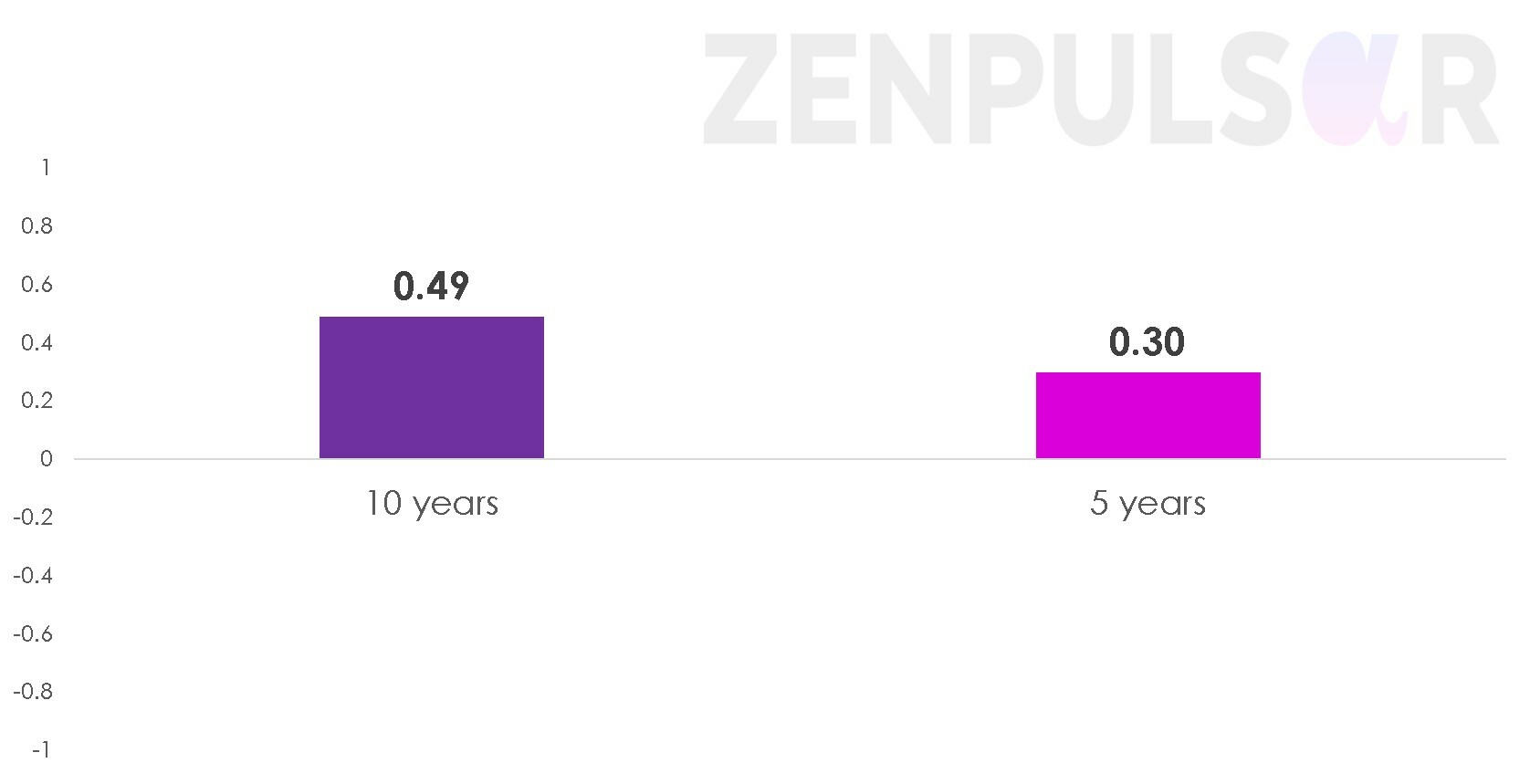

Using the same approach as we applied with silver, we first looked at monthly return correlations between gold and platinum for two reference periods – the last 10 years and the last 5 years. The correlation coefficients were 0.49 and 0.30, respectively.

Monthly return correlations – Gold vs Platinum

These correlations are considerably weaker than the correlations between gold and silver. The 10-year correlation (0.49) can be classified as moderate, while the 5-year coefficient (0.3) indicates only a weak correlation. The correlations are definitely lower than what is normally expected of the platinum-gold interrelationship.

Thus, based on our findings, platinum might act as a decent, though not the best, diversifier for gold.

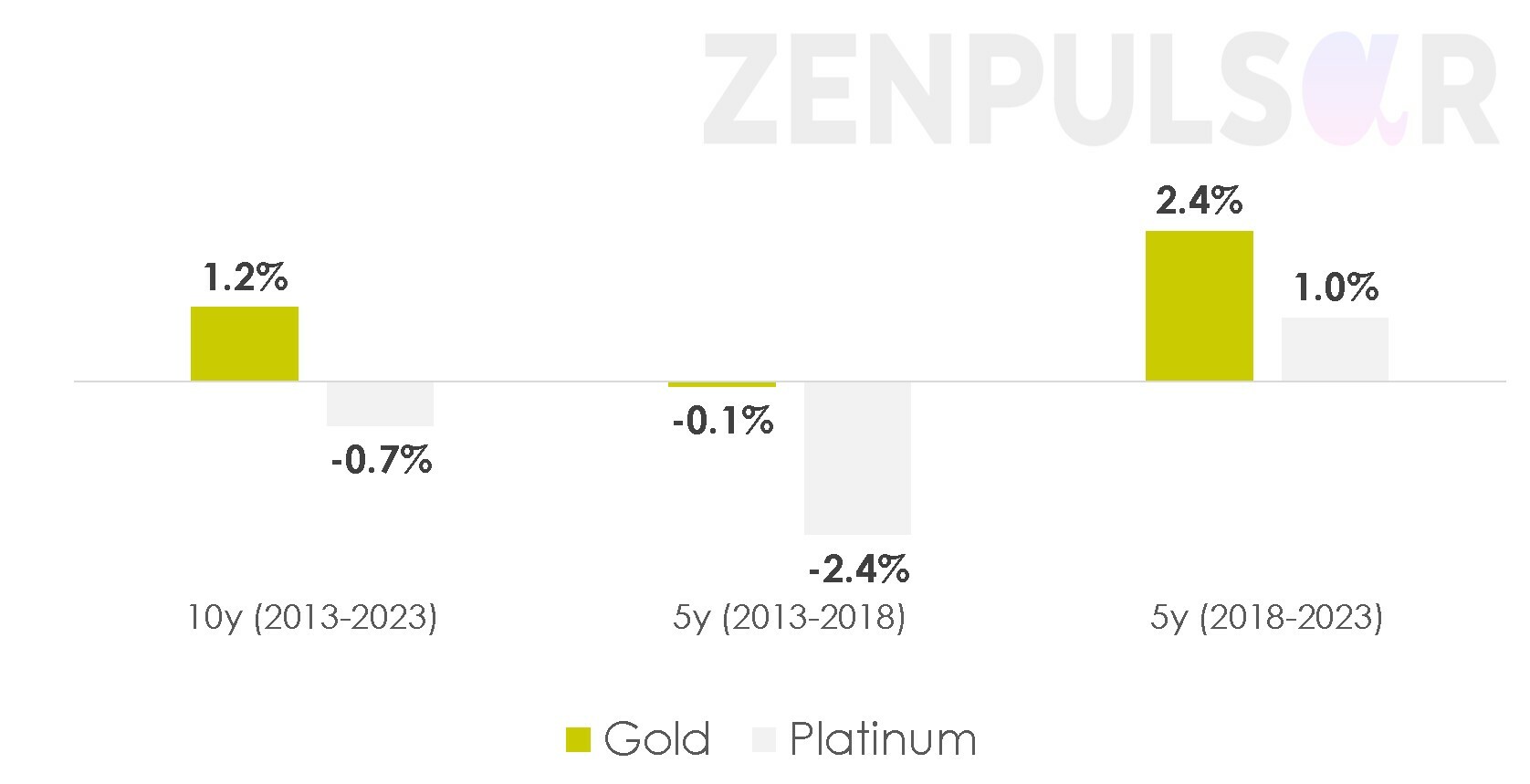

To see if we were drawing the correct conclusions from these numbers, we looked at the average quarterly returns for platinum and compared them with the returns for gold.

Average quarterly returns – Gold vs Platinum

The results above paint a mixed picture of platinum. On the one hand, the return outcomes for gold and platinum are divergent enough to warrant calling platinum a good diversifier asset in a portfolio with gold. As such, platinum does satisfy the primary criteria for our analysis.

However, looking beyond the immediate goals of our analysis, we could see that platinum consistently underperformed in comparison to gold during all three reference periods.

When it mattered the most – between 2013 and 2018, during gold’s negative returns period – platinum didn’t save the situation. During this time, while gold was declining by an average of 0.1% per quarter, platinum was nosediving at the speed of 2.4% per quarter (which translates to a nearly 10% loss per year).

Based purely on its return dynamics, platinum, with its weak to moderate correlations with gold, might be a decent diversifier for gold. However, the metal has a history of chronic underperformance in recent years. If platinum returns stabilise in the coming months and years, this metal might act as a reasonable, though not very good, complement to gold in an investment portfolio.

Gold vs Palladium

Palladium was the last asset we compared with gold. This precious metal can be even more volatile than platinum. Just as platinum, it is believed to share at least reasonably strong correlations with gold. While platinum’s correlations with gold were weaker than we expected, it was palladium that delivered the biggest surprise during our analysis.

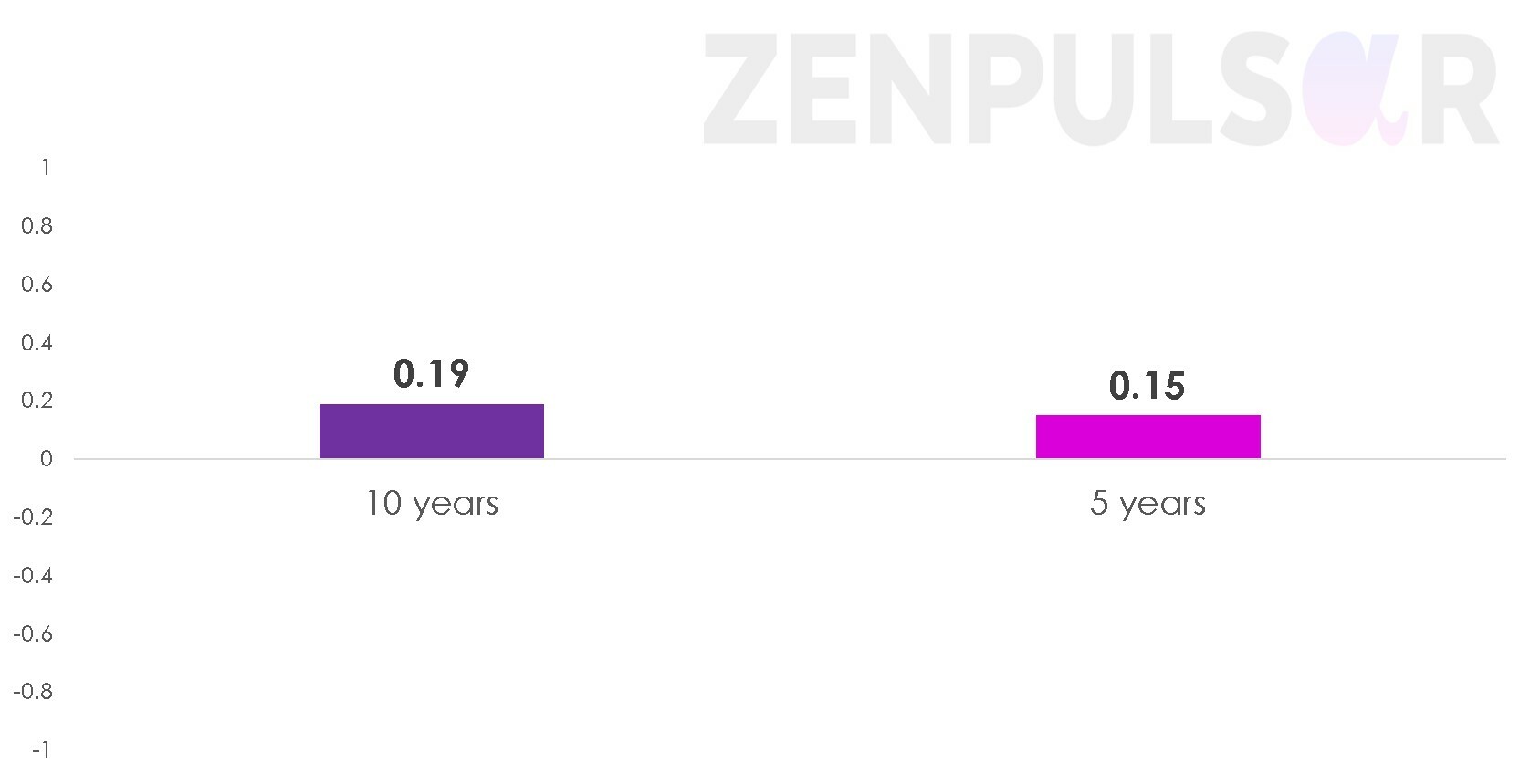

Palladium’s return correlations with gold for the last 10 years and the last 5 years were mere 0.19 and 0.15, respectively. Both figures are indicative of a very weak correlation.

Monthly return correlations – Gold vs Palladium

Based on these figures, palladium might be a very good diversifier for gold.

To further establish the nature of palladium’s relationship with gold, we looked at the average quarterly returns data.

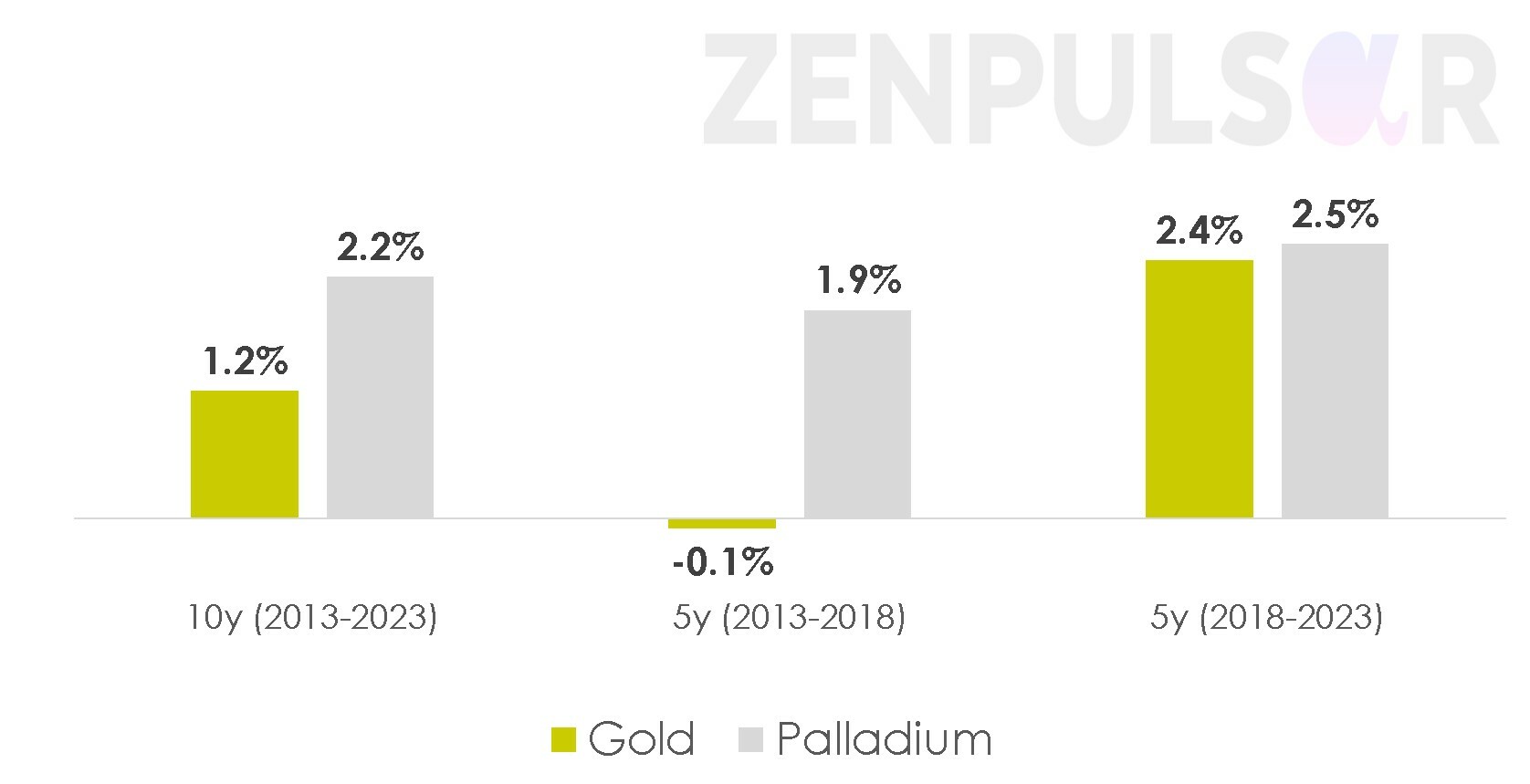

Average quarterly returns – Gold vs Palladium

Over the span of the entire 10-year period, palladium has significantly outperformed gold, with an average quarterly return of 2.2% vs gold’s 1.2%. In fact, palladium has done better than gold on this metric for all three reference periods above.

During the critical 2013-2018 period, when gold was in decline, palladium, as a true great diversifier, delivered positive (and quite solid for a precious metal asset) average returns of 1.9% per quarter.

Based on this data, palladium might be a very solid diversifier for gold. However, we would also like to note that since February last year, palladium prices have been in a consistent downtrend, which affected its return performance during this time. The positive average returns of 2.5% during the last 5 years in the chart above are largely thanks to palladium’s pre-Feb2022 performance.

In the last five quarters to Q2 2023, palladium delivered negative returns in four of them. Palladium prices are now at multi-year lows. While palladium could slide even lower, the current situation might also suggest that palladium is undervalued and a positive turnaround for the metal is close.

We conclude that palladium, under normal circumstances, might be an excellent diversifier for gold. It is currently at multi-year lows. If these lows are indicative of a positive reversal in the short- or medium-term future, palladium could be an excellent addition to gold in a precious metal focused portfolio. At the same time, regardless of palladium’s price performance in the immediate future, our analysis indicates that, in general, this metal, contrary to the beliefs of many in the industry, shares surprisingly low return correlations with gold.

Conclusion

At the outset of our analysis, we expected to mostly find confirmations of the proposition that gold shares at least reasonably high correlations with the other three precious metals. The results turned out to be somewhat different with regard to platinum and especially palladium. Here are our concluding remarks for each of the three metals we have compared with gold:

· Silver – we confirmed that silver shares reasonably strong return correlations with gold and would be a poor diversifier for the yellow metal.

· Platinum – this metal’s correlations with gold were considerably weaker than expected, pointing to some, though not very high, diversification potential. Under some circumstances, platinum might act as a moderately successful diversifier for gold, but its chronic return underperformance over very long time intervals is worrying.

· Palladium – contrary to expectation, we found very low correlations between palladium and gold, which points to significant diversification potential.