Back in January, in our coverage of the best Metaverse-related stocks, we picked NVIDIA (NVDA) as one of the best technology companies to invest in. Since then, in a period of less than 4 months, the NVDA stock price has grown by a spectacular 64%. NVIDIA continues to outperform the market and other prominent technology companies. In this article, we will take a detailed look at this company and its stock’s prospects.

NVIDIA’s History and Stock Market Performance

Founded in 1993, NVIDIA is a major manufacturer of graphical processing units (GPUs) and chipsets for computers and gaming devices. The company was listed on NASDAQ in 1999, back then hardly noticeable in the shadows of the 90s semiconductor industry giants like Intel and AMD.

NVIDIA started to grow more prominent in the semiconductor industry around 2016. However, it wasn’t until 2020 that NVIDIA’s footprint in the niche started to grow rapidly. In mid-2020, NVDA rose above the $100 mark for the first time in its history. Between then and November 2021, the company’s stock experienced its most impressive growth rate to date, reaching an all-time high of $333 by late November 2021.

This was around the time when the overall stock market peaked, with both NASDAQ and S&P500 registering their all-time high results to date. The late 2021 market crash and the subsequent uncertainty ravaged NVDA, sending it down to $121 by early September 2022.

Despite the slump, NVDA recovered very quickly and has been on a steep uptrend since September last year. In fact, there is hardly any major tech stock that managed to recover from the 2021 crash as confidently, quickly, and decisively as NVDA.

NVIDIA’s Recent Return on Investment Results

As of 8 May 2023, NVDA has delivered a yearly ROI of 69%, a six-month ROI of 108%, and a three-month ROI of 29%. These results are nothing but spectacular compared to both the overall technology sector and NVIDIA’s key niche – the semiconductor industry.

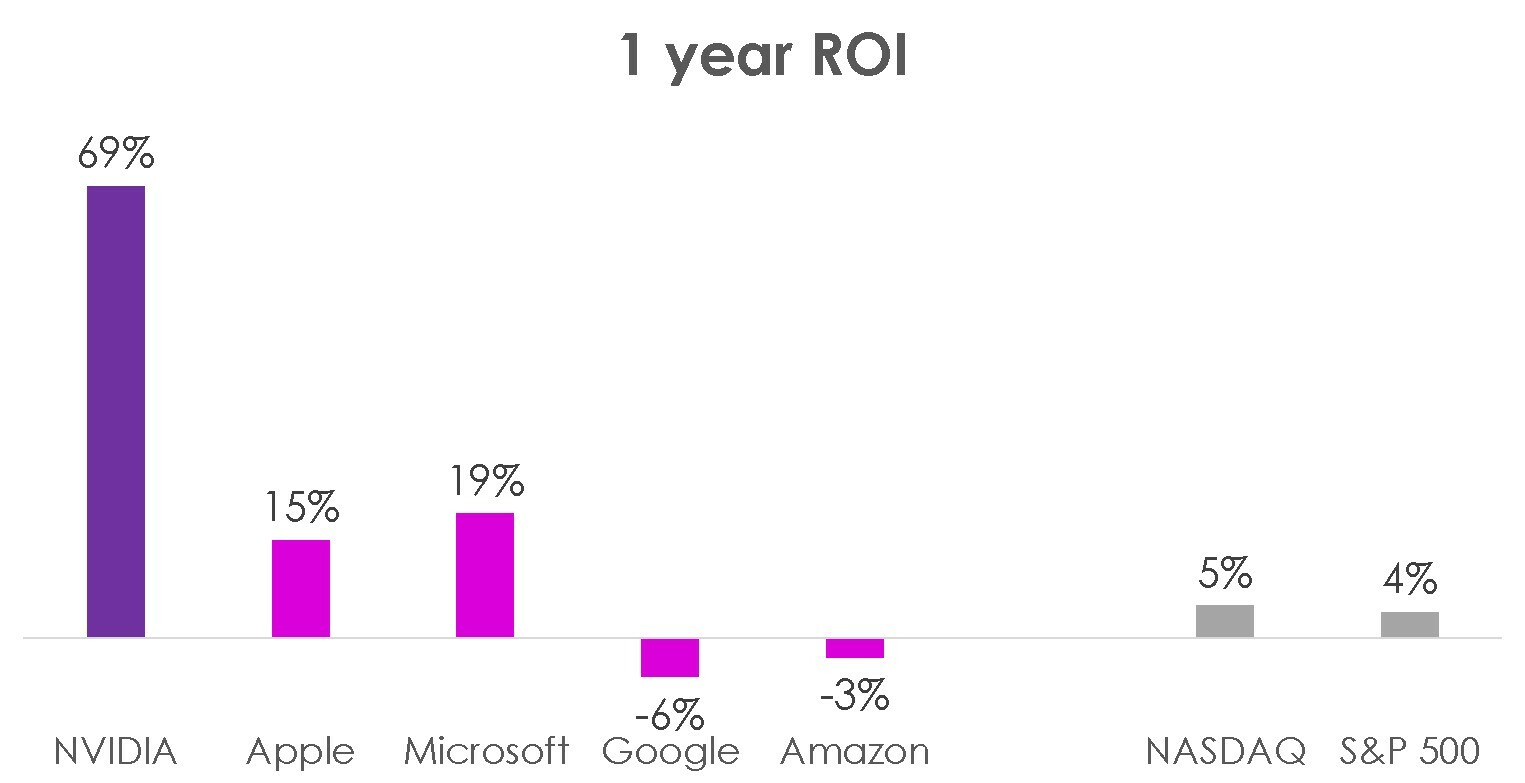

The chart below shows the 1-year growth rates for the five largest US-based technology stocks by market capitalisation. NVIDIA is the 5th largest company by market cap among these. The other four companies in the chart currently occupy the top four positions. In addition to the returns for these top tech companies, we have also included the results for the two main indicators of the overall market’s performance – NASDAQ and S&P500. The data is based on the closing daily prices sourced from Yahoo Finance.

NVIDIA’s exceptional results are clearly visible in the chart. The 2nd best result among the top tech over the year was achieved by Microsoft. The Redmond giant’s 19% ROI pales in comparison to NVIDIA’s 69%. During the same period, Google and Amazon couldn’t even break even, sinking to negative figures.

The overall market was also far from buoyant, with both NASDAQ and S&P500 posting very modest results.

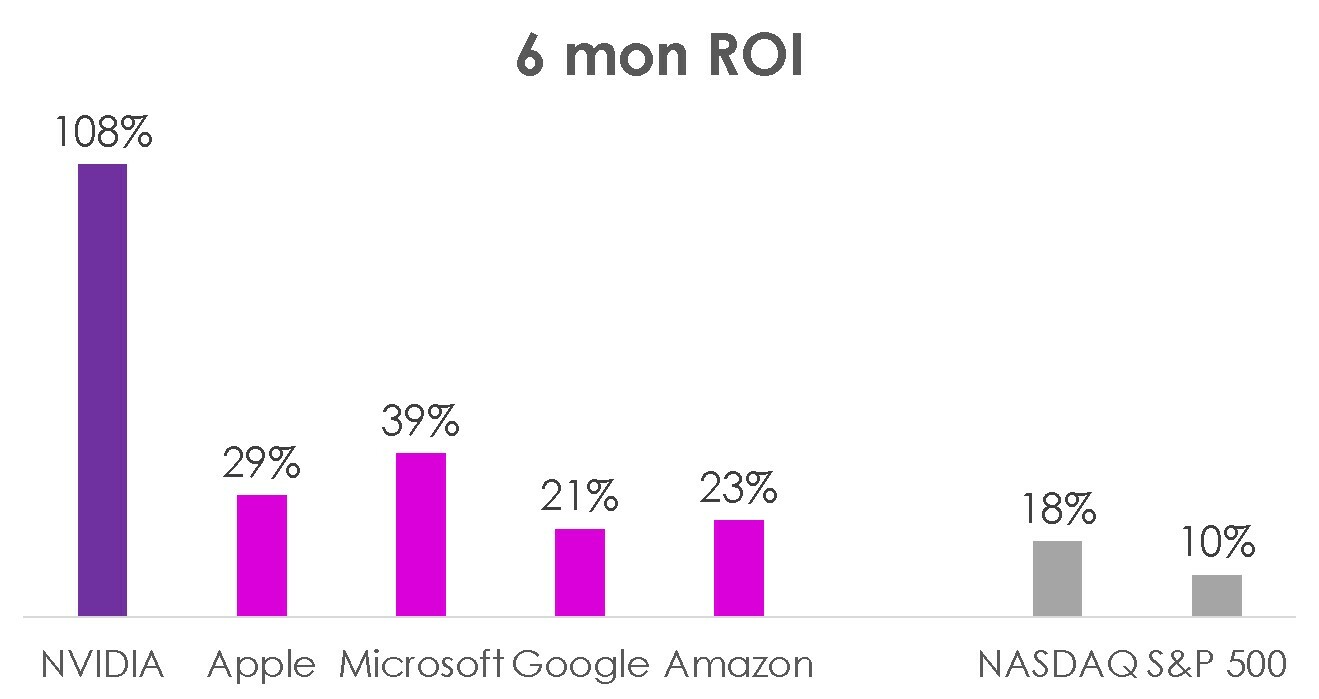

NVIDIA’s result over the last 6 months has been even more impressive.

Could NVIDIA’s outstanding performance be partly attributable to the growth of its primary sector – semiconductor manufacturing? To answer this question, we have taken a look at the 1-year and 6-month growth rates for the largest US semiconductor stocks besides NVIDIA.

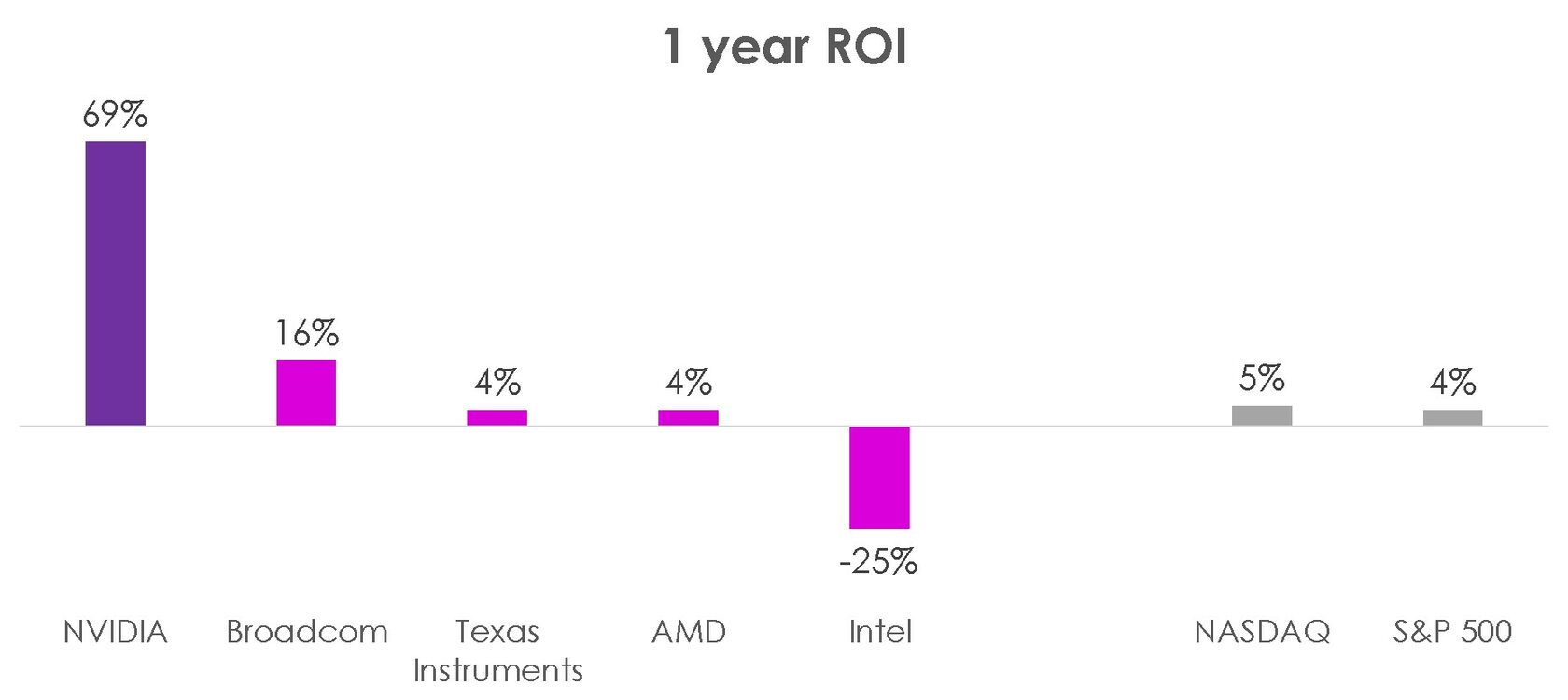

Below are the 1-year returns for NVIDIA’s largest competitors in the semiconductor category listed on US stock exchanges.

It’s evident from the chart that the overall semiconductor industry, at least as measured by the top stocks, hasn’t been graced with any impressive growth rates. Broadcom posted a solid 16% result, which still pales in comparison to NVIDIA’s 69%; Intel lost 25%; while Texas Instruments and AMD simply matched the overall market’s result with the paltry 4% figures.

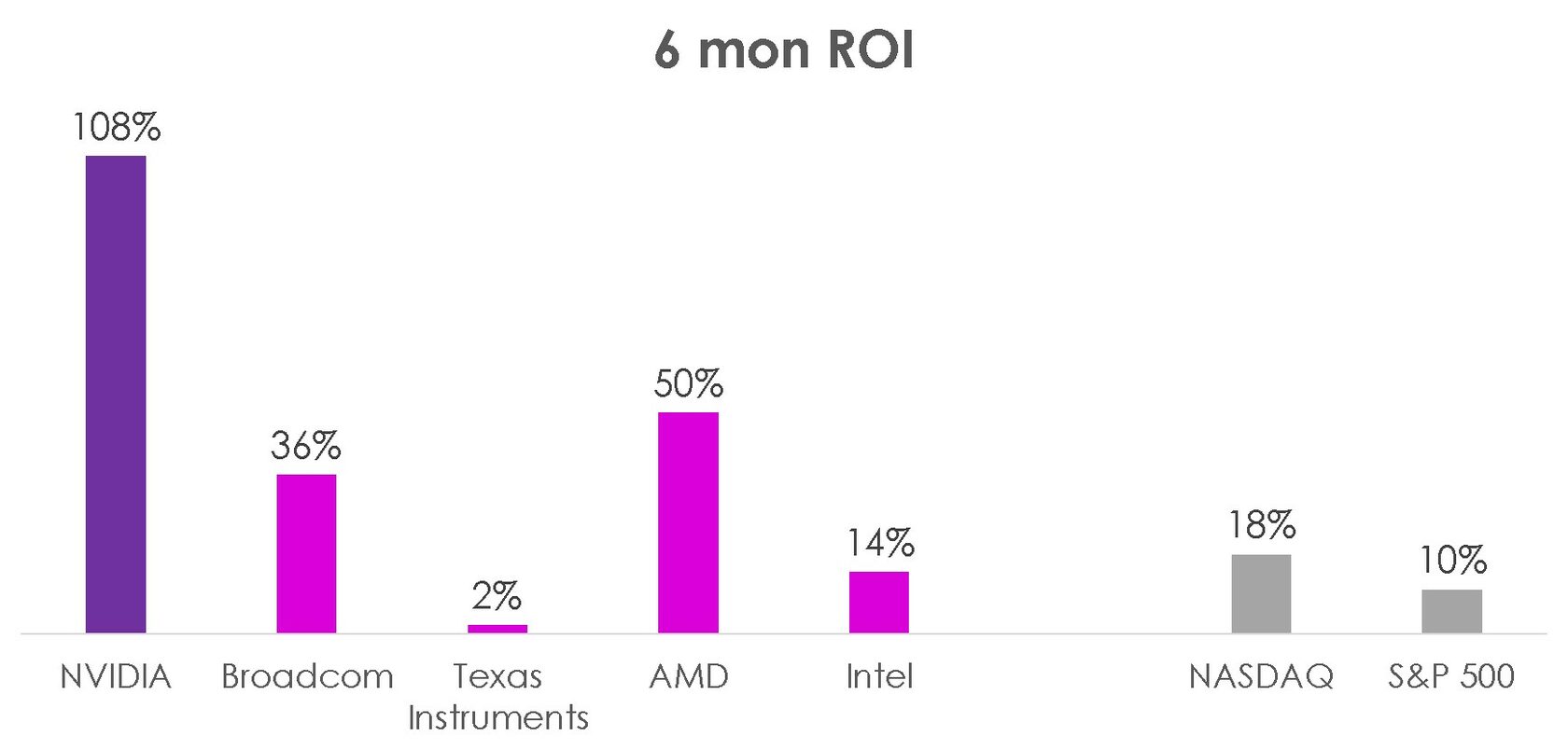

The last 6-month results show a better situation for the top semiconductor manufacturers.

Yet, NVIDIA’s massive 108% growth is way ahead of Broadcom’s 36% and even AMD’s 50%.

What Is the Outlook for NVDA?

The results above are undoubtedly very impressive. Those who longed NVDA a year ago or six months ago are reaping the benefits. What about the future for the stock? Are NVDA’s recent spectacular growth rates about to correct? Will the stock sustain these return rates?

In our view, while NVDA might not match its recent returns in the foreseeable future, it is definitely a buy stock and will likely keep delivering some of the best returns in the tech world. Here are the key reasons for our optimism towards NVDA:

1. NVIDIA is one of the main stocks that stand to benefit from the development and introduction of the Metaverse, a pervasive blockchain-based 3D virtual world. The visual sophistication of the Metaverse will place massive demands on graphics hardware. NVIDIA is perfectly positioned to benefit from this demand – graphics card manufacturing is the company’s core business.

2. The gaming industry keeps growing, with further growth expected in the future as well. Just as in the case with the Metaverse, NVIDIA is perfectly positioned to benefit from the growth in gaming by being the top graphics card manufacturer. While the Metaverse might be a few years away, the current gaming frenzy is right here today.

3. NVIDIA is more likely to attract quality capital than the other big tech companies. While the 5th highest-capped technology company, NVIDIA has never been as much in the news headlines as the likes of Microsoft, Apple, Google, Tesla, Amazon, or Meta. Within our social media analytics platform, PUMP, we consistently observe significantly more social signals for these brands than for NVIDIA. By being probably “the least high-profile” among the top tech brands, NVIDIA doesn’t attract as much “naïve money”, i.e., unsophisticated investors often driven by market hype rather than sound analysis, as the other big technology stocks. Naïve money is often the cause of instability and deceptive results for a stock.

4. NVIDIA has confidently entered the AI field with a number of products, including its suite of Enterprise AI solutions. The AI field’s strong expected growth over the coming years will be another support factor for NVDA.

Overall, we expect NVDA to keep delivering, perhaps not at the same spectacular return rates it has achieved in recent times. NVIDIA’s fundamentals are strong and very promising both from a medium-term and long-term perspective. Among the major technology stocks, nothing looks as solid as NVDA. It might not have the glamour factor of Apple or Meta, but NVIDIA trumps these technology rivals in the stock outlook department.