In our 3rd article on Metaverse investment, we are taking a closer look at the best Metaverse corporate stocks. In the earlier articles of this series, we covered two key Metaverse index-based products – the Metaverse Index Fund (MVI) and the Roundhill Metaverse Index ETF (METV). These products are a great choice for investors looking for the asset diversity inherent in any index-based product. What if you would like to pick the best individual stocks that will benefit from the Metaverse becoming a reality? Using an index fund or an ETF will limit your options in this case. On the other hand, carefully selecting the most promising company stocks can make your investment deliver much better returns than relying on an ETF or index.

Classification of the Metaverse Stocks

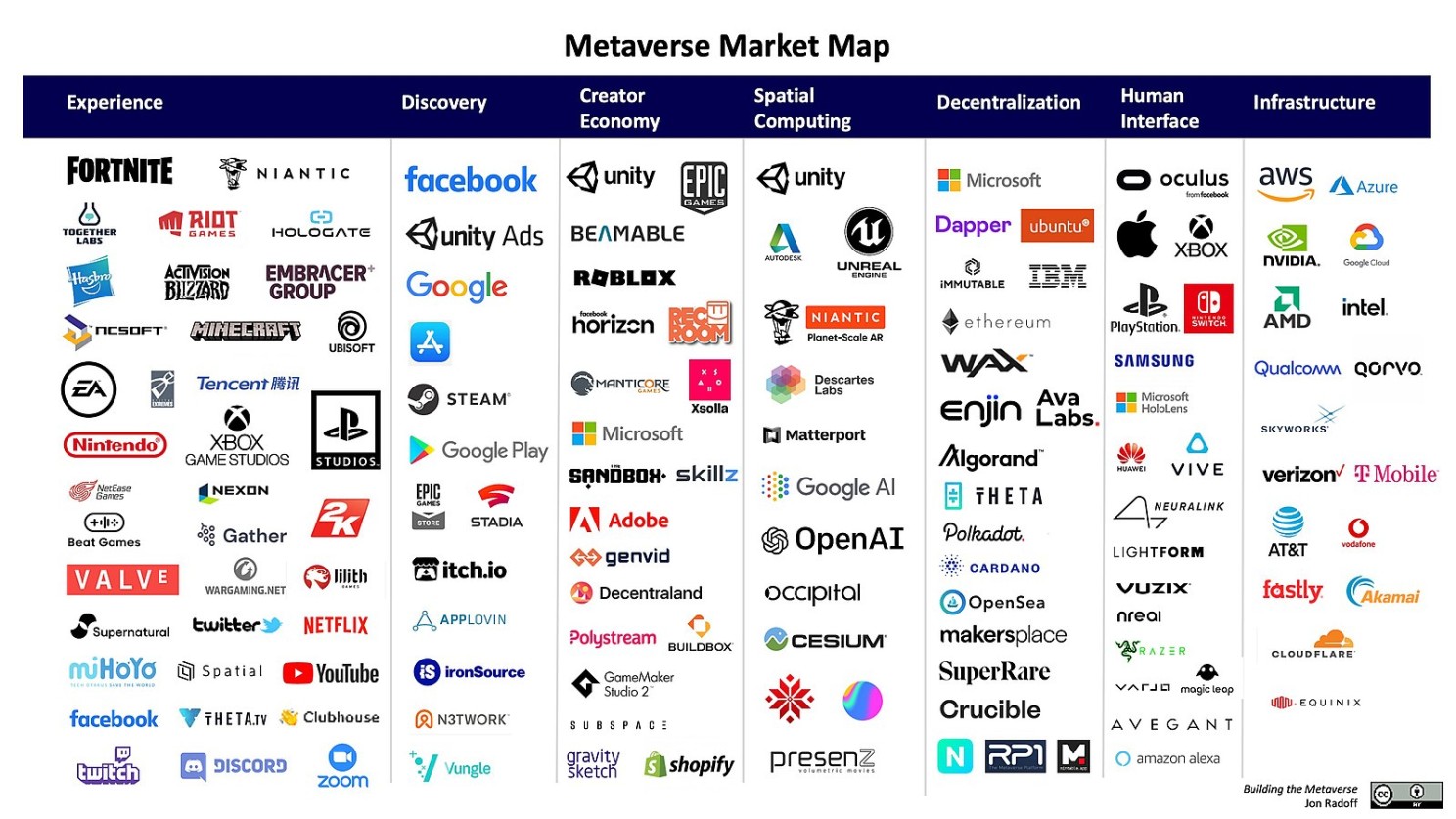

The Metaverse is such a colossal undertaking that, naturally, companies related to it could never come from one sector or niche. The colourful array of companies involved in the Metaverse advancement is often classified into 7 key layers – Experience, Discovery, Creator Economy, Spatial Computing, Decentralization, Human Interface, and Infrastructure. These layers were proposed in the Metaverse Market Map developed by Massachusetts-based technology entrepreneur Jon Radoff.

The Metaverse Market Map

Classification of the Metaverse Stocks

The Metaverse is such a colossal undertaking that, naturally, companies related to it could never come from one sector or niche. The colourful array of companies involved in the Metaverse advancement is often classified into 7 key layers – Experience, Discovery, Creator Economy, Spatial Computing, Decentralization, Human Interface, and Infrastructure. These layers were proposed in the Metaverse Market Map developed by Massachusetts-based technology entrepreneur Jon Radoff.

The Metaverse Market Map

Radoff’s Metaverse Map, created in April 2021, has grown hugely popular in the technology community and serves as a great tool for the taxonomy of companies related to the Metaverse. For investors considering Metaverse stocks, it can help immensely with asset diversification.

If you are thinking about buying a few Metaverse stocks, Radoff’s taxonomy could help you avoid allocating all/most of your funds towards companies in the same category. By investing in a variety of Metaverse categories, you are protecting yourself from possible differential growth rates for companies across different categories. Consider this to be a form of “micro-diversification”.

Naturally, some companies are present in more than one category. For instance, Meta (still Facebook when Radoff came up with the map in April 2021) is present in three layers – Experience, Discovery, and Human Interface (via Oculus). Microsoft has booked four seats – in the Experience (via Xbox), Creator Economy, Decentralization, and Human Interface categories.

As discussed next, being related to more than one category on the map is a distinct advantage for a company/stock.

What Are the Best Metaverse Stocks?

If you plan to invest in stocks with the goal of benefiting from the Metaverse development, short-term projections, the stock’s current price dynamics, and its 12-month return figures are unlikely to be of much use as selection tools. The Metaverse is years away from us, and any planning in this area is bound to be very long-term oriented. In short, the Metaverse investment is not a road to quick wins.

When selecting the best Metaverse stocks, we first picked the market players who span multiple categories on the Metaverse Map. If a company is present in multiple Metaverse niches, it is a more solid candidate for benefiting from the Metaverse advancement. Moreover, as noted above, such stock is less likely to suffer if a certain niche within the Metaverse industry starts to lag. Although the 7 categories are quite inter-related, differential growth rates across different niches are a possibility in any massive-scale project or industry.

This approach gave us three big name tech stocks – Meta, Microsoft, and Google. However, restricting your investment choices only to these giants is probably not the best way to diversify or find a stock with the highest growth potential. Some of the other brands in the Metaverse sphere might have even higher growth potential than this trio.

Thus, we have selected two more stocks, leading niche players within their category, that may also make a great Metaverse investment.

This is our final list of the best Metaverse stocks to invest in:

Stock 1 – Microsoft (MSFT). The Redmond giant is at the forefront of the Metaverse development. It is present across multiple niches, including Experience, Creator Economy, Decentralization, and Human Interface. The Metaverse Map lists one of Microsoft’s troubled projects – Hololens – within the Human Interface niche. However, regardless of what happened to Hololens, Microsoft is still present in this niche via Xbox.

Stock 2 – Google (GOOGL). Google’s products also span no fewer than 4 niches of the Metaverse – Infrastructure, Spatial Computing, Discovery, and Experience (via YouTube). The Infrastructure niche is of particular importance. Without a solid base to support the Metaverse’s massive infrastructure requirements, other categories will simply not thrive.

Stock 3 – Meta (META). Meta is present in two mass consumer oriented niches of the Metaverse – Experience and Discovery. Timewise, these niches are furthest away from realization in the true sense. Immersive consumer experiences will only be possible when the infrastructural backbone of the Metaverse is solid. Thus, Meta, while a great stock for the Metaverse, will likely benefit from the virtual world’s arrival later than Microsoft or Google.

Stock 4 – Nvidia (NVDA). Nvidia is one of those stocks outside of the big trio above that is likely to be a big beneficiary of the Metaverse revolution. It sits firmly within the Infrastructure niche, whose importance we touched upon above. The Metaverse is going to be all about visual experiences, and who else is best positioned to address this demand than the world’s top graphics hardware manufacturer?

Stock 5 – Roblox (RBLX). A Metaverse portfolio without a gaming platform? Not a chance! Occupying the extremely competitive Creator Economy niche, Roblox is among the leading gaming and game development platforms. What sets Roblox apart from its key competitors is the ease of game development on the platform. You absolutely do not need to be a developer to create games on Roblox. As the Metaverse develops, it will be ordinary users creating and populating their digital environments – an undertaking that Roblox is well-positioned to support.

However, Roblox, similar to Meta, addresses consumer demand at the relatively later stages of the Metaverse maturity pipeline. Thus, investment in RBLX should be among the most long-term oriented in any Metaverse portfolio.

If you are thinking about buying a few Metaverse stocks, Radoff’s taxonomy could help you avoid allocating all/most of your funds towards companies in the same category. By investing in a variety of Metaverse categories, you are protecting yourself from possible differential growth rates for companies across different categories. Consider this to be a form of “micro-diversification”.

Naturally, some companies are present in more than one category. For instance, Meta (still Facebook when Radoff came up with the map in April 2021) is present in three layers – Experience, Discovery, and Human Interface (via Oculus). Microsoft has booked four seats – in the Experience (via Xbox), Creator Economy, Decentralization, and Human Interface categories.

As discussed next, being related to more than one category on the map is a distinct advantage for a company/stock.

What Are the Best Metaverse Stocks?

If you plan to invest in stocks with the goal of benefiting from the Metaverse development, short-term projections, the stock’s current price dynamics, and its 12-month return figures are unlikely to be of much use as selection tools. The Metaverse is years away from us, and any planning in this area is bound to be very long-term oriented. In short, the Metaverse investment is not a road to quick wins.

When selecting the best Metaverse stocks, we first picked the market players who span multiple categories on the Metaverse Map. If a company is present in multiple Metaverse niches, it is a more solid candidate for benefiting from the Metaverse advancement. Moreover, as noted above, such stock is less likely to suffer if a certain niche within the Metaverse industry starts to lag. Although the 7 categories are quite inter-related, differential growth rates across different niches are a possibility in any massive-scale project or industry.

This approach gave us three big name tech stocks – Meta, Microsoft, and Google. However, restricting your investment choices only to these giants is probably not the best way to diversify or find a stock with the highest growth potential. Some of the other brands in the Metaverse sphere might have even higher growth potential than this trio.

Thus, we have selected two more stocks, leading niche players within their category, that may also make a great Metaverse investment.

This is our final list of the best Metaverse stocks to invest in:

Stock 1 – Microsoft (MSFT). The Redmond giant is at the forefront of the Metaverse development. It is present across multiple niches, including Experience, Creator Economy, Decentralization, and Human Interface. The Metaverse Map lists one of Microsoft’s troubled projects – Hololens – within the Human Interface niche. However, regardless of what happened to Hololens, Microsoft is still present in this niche via Xbox.

Stock 2 – Google (GOOGL). Google’s products also span no fewer than 4 niches of the Metaverse – Infrastructure, Spatial Computing, Discovery, and Experience (via YouTube). The Infrastructure niche is of particular importance. Without a solid base to support the Metaverse’s massive infrastructure requirements, other categories will simply not thrive.

Stock 3 – Meta (META). Meta is present in two mass consumer oriented niches of the Metaverse – Experience and Discovery. Timewise, these niches are furthest away from realization in the true sense. Immersive consumer experiences will only be possible when the infrastructural backbone of the Metaverse is solid. Thus, Meta, while a great stock for the Metaverse, will likely benefit from the virtual world’s arrival later than Microsoft or Google.

Stock 4 – Nvidia (NVDA). Nvidia is one of those stocks outside of the big trio above that is likely to be a big beneficiary of the Metaverse revolution. It sits firmly within the Infrastructure niche, whose importance we touched upon above. The Metaverse is going to be all about visual experiences, and who else is best positioned to address this demand than the world’s top graphics hardware manufacturer?

Stock 5 – Roblox (RBLX). A Metaverse portfolio without a gaming platform? Not a chance! Occupying the extremely competitive Creator Economy niche, Roblox is among the leading gaming and game development platforms. What sets Roblox apart from its key competitors is the ease of game development on the platform. You absolutely do not need to be a developer to create games on Roblox. As the Metaverse develops, it will be ordinary users creating and populating their digital environments – an undertaking that Roblox is well-positioned to support.

However, Roblox, similar to Meta, addresses consumer demand at the relatively later stages of the Metaverse maturity pipeline. Thus, investment in RBLX should be among the most long-term oriented in any Metaverse portfolio.