Since its launch in 2021, ZENPULSAR has introduced eight social media analytics products for investors, traders, fund managers, and market analysts across three wider markets we specialise in - cryptocurrencies, equities, and commodities. In this article, we would like to provide an overview of our product line, starting with our flagship SaaS social analytics platform, PUMP.

1. PUMP – A Comprehensive Social Media Analytics SaaS Platform

PUMP is a SaaS-based platform that provides a user-friendly interface to review, track, and analyse social media sentiment and news for 54 major cryptocurrencies, over 20 commodities, and more than 800 equities. New assets are being continually added to PUMP on a weekly basis. Besides the asset classes above, PUMP also includes sentiment data for US bonds and 10 major forex trading pairs.

PUMP provides comprehensive social media sentiment analytics based on asset-specific measures such as posts, reposts, likes, comments, views, and total audience reach. Using these input metrics, we derive the key asset-specific sentiment parameters – bullish sentiment, bearish sentiment, dominating sentiment, and more.

For every asset, PUMP also includes relevant news sourced from social media platforms and news outlets.

For users who prefer not to deal with API datasets, PUMP is an ideal, user-friendly solution that acts as a comprehensive package with a convenient point-and-click interface to follow social media sentiment for all the financial assets tracked by ZENPULSAR.

PUMP sources data from seven major social media platforms – Twitter, Reddit, LinkedIn, SeekingAlpha, Telegram, Facebook, and Weibo – a width of coverage unmatched in the industry.

2. Social Media Pulse for Equities – API Dataset

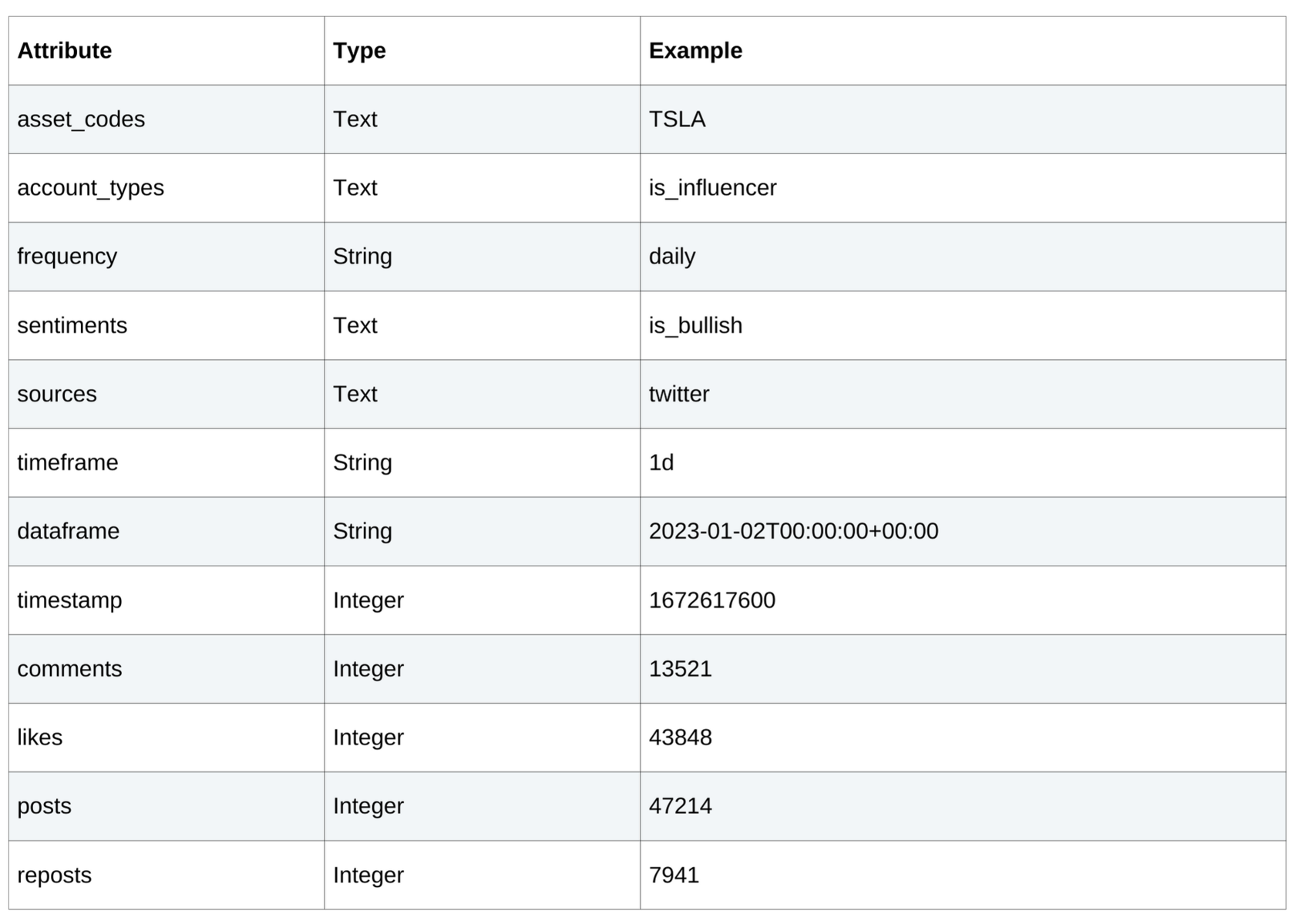

Social Media Pulse for Equities is an API Dataset (available in JSON and CSV) that provides detailed time series sentiment data for more than 800 equity assets.

Social sentiment data for equities from PUMP is included in the API Dataset format for easy integration with your own web apps and databases.

Number of assets included: 895 stock tickers and major indices from the US, European, and key Asian markets.

Source of data: Twitter, Reddit, LinkedIn, SeekingAlpha, Telegram, Facebook, and Weibo

Dataset attributes:

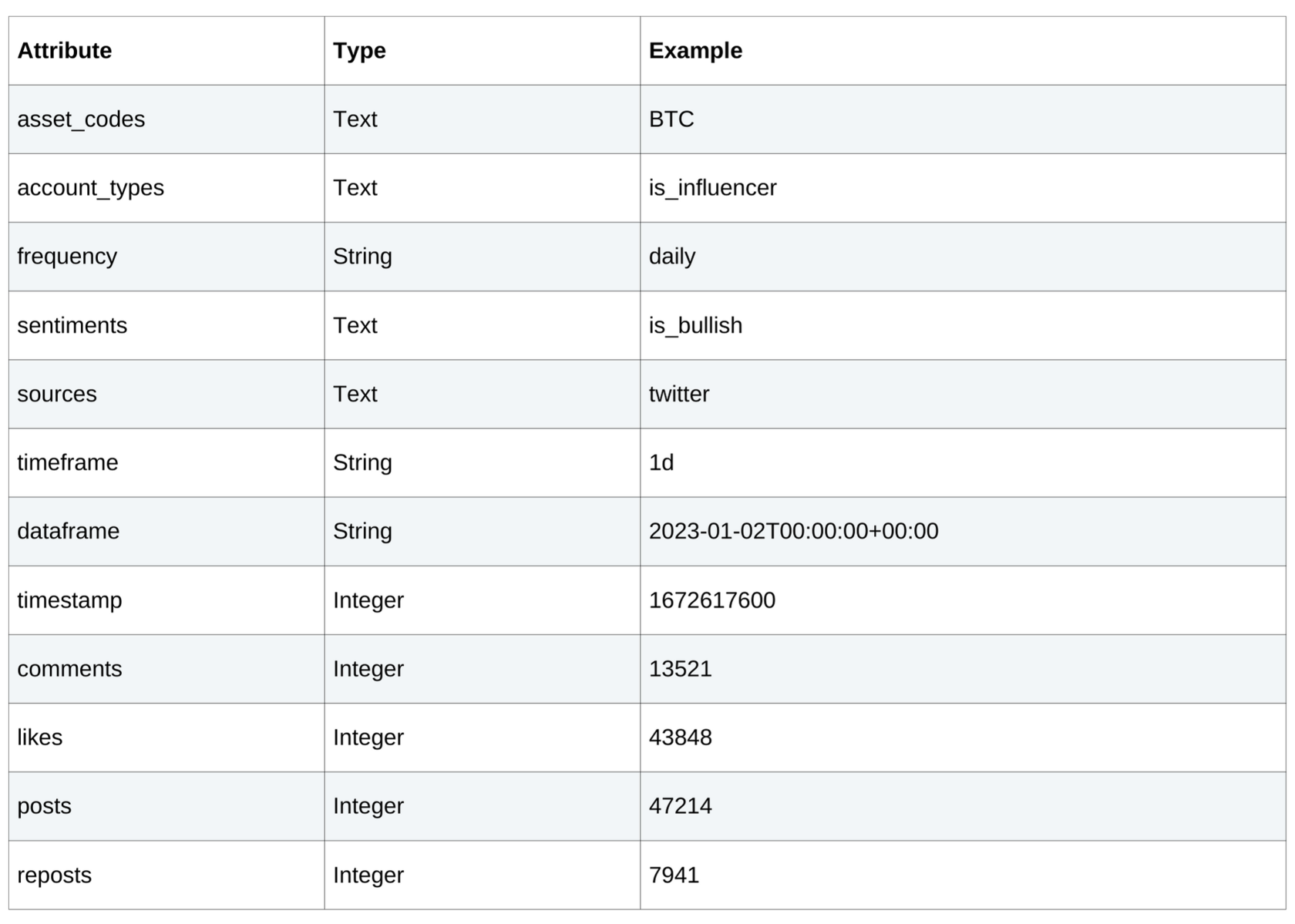

3. Social Media Pulse for Cryptocurrencies – API Dataset

Social Media Pulse for Cryptocurrencies is another major API Dataset product we provide. It has similar characteristics to the Pulse for Equities product above in terms of the data sources and key attributes, but tracks major cryptocurrency assets.

Number of assets included: 54 major cryptocurrencies, including Bitcoin, Ethereum, all the top 20 coins by market cap, and major DeFi tokens.

Source of data: Twitter, Reddit, LinkedIn, SeekingAlpha, Telegram, Facebook, and Weibo

Dataset attributes:

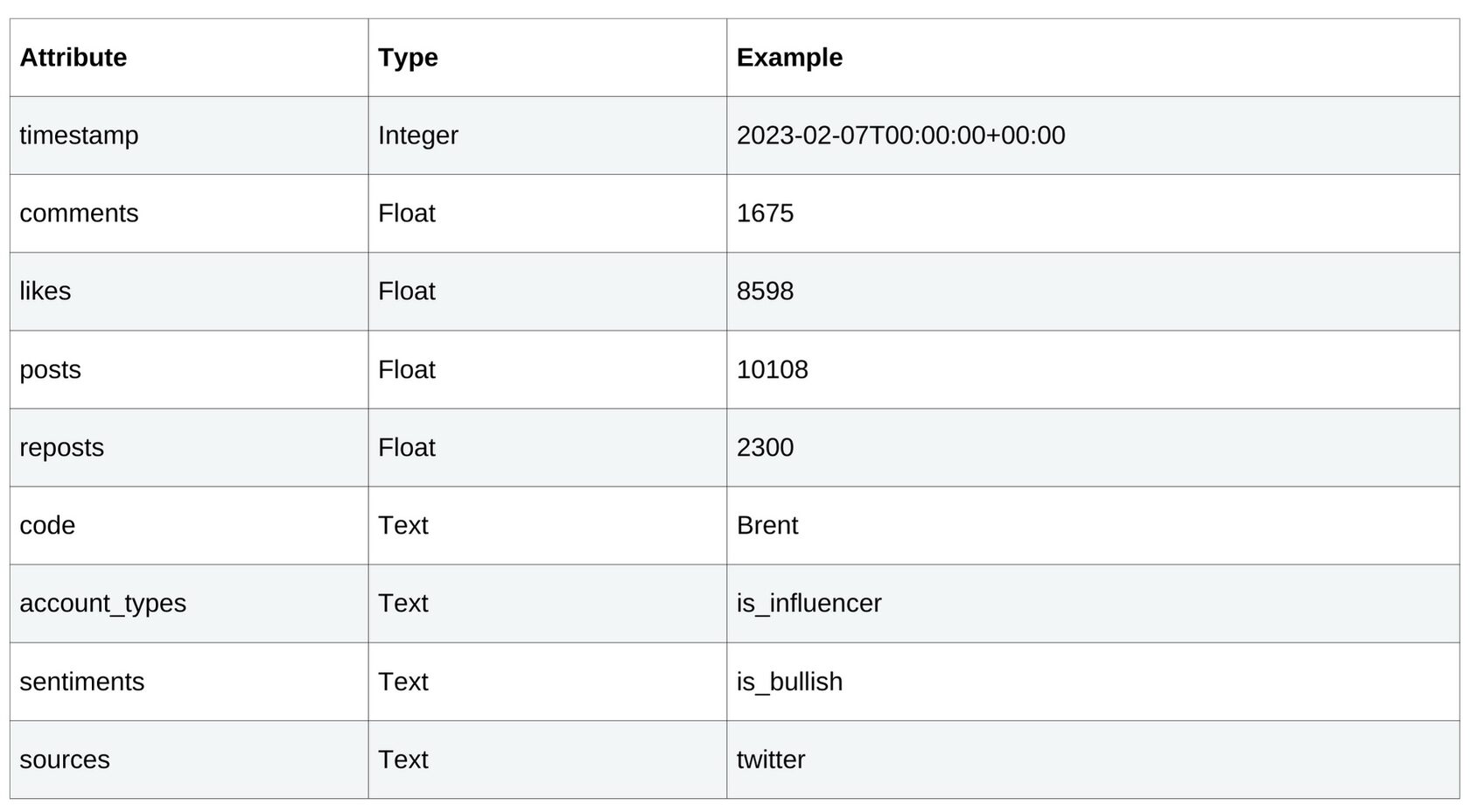

4. Social Media Pulse for Commodities – API Dataset

Another product in the Social Media Pulse series is focused on commodity assets. All the major energy, agricultural, and metal commodities are provided. Social Media Pulse for Commodities has the same data sources as the equities and cryptos Pulse datasets but a slightly different attribute list, as shown below.

Number of assets included: 20 commodities, including the major energy, agricultural, and metal commodity assets.

Source of data: Twitter, Reddit, LinkedIn, SeekingAlpha, Telegram, Facebook, and Weibo

Dataset attributes:

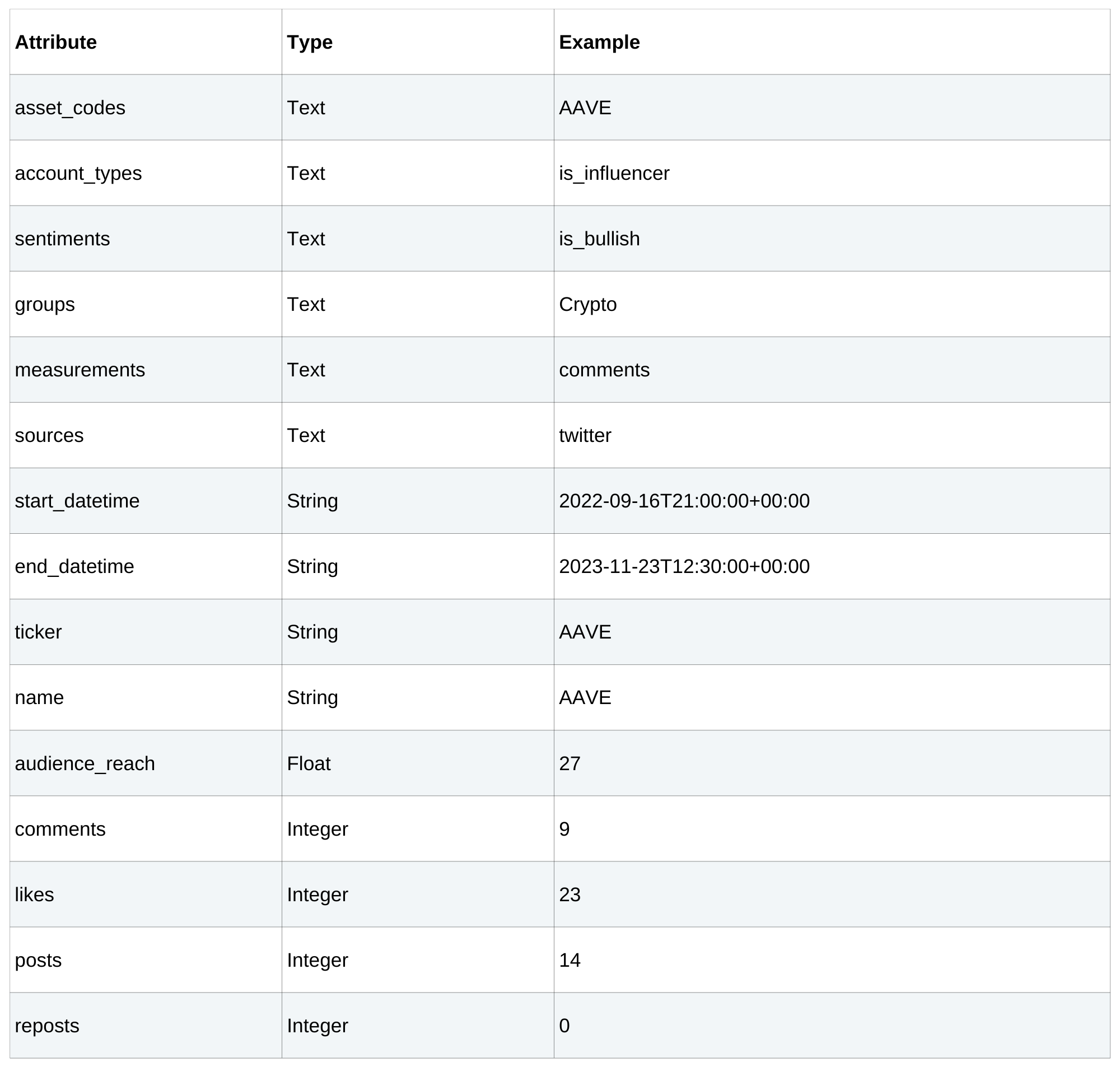

5. Social Media Momentum for Equities, Cryptocurrencies, and Commodities – API Dataset

This API Dataset is based on social sentiment data for all three major asset groups – equities, cryptocurrencies, and commodities. Social Media Momentum has a somewhat different structure and goals compared to the Pulse datasets above.

The Momentum dataset tracks mentions of assets on social media and evaluates their popularity. It measures how the dynamics of popularity changes among different groups of users (influencers, bots, and retail investors).

The key difference between Momentum and the three Pulse datasets lies in the goals of the analysis. Pulse datasets are best for an in-depth look at a specific asset of interest to you. You can view detailed time series data on the asset and drill down on all the stats, such as posts, likes, reposts, audience reach, by using various filters (e.g., by bots vs humans, by specific social media source, by account types, by various time intervals, and more).

On the other hand, Momentum is a better product to get an overview of the three key markets – equities, cryptos, and commodities; see the asset rankings by all the detailed stats within the dataset. The Momentum dataset is excellent for a birds-eye view of what is happening with specific equities, cryptos, and commodities in terms of their relative position in the market.

Number of assets included: 895 equities, 54 cryptocurrencies, 20 commodities

Source of data: Twitter, Reddit, LinkedIn, SeekingAlpha, Telegram, Facebook, and Weibo

Dataset attributes:

6. ZENPULSAR Bank-run – API Dataset

Bank-run is an API dataset (available in JSON and CSV formats) that measures and tracks social media sentiment for banking stocks from Twitter, Reddit, Telegram, Weibo, and SeekingAlpha.

While the Pulse and Momentum datasets above cover their wider respective markets, Bank-run is a specialised, niche product for banking stocks.

The dataset includes detailed time-series sentiment data and provides various metrics, such as panic share, panic reach, dominating sentiment, scaled dominating sentiment, and ratio dominating sentiment, calculated using specific formulas. The panic share and panic reach are unique measures in the dataset designed to monitor large sentiment swings that often act as precursors to bank runs, events that have recently led to the collapse of several banks in the US.

Number of assets included: 316 financial organisation stocks, including most of the US equities and some key European and Asian equities.

Source of data: Twitter, Reddit, Telegram, Weibo, and SeekingAlpha

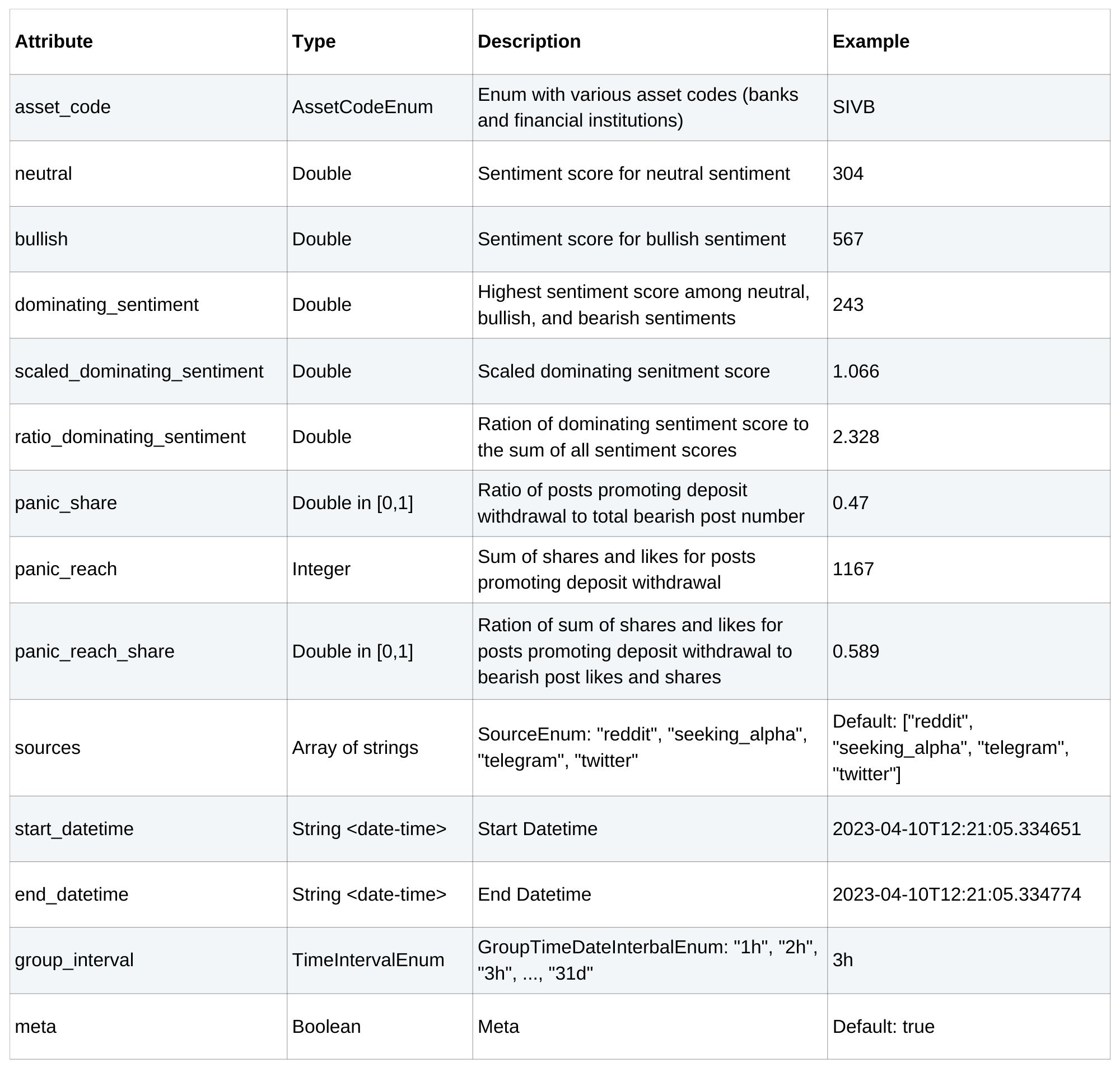

Dataset attributes:

7. ZEN Pulse – API Dataset

ZEN Pulse - Social Media Pulse for Asian Equities, tracks and quantifies the impact of Asian (mainland China, Hong Kong, and Taiwan) social media on local stocks.

This is another niche product for our users. The sentiment data, based on 100,000 daily data points, is sourced from the top Chinese micro-blogging platform, Weibo. This is the first social sentiment product in English that provides detailed measurement and tracking of Chinese-language social sentiment.

Besides Weibo, additional Asia-based financial social media sources are planned for inclusion in the product.

Number of assets included: 63 leading regional stocks plus the Hang Seng index.

Source of data: Weibo, Discuss.com, PTT.cc, mobile01

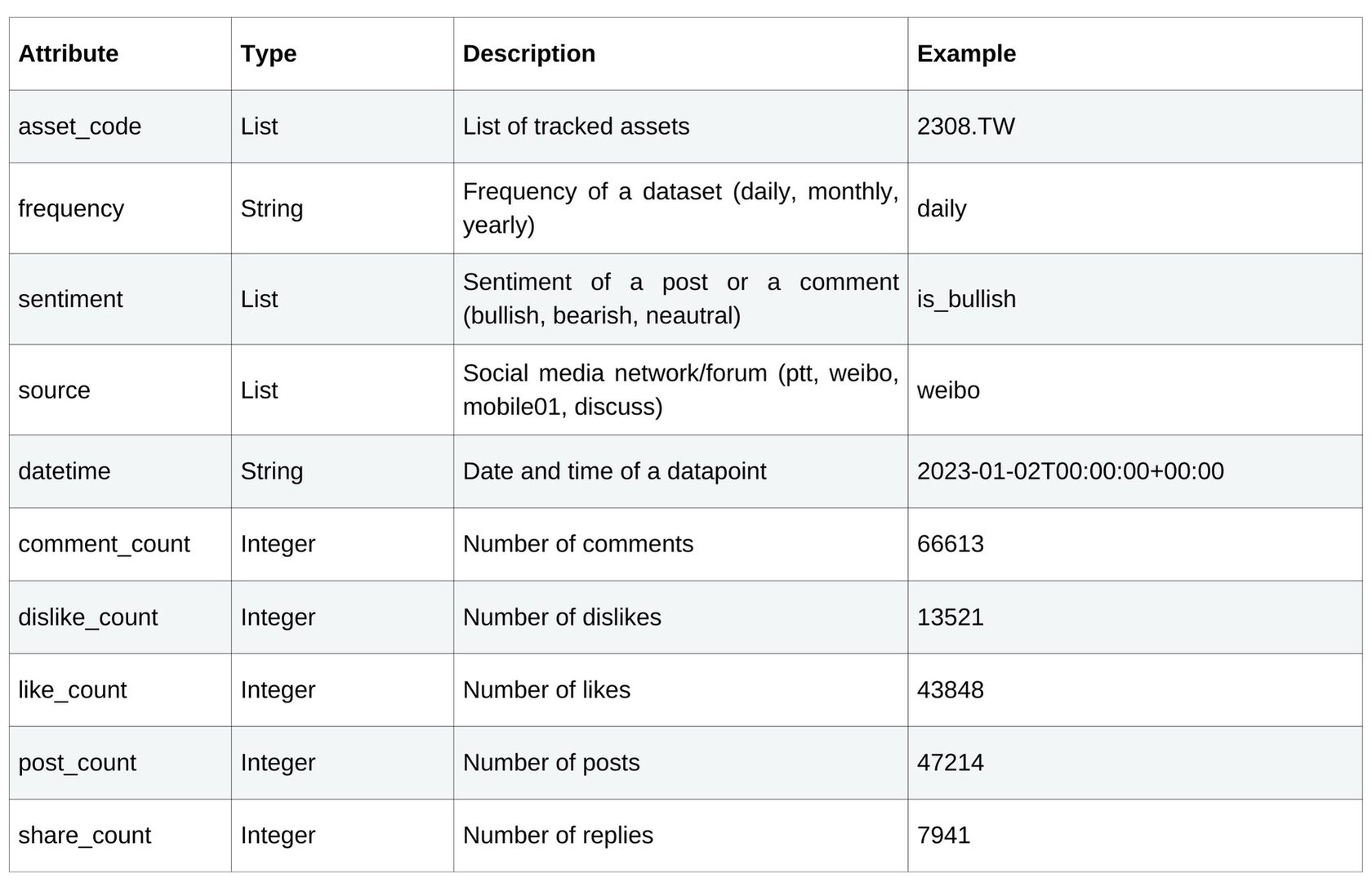

Dataset attributes:

8. ZENPULSAR Oracle – API Dataset

Oracle is an API Dataset product that takes social sentiment measurement to the next level. For a wide range of cryptos, equities, commodities, bonds, and foreign currencies, Oracle classifies each sentiment mention into one of the three groups – fact, opinion, or prediction.

Using advanced NLP models, Oracle adds the new 3-group classification to the standard bullish/bearish/neutral sentiment measures. For instance, Oracle dataset users can see if a certain asset’s bullish signal is a fact, opinion, or prediction. ZENPULSAR’s Oracle is the first social listening product on the market that adds this classification to sentiment measures.

Number of assets included: 891 equities, 60 cryptocurrencies, 24 commodities, 2 US fixed income assets, and 11 forex pairs.

Source of data: Twitter, Reddit, Telegram, and SeekingAlpha

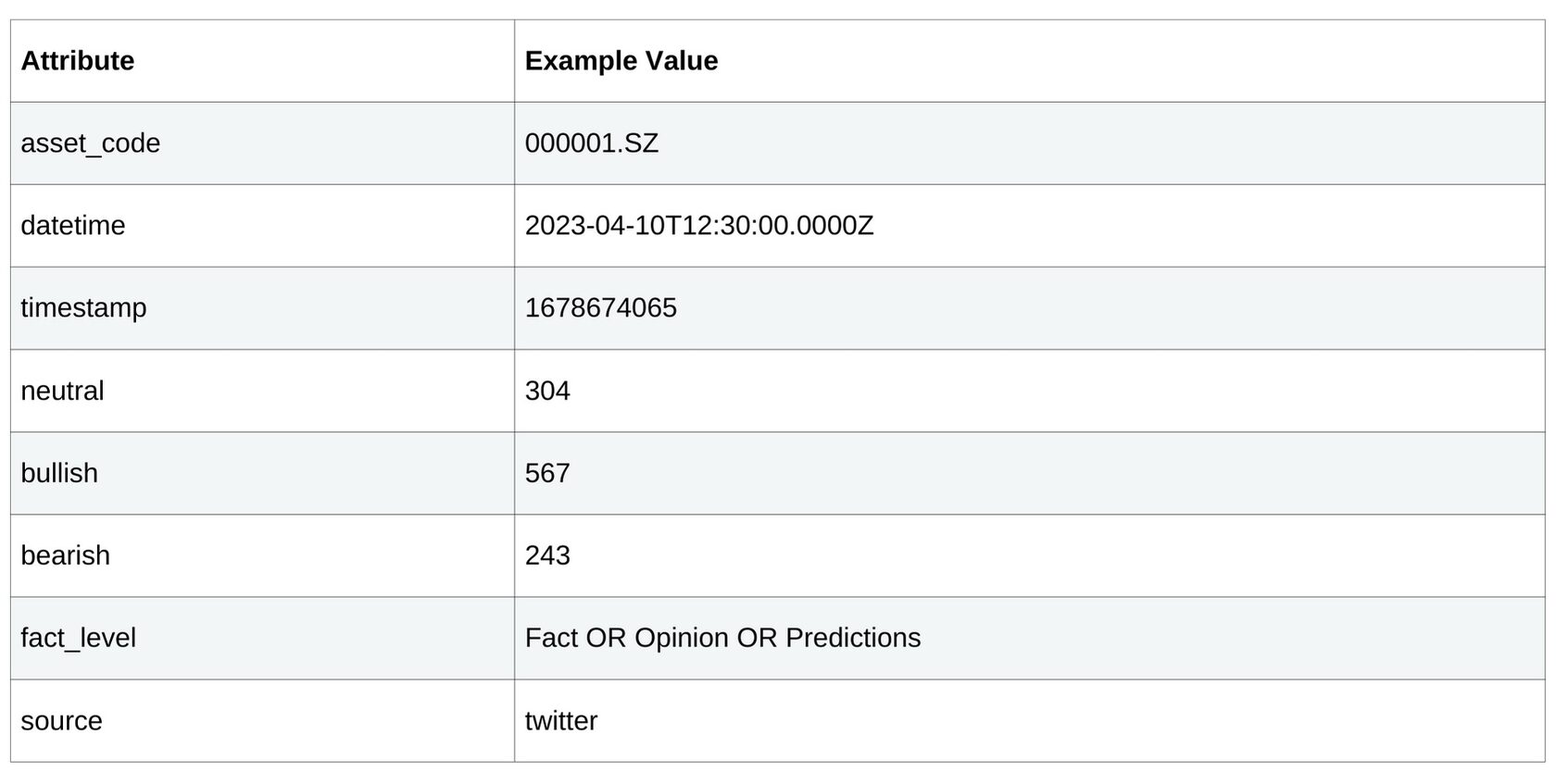

Dataset attributes:

Major Use Cases for ZENPULSAR Social Sentiment Products

Ø Sentiment Analysis

Ø Hedge Funds

Ø Asset Management

Ø Trading Strategies

Ø Market Insights

Ø Quantitative Investing

Ø Alpha Generation

Ø Online Reputation Management

Ø Brand Image Management

Our current line of the 8 products above is designed to address both the general and in-depth social analytics needs of traders, investors, fund managers, and analysts. If you would like to get more details on any of the products above, please email us at contact@zenpulsar.com or use the contact form on our website.