One of the key goals of our social media analytics platform, PUMP, is to help investors achieve Alpha and a superior ROI. Measuring social sentiment for cryptos, equities, and commodities with a high degree of precision, PUMP is designed to provide early signals to investors. In our earlier articles (here and here), we covered PUMP’s ability to predict trading prices for shorter time windows – from a few hours to a few days. This is useful for day traders.

In this article, we would like to demonstrate how PUMP is capable of predicting price changes and boosting ROIs for longer-term windows, typically several months, using the example of Bitcoin. This is more applicable to the needs of investors and fund managers that place multi-month trades with a view to earning positive returns at the investment’s maturity.

Bitcoin’s Price Slump & Bullish Social Signals Picked Up by PUMP

Back in early November 2022, Bitcoin (BTC) experienced a marked shift-down in its prices. On 7 November, BTC traded at nearly $21,000. Three days later, on 10 November, it was down to $15,742 and remained around the mid-teens of thousands for the next 2 months. The price slump and the lack of a quick recovery were not adding any positivity to the crypto’s future prospects.

However, during the 2-month period when BTC’s prices were depressed, PUMP registered two large spikes in bullish social media sentiment for it. For an observant investor using PUMP, this provided a strong indication that an upward move in prices was to come at some point down the line.

The first spike in bullish sentiment occurred in early November, exactly at a time when BTC was sliding down. The second large jump came in late December, when BTC still stayed at around $16,000.

The image below shows a PUMP screen, with two large jumps in bullish sentiment for BTC clearly visible (the upper line chart). The lower chart (below the sentiment chart) shows Bitcoin’s trading prices.

As seen from the chart, both spikes in bullish sentiment happened during the time when BTC’s prices remained low. Such large spikes in sentiment, especially when they go against the current price dynamics, provide great signals to investors. In this specific case, the bullish spikes signaled that BTC could be a good asset to long even if it was going to remain depressed for a short term.

Investing in Bitcoin Based on PUMP Data

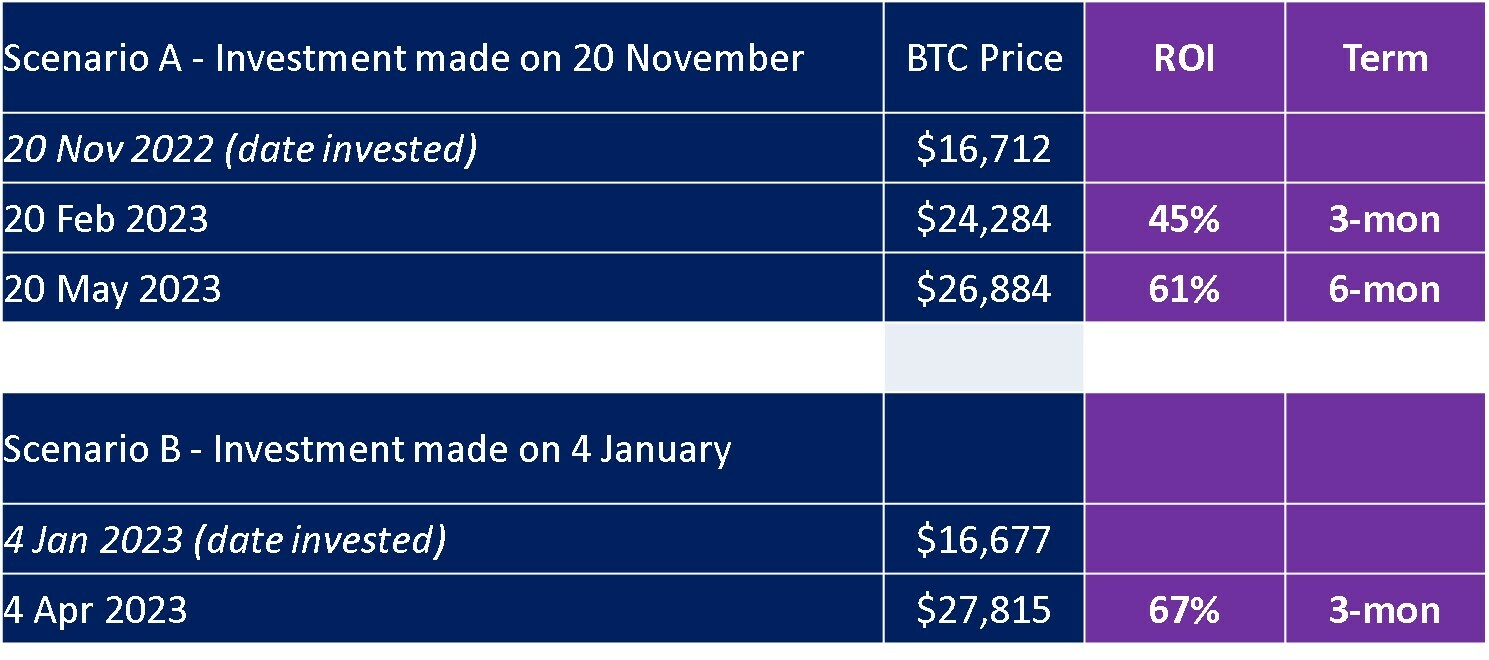

Let’s consider the situation when an investor decided to buy Bitcoin guided by these signals. For Scenario A, let’s assume that the investor bought the asset right after witnessing the first spike, and did so when the sentiment line dropped down to the average levels, which was on 20 November. For this scenario, we will calculate an ROI for a 3-month period (to 20 February 2023) and for a 6-month period (to 20 May 2023). Three and six months are quite typical investment periods for many medium-term oriented retail investors. A lot of hedge fund managers also rebalance their portfolio investments quarterly or half-yearly.

For Scenario B, let’s assume that the investor was not completely convinced by the first bullish spike and bought the asset only after witnessing the second spike, the one that came in late December. As a starting date for this investment, we will also assume the date when this second spike “died down”, which fell on 4 January 2023. For this scenario, we will calculate a three-month ROI (to 4 April 2023).

How did our investors, under scenarios A and B, fare in terms of an ROI? In both scenarios, the investments achieved excellent returns, as per the image below:

These returns – 41%, 61%, and 67% - are nothing but remarkable. Do note that these investments were made at a time when Bitcoin prices slumped, remained depressed, and there were a lot of predictions by market analysts that the world’s leading crypto would either remain depressed or even slump further. Yet, an investor guided by PUMP could realise these great returns based on following social signals.

In the case above, the key giveaway that longing BTC would pay off was the large bullish sentiment spikes that were against the crypto’s price dynamics at the time. PUMP produces other valuable signals as well that can guide investors to achieve great returns. In this article, we focused on Bitcoin, as it is the most popular cryptocurrency considered in investment portfolios. However, PUMP has already done a similar great predictive job with regard to some other leading cryptos, as well as stocks and commodity assets. In our future articles, we will cover the cases of other assets where PUMP guided its users to great returns based on multi-month investment windows.